By Preserve Gold Research

A regulatory reversal is quietly unfolding within American banking, subtle enough to pass beneath the country’s louder anxieties about inflation, geopolitics, and elections. In the years after 2008, policymakers reinforced the financial system with higher capital requirements, stricter liquidity standards, and routine stress tests, all designed to prevent private risk-taking from spilling back onto the public balance sheet. Today, that posture is shifting. The Federal Reserve is moving to ease capital rules for the largest banks, framing the change as a technical adjustment rather than a major deregulatory move. Because the shifts are incremental, the changes have not drawn much scrutiny. But even small revisions can reshape incentives at scale. By softening safeguards built to absorb future shocks, regulators may be bolstering near-term profitability while leaving the system more exposed over time. The trade-off is quiet, but its consequences may not be.

Why the Basel III “Endgame” Is Losing Momentum in Washington

The Federal Reserve has circulated revised plans that would soften a Biden-era proposal requiring the largest banks to hold much more capital. Under the new approach, Wall Street’s biggest lenders would face a modest increase of up to 7% in loss-absorbing equity, far below what was envisioned in earlier drafts. The contrast between the original plan and the quiet revision is stark.

After the global financial crisis of 2007-09, regulators worldwide agreed on tougher standards (known as Basel III) to ensure banks could weather severe downturns. Under that initial proposal, common equity capital at large banks would have risen by an estimated 16-20% on average. The “Basel III endgame” proposal unveiled in mid-2023 was to be the final step in this post-crisis journey. It aimed to standardize risk models and extend stricter requirements even to mid-sized banks after a series of regional bank failures in March 2023.

Now, however, those ambitions are being dialed back. The Fed’s revised plan aligns more closely with long-standing industry objections that higher capital requirements would constrain lending and slow growth. Instead of a structural shift, the proposal amounts to a technical adjustment that leaves banks with thinner cushions than reformers intended. But you won’t see it on the news, in part because the changes are emerging via obscure regulatory channels. In an era when daily economic news is focused on inflation, jobs, or the latest market rally, a wonky recalibration of bank safety margins doesn’t grab headlines.

What’s Actually Changing Inside the Banking System

To grasp the stakes, it helps to look into the mechanics of the proposed changes. At the surface, large banks would face smaller capital surcharges than regulators once envisioned. In practice, the revisions go further. The Fed’s new framework would ease requirements most sharply in trading and investment banking, areas once singled out as sources of outsized loss during periods of market stress. Under the revised approach, regulators appear more willing to rely on banks’ internal risk models, reducing standardized capital add-ons for market activities. That shift could allow major dealers to run larger trading books or extend more leverage with less equity backing each unit of risk.

The recalibration extends to wealth management and other fee-based businesses. Earlier proposals imposed uniform capital charges across a wide range of assets and exposures, a design that banks argued overstated the risk of advisory and custodial services. Regulators now seem persuaded. The proposed rules would treat these activities more leniently, lowering capital requirements for banks whose revenues tilt toward asset management and client services. The effect is subtle but meaningful: diversified institutions would see improved returns on equity without taking on new risk.

Mid-sized regional banks also stand to benefit. The original Basel III endgame sought to extend tougher standards to lenders with $100 to $250 billion in assets, closing gaps exposed by the 2023 regional bank failures. But that effort has since met political resistance. Lawmakers have argued that applying the same framework to regional lenders ignored differences in business models and congressional intent following the 2018 Dodd-Frank revisions. Regulators now appear open to tiered treatment. Some mid-sized banks could face narrower capital calculations or exemptions from marking unrealized bond losses against capital.

The most consequential change could be the Fed’s reworking of its annual stress tests. Instituted after 2008, these exercises determine how much capital banks must hold under hypothetical recessions. The Fed now plans to make them more transparent and predictable, disclosing far more detail about scenarios and models and inviting public input. Supporters argue this reduces volatility and improves fairness. But critics counter that predictability invites optimization. Fed Governor Michael Barr, the architect of the earlier, tougher capital proposal, issued a rare dissent, warning that making the stress test so transparent will render it “weaker and less credible.” Banks will be able to fine-tune their books to just pass, eroding the buffer that the test is supposed to ensure.

The Real Winners of the Fed’s Revised Capital Plan

It doesn’t take a PhD in finance to see who the primary beneficiaries of the Fed’s revised capital plan are. Wall Street banks and their shareholders have cheered these developments, and for good reason. Lower capital requirements free balance sheet capacity that can be redeployed into new lending, trading activity, or direct payouts to investors. Almost as soon as whispers of the softer capital plan emerged, analysts began calculating the windfall. One widely cited estimate suggests that easing capital constraints could unlock more than $2 trillion in additional lending capacity across major U.S. banks. Some of that capacity will likely support real economic activity. But experts say it’s likely that a meaningful share will flow toward buybacks, dividends, and acquisitions.

