By Preserve Gold Research

After two years of conflict, the war in Gaza has finally come to a halt under a U.S.-brokered ceasefire agreement in early October 2025. The truce, announced by President Trump and agreed to by Israel and Hamas, has paused the daily bloodshed and raised hopes that a measure of stability could return to the Middle East.

Markets, too, seem to have exhaled, if only briefly. Oil traders, who had priced in the constant threat of escalation, have responded with wary optimism. Brent crude settled 1.6% lower on the news, falling to about $65 a barrel as the “geopolitical risk premium” in energy markets eased. “Crude futures are in a corrective phase as the Israel-Hamas conflict looks to be ending,” said Dennis Kissler, senior VP of trading at BOK Financial.

Even as Americans and much of the world exhaled with relief at the end of one conflict, another was already gathering on the horizon. In what many viewed as a cruel twist of timing, early October brought a fleeting sense of calm before renewed tensions. The ink on the Gaza ceasefire was barely dry when headlines erupted with news that the United States was moving forward with a fresh wave of tariffs on Chinese goods. What had seemed like a season of respite quickly turned into a reminder that global trade remains at the mercy of political forces.

This rekindled trade confrontation between Washington and Beijing may not involve soldiers or smoke, but its battleground is no less consequential. Experts say tariffs could ripple through supply chains, unsettle financial markets, and strain an economy already tested by inflationary pressures and policy fatigue.

The U.S.–China Trade War Reignites

After a brief and uneasy lull, economic hostilities between Washington and Beijing have erupted once again. In mid-October 2025, President Donald Trump announced that the United States would re-impose sweeping trade penalties on China, marking a full return to confrontation after a short-lived détente.

In a series of fiery posts on Truth Social, Trump declared that beginning November 1, his administration would “set a 100% tariff on Chinese goods” and “impose Export Controls on any and all critical software.” He said the move came in response to Beijing’s decision to restrict exports of rare-earth magnets and other key materials. “This was a real surprise, not only to me, but to all the Leaders of the Free World,” he wrote. “I was to meet President Xi in two weeks, at APEC, in South Korea, but now there seems to be no reason to do so.”

The 100% duty, Trump added, could come “sooner, depending on any further actions or changes taken by China,” effectively reviving what he called an “embargo on Chinese goods.” At a later press event, he told reporters he might still attend the APEC summit—”I haven’t canceled, but I don’t know that we’re going to have it… I’m going to be there regardless, so I would assume we might have it“—but hinted the tariffs could be dropped if Beijing reversed course. “We’re going to have to see what happens. That’s why I made it November 1,” he explained.

Trump accused China of weaponizing global supply chains, claiming that Beijing had sent letters to foreign governments outlining plans to restrict exports “of every element of production having to do with Rare Earths, and virtually anything else they can think of, even if it’s not manufactured in China.” He warned that such actions could “clog the Markets, and make life difficult for virtually every Country in the World.” In another post, he charged that China is “becoming very hostile,” adding that it’s trying to hold the world “captive” by restricting exports of rare metals.

Beijing’s response was swift. Chinese officials denounced the U.S. measures as a deliberate provocation, accusing Washington of “threatening to intimidate” China with aggressive tariffs. The Chinese commerce ministry vowed it would “fight to the end” rather than capitulate to American pressure. Beijing, meanwhile, refused to confirm the planned meeting and made clear it would not negotiate under threats. What had been a simmering rivalry has now erupted into a full-blown economic confrontation. Tariffs that were once paused have come roaring back, and new fronts, from maritime trade fees to high-tech export bans, are opening.

As of mid-October, U.S. tariffs on Chinese imports had already averaged 58% (with Chinese tariffs averaging 33% on U.S. goods), and they are poised to go even higher. “We’ve got now multiple trade wars on multiple fronts,” observed Diane Swonk, chief economist at KPMG, noting that if all of Trump’s tariff threats are implemented, the effective U.S. tariff rate could skyrocket to levels “not seen since 1936”, leaving the economy “flirting with stagflation“.

Trade War Sparks Global Selloff, Crypto Crash, and Surge in Safe-Haven Demand

The renewed trade war didn’t stay confined to speeches or social media posts. It jolted financial markets across the globe within hours. Investors who had only just exhaled after the Gaza ceasefire were blindsided by the abrupt escalation between the world’s two largest economies. The S&P 500 sank more than 2.5% in a single session (its sharpest drop since April) while tech-heavy Nasdaq tumbled over 3.5%.

“The second largest economy and the first largest economy are arguing again, and we’re seeing a sell-first, ask-questions-later mentality,” said Ryan Detrick, chief market strategist at Carson Group. He added that Trump’s fiery rhetoric “seemed to come out of nowhere,” unleashing a torrent of market volatility. By week’s end, the Dow Jones had lost nearly 2%, and the Nasdaq logged its worst weekly decline since the spring.

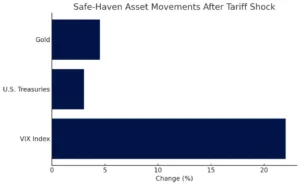

Safe-haven assets surged as equities sank. Gold, already above $4,000 an ounce, climbed even higher, and U.S. Treasury yields fell as nervous money sought refuge in government debt. The dollar wobbled against other major currencies, reflecting growing anxiety about U.S. growth prospects. The CBOE Volatility Index, the market’s so-called fear gauge, spiked to its highest level since mid-summer. “We haven’t had this level of volatility in a long time,” Detrick remarked, describing October’s trading as “spooky” for markets that are usually calm heading into year-end.

Gold surged 4.5%, U.S. Treasury yields fell 3%, and the VIX “fear gauge” spiked 22%, signaling a flight to safety. Source: Bloomberg & CBOE Data, October 2025

Commodity markets were equally shaken. Oil, which had been easing lower amid hopes for Middle East stability, plunged on fears that tariffs could choke global demand. Brent crude fell nearly 4% to around $62.70 a barrel, its lowest level since May. “The sell-off was driven by a shift to risk-off sentiment after Trump’s post, threatening tariffs,” explained Giovanni Staunovo, a UBS commodities analyst.

Andrew Lipow of Lipow Oil Associates added, “Today is the culmination of a variety of factors, of which Trump’s threat of massive tariffs on China is just the latest,” noting that rising OPEC production and fading war risks compounded the drop. In other words, the trade war fears were the straw that broke the oil market’s back, triggering a notable drop in fuel prices. While cheaper oil might sound like good news for consumers, in this case, it could be a harbinger of weaker global growth expectations, hardly a positive signal.

Across the Pacific, Chinese markets also shuddered. The Shanghai and Hong Kong stock indices saw sharp sell-offs, with export-oriented companies and manufacturers hit hardest. China’s currency, the yuan, briefly dipped to multiyear lows against the dollar amid concerns that exports would suffer under U.S. tariffs. Beijing downplayed the reaction, calling it temporary, yet confidence across Asia faltered. When two elephants fight, the grass gets trampled, as the saying goes, and smaller economies from South Korea to Vietnam have already been feeling the tremors. Their export-driven industries, heavily reliant on the stability of U.S.–China trade, now face currency swings, supply-chain disruptions, and evaporating investor confidence.

The fallout didn’t stop at stocks or commodities. Cryptocurrency markets were hit by an even sharper collapse. Within hours of President Trump’s tariff announcement, more than $19 billion in leveraged crypto positions were wiped out, triggering the largest digital-asset liquidation in history. Bitcoin plunged 12% in a matter of hours, while smaller tokens cratered by as much as 80% as margin calls cascaded through the system. Even World Liberty Financial, a Trump-linked token, plummeted more than 30% by day’s end. The wipeout exposed the dangerous level of leverage underpinning the months-long rally that had followed Trump’s re-election—a rally built on speculation that his administration would loosen regulations on digital assets.