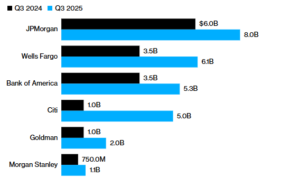

Bank Buybacks Surge Ahead of Softer Capital Rules

Major U.S. banks sharply increased share buybacks heading into 2025, with JPMorgan, Wells Fargo, and Bank of America leading a broad industry push to return capital to shareholders. The acceleration reflects a more permissive regulatory environment and expectations of lighter capital requirements ahead. Source: Bloomberg.

Share repurchases, in particular, look poised to rise. The largest U.S. banks have already resumed aggressive buybacks in recent years as pandemic-era limits lifted, but they have been moderating, partly in anticipation of higher capital rules. Now that regulators are easing off, banks are signaling they can ramp up those shareholder rewards again. When banks hold more capital than the minimum required, they often view the surplus as “trapped” money earning a poor return; freeing it means they can distribute it.

The mechanics are straightforward. Capital cushions absorb losses, but they also dilute returns in good times. Lower required equity allows banks to operate with higher leverage, boosting return on equity as long as conditions remain favorable. While bank executives have unsurprisingly welcomed the news, the balance toward short-term profitability and resilience risks sowing the seeds of another crisis.

Markets, for now, are applauding, even as some watchdogs watch warily from the sidelines. Industry groups have welcomed the changes as pro-growth, and investors are rewarding the prospect of higher profitability. Yet, the enthusiasm rests on an assumption that thinner buffers won’t be tested. History suggests otherwise. As Wall Street revels in its gains, the bigger question is who stands to lose when the cycle turns.

Who Bears the Risk When Banks Prioritize Profits Over Stability?

Banking regulation has always been a tug-of-war between profit and safety. Capital buffers exist for a simple reason. They force banks and shareholders to absorb their own losses so that downturns do not spill outward into the broader economy. When those buffers are shrunk, the risk doesn’t disappear; it migrates. Less equity today increases the likelihood that losses tomorrow fall on someone else.

Who is that “someone else”? Potentially all of us: depositors, taxpayers, and the broader economy. We learned this painfully in 2008. In the lead-up to that crisis, banks operated with thin capital and high leverage, convinced that sophisticated risk models and benign economic conditions made them safe. When the housing bubble burst and subprime loans went bad, those slivers of equity evaporated. Banks that had “won” for years by leveraging up and privatizing profits suddenly had losses that vastly exceeded their cushions.

The outcome was predictable for anyone who bothered to pay attention. Many banks stumbled or failed, and the losses had to be socialized. Shareholders were wiped out in some cases, but the far more consequential hit was to society. While mega institutions received billions in emergency government aid, the economy cratered. Unemployment spiked, and millions of families lost their homes, jobs, and savings in the aftermath of the Great Recession. The lesson was clear. Banks’ profits may be private, but their losses are often public.

That lesson explains why capital requirements function as shock absorbers rather than red tape. If we weaken them, the shocks don’t disappear; they just hit the vehicle (and all its passengers) harder when the road turns rough. A thinner capital cushion amplifies losses during downturns because there’s less of a buffer to take the blow. Even slight differences in equity can determine whether a bank survives a downturn or fails outright. Reduced capital also incentivizes banks to take “just a little more” risk because returns on equity are juicier, until suddenly the risk proves not so little.

The Hidden Economic Costs of Weaker Bank Safeguards

Financial regulation can seem abstract, but the consequences of weaker safeguards can have a real impact on our daily lives. While most Americans don’t spend their days thinking about bank capital ratios, they do care about the outcomes those ratios are supposed to support: the safety of their deposits, the availability of loans, the health of the economy, and the likelihood of taxpayers getting called on to clean up a mess. So what does this quiet deregulation push mean for the average American?

Depositors face the most direct exposure. Federal insurance covers up to $250,000 per account, enough for most households but not for many small businesses or higher-balance savers. Strong capital cushions make losses unlikely even for uninsured deposits, because equity and bondholders absorb shocks first. As those cushions thin, the margin for error narrows.

We saw a glimpse of this in 2023 when Silicon Valley Bank failed. Heavy bond losses and limited capital left uninsured depositors facing potential losses until regulators intervened to guarantee all deposits. That intervention prevented wider panic, but it effectively extended the safety net beyond its stated limits. If large banks operate with less capital, future crises may force the same choice: impose losses on depositors or expand public backstops to stop contagion. Either outcome carries costs.