Industry in the Crossfire: Tech, Farms, and Factories

Beyond the immediate market fireworks, the renewed trade war has also pierced deep into the fabric of the U.S. economy. American companies, large and small, have spent the past few years navigating supply chain disruptions and tariff lists; now they face a new round of uncertainty.

Nowhere is the strain felt more acutely than in technology. Many of America’s most advanced manufacturers depend on rare earth elements and precision components sourced from China. Beijing’s decision to tighten rare earth export controls strikes directly at that dependency. Since China produces over 90% of the world’s processed rare earths and magnets (materials vital to smartphones, electric vehicles, and fighter jets), its move is a direct blow to U.S. tech and defense firms.By weaponizing these critical minerals, China can choke off supply to American companies, forcing them to scramble for scarce alternatives. U.S. experts warn that if the dispute isn’t resolved, major supply chain disruptions are likely, particularly for industries like electronics and green energy that depend on specialized Chinese materials.

At the same time, Washington’s May 2025 export bans on U.S. software and high-tech hardware to China continue to pinch the revenues of American firms that count China as a key market. Chipmakers and aerospace firms now face bans on selling critical components to Chinese buyers. Analysts warn that blocking U.S. software exports could deal a “big blow” to China’s tech ambitions, yet it’s equally perilous for U.S. companies, which stand to lose billions in revenue.

While tech grapples with minerals and software bans, America’s heartland industries face their own battles. Chief among them are the farmers of the Midwest, for whom China’s massive consumer market had been a lifeline. Now, that lifeline has been severed. No country comes close to China in terms of appetite for American agricultural products, particularly soybeans. In 2024, China bought over $12 billion worth of U.S. soybeans, roughly half of all U.S. soybean exports, but this year, amid the tit-for-tat trade war, that figure has fallen to zero.

The federal government has floated ideas for emergency aid and commodity purchases, but political gridlock has delayed any real relief. An October shutdown froze planned farm support payments, leaving growers to watch trade headlines with a mix of anxiety and resignation. Many in rural America, still broadly supportive of Trump, face a painful choice: back a trade policy they believe might protect U.S. interests in the long term, or reject one that is eroding their livelihoods today.

Manufacturing and retail, meanwhile, are caught in the middle. American factories that rely on Chinese-made parts or materials are seeing their input costs soar as tariffs hike the price of imported components. Small manufacturers complain that they are losing bids because they’ve had to pass these higher costs onto customers. Many have halted investments or hiring, uncertain whether key suppliers will soon face 100% duties.

Major U.S. exporters, such as automakers and aerospace firms, face retaliatory barriers in China. For example, Boeing jets could be at risk if China diverts orders to Europe’s Airbus as a form of retaliation. Retailers, too, warn of pain ahead for consumers. The National Retail Federation’s chief economist, Jack Kleinhenz, noted that many small businesses lack the cushion of big corporations and could face even more difficult choices in the months ahead. From the aisles of Walmart to local mom-and-pop shops, Americans may soon be paying more for everyday items, an inflationary squeeze directly attributable to the trade conflict.

Tariffs Threaten America’s Recovery as Inflation Risks Return

Even before this trade war resurgence, the U.S. economy was navigating a delicate path. Growth had been resilient through 2024, unemployment remained low, and inflation had been gradually cooling from its post-pandemic highs. But the escalation of tariffs and turmoil in trade policy now threaten to undermine that stability, and economists are worried about what comes next.

Many warn that the new tariffs amount to “a recipe for fewer jobs, slower growth, and higher prices.” These levies act like a sweeping tax increase on both businesses and consumers, delivering an immediate price shock that may erode purchasing power and confidence. Diane Swonk of KPMG cautioned that the sudden reimposition of tariffs could “begin to kill demand” as households curb spending and firms freeze hiring to offset rising costs. If tensions persist, “a recession by next year is not out of the question,” she added. Some Wall Street analysts now estimate the probability of a 2026 recession at over 50%, a sharp increase from just a few months ago.