Beyond depositors, anyone with a stake in the broader economy is indirectly affected by bank resilience. Retirees and pension funds hold bank stocks and bonds, which stand to benefit in good times from higher profitability. Those same assets, however, become more fragile when leverage rises. In downturns, equity losses deepen, and even bank debt can come under pressure. More broadly, a weakened banking system tends to amplify recessions. When banks retrench, credit tightens quickly. Mortgages, auto loans, and small business financing become harder to obtain precisely when households and employers need flexibility most. The upside of deregulation accrues narrowly in the form of higher returns. The downside spreads widely through lost jobs, reduced investment, and slower recoveries.

Confidence itself is an underappreciated casualty. Financial crises leave long shadows, shaping consumer behavior for years. Households become more cautious, spending slows, and trust in institutions erodes. That drag on confidence can outlast the initial shock, reducing economic dynamism. Capital rules, dull as they appear, help prevent these psychological aftershocks by lowering the odds that stability is suddenly called into question.

Deregulation in an Already Fragile Economy

It’s often said that the best time to fix a roof is when the sun’s out. The same can be said for the economy. Reforms are safest when underlying conditions are stable. But when latent fragility underpins an economy, loosening safeguards doesn’t just raise the risk at the margins; it multiplies it.

Consider where we stand today. Corporate bankruptcies have been climbing, with large U.S. failures approaching levels not seen in more than a decade. In just the first ten months of 2025, there were nearly as many big bankruptcies as in all of 2024. Higher interest rates have kept refinancing costs high, exposing vulnerabilities built during years of cheap credit. Meanwhile, debt burdens remain heavy, and stress has begun to surface across the global credit market, including institutions that sit at the core of the financial system. In other words, even before any new deregulatory moves take effect, cracks have been forming. Banks may not be facing a crisis yet, but they’re not immune to these stresses. They hold the loans that companies are defaulting on, and they navigate markets that have been whipsawing on every piece of economic news.

Now imagine layering deregulation on top of this. Easier capital rules tend to be procyclical and often amplify late-cycle dynamics by encouraging more lending and risk-taking when leverage is already high. Marginal borrowers gain access to financing, and banks push further along the risk spectrum to sustain returns. While this can create the appearance of renewed momentum, the underlying economic fragilities remain unaddressed.

History offers a cautionary parallel. In the mid-2000s, clear vulnerabilities were already present with rising household debt, inflated housing prices, and rapid credit growth. Yet regulators moved in the opposite direction. The SEC allowed big banks to increase leverage, while bank supervisors declined to raise capital requirements even as balance sheets expanded. That permissiveness only intensified the downturn. Easier rules helped propel the final, euphoric phase of the housing boom, leaving the system far more exposed when prices turned.

Global dynamics add another layer of complexity. The policy divergence mentioned earlier, where the U.S. is easing while Europe and others hold firm or tighten, could introduce fragility via international channels. If U.S. banks lever up and something goes wrong, the shock could transmit overseas. Conversely, if foreign regulators start worrying that U.S. banks are undercapitalized compared to theirs, they might ring-fence or impose extra constraints on U.S. bank branches, complicating coordination when it matters most.

Put simply, lowering safeguards in a fragile economy trades resilience for speed. It may smooth the road briefly, but it leaves the system more exposed when conditions deteriorate. At a moment when uncertainty is already high, the decision to reduce buffers amounts to a bet that stresses will remain contained. If that bet fails, any benefits from a temporary pick-up in growth could pale in comparison to the costs of a full-blown financial crisis.

A Familiar Pattern Emerging

If all of this sounds like déjà vu, it’s because it is. History has a clear pattern: periods of confidence and deregulation breed leverage and speculative excess, which eventually lead to instability and crisis, followed by a re-regulation to restore order. The cycle then repeats once memories fade. We’ve seen this movie before, repeatedly, and the early scenes playing out today echo those past episodes.

Veteran banking expert Elaine Duffus recently summarized the script bluntly: “For 40 years, American banking has followed a predictable cycle: Deregulation enables innovation, innovation becomes speculation, speculation triggers collapse, collapse demands bailouts, and bailouts birth stricter regulation.” The historical record bears this out. In the 1980s, the deregulation of savings and loan institutions fueled reckless real estate lending far beyond their expertise. The cleanup cost taxpayers around $150 billion. Lesson learned? For a while.

Regulations were tightened in the 1990s, but by the late 1990s and early 2000s, we saw another wave. Glass-Steagall Act protections (which had kept commercial banks and risky investment activities separate since the 1930s) were dismantled, and new exotic financial products (mortgage-backed