Consumer sentiment is already showing cracks. The University of Michigan’s index of consumer confidence, a widely watched indicator, has drifted near historic lows in recent readings. Households are wary, citing “high prices and weakening job prospects” as among their top concerns. The trade war adds another worry to that list: the prospect that prices will climb higher still and that jobs in export-dependent industries could be at risk.

Business sentiment has likewise deteriorated; surveys of manufacturers and service companies indicate growing uncertainty and plans to “wait and see” rather than to expand. “The exceptionalism and resilience that we’ve been talking about for two years is starting to show some cracks,” observed Gregory Daco, chief economist at EY-Parthenon. He noted that consumer spending had become ever-more reliant on a narrower slice of high-income consumers, and that confidence was softening even before the tariff shock. Now, with this escalation, those cracks could widen.

The Federal Reserve now faces one of its most difficult tests. After spending 2023 and 2024 tightening policy to tame inflation, the Fed appeared to achieve a soft landing, at least on paper. But the trade war changes everything. Tariffs may re-ignite inflation even as they cool growth, forcing policymakers into a painful dilemma. The Fed may be caught between a rock and a hard place as it tries to balance the risks of both inflation and recession. Some officials have hinted that they might tolerate slightly higher inflation to avoid strangling growth. “We have to tread with caution,” said St. Louis Fed President Alberto Musalem. For central bankers, it’s an uncomfortable echo of the 1970s. A decade when they had to choose between fighting inflation and supporting growth, and found they couldn’t do both.

Globally, the stakes are just as high. The International Monetary Fund, which had only weeks ago slightly upgraded its world growth forecasts on hopes that trade tensions were easing, warned that a renewed U.S.-China trade war is a “significant risk” to the world economy. IMF Chief Economist Pierre-Olivier Gourinchas noted that recent tariff truce deals had been “not as bad as we feared” for growth, but cautioned that Trump’s new 100% tariff threat “shattered the calm” and could sharply cut next year’s global outlook.

In a downside scenario analysis, the IMF modeled what happens if tariffs escalate across major economies: the result was a materially slower growth rate worldwide and higher uncertainty, damping investment. In plainer terms, if the two largest economies enter an all-out trade war, everyone loses—factories from Germany to Mexico could see order cancellations, commodity exporters from Brazil to Australia could see prices fall, and financial markets could become more disorderly. “Obviously, if this were to materialize, it would be very significant,” Gourinchas said of the trade conflict, emphasizing that it adds to the uncertainty that is cooling investment and spending globally.

Bracing for an Uncertain Future

In American economic history, autumn 2025 may be remembered as a moment when fortunes turned. And when the emergence of another almost immediately overshadowed a hopeful end to one crisis. The “ceasefire dividend” from Gaza’s truce offered a brief sense of relief, but that calm has been eclipsed by the escalating trade war, which shows no sign of resolution. The United States now enters unfamiliar waters, and Americans are understandably anxious.

While the nation has weathered trade frictions before (think of the 1980s trade tensions with Japan, or the tariff battles of the 1930s), it has never had to deal with an economy as globally intertwined as today’s. The U.S. and China are deeply intertwined through supply chains, capital flows, and digital infrastructure, making even a partial unwinding a source of sharp pain.

Some policymakers argue that short-term pain may be necessary to address long-standing imbalances and security concerns in the U.S.-China relationship. But for the average American household, these debates feel distant compared to the everyday impact of rising prices and volatile markets. Groceries, electronics, and fuel may soon cost more; retirement accounts fluctuate with every headline.

The questions are growing louder: Can consumer spending, the engine of U.S. growth, withstand the strain? Will employers scale back hiring or investments if uncertainty deepens? Economists caution that much depends on whether negotiations resume or whether the trade war intensifies further. History suggests that even a symbolic truce could steady markets, yet so far, neither side shows much appetite for compromise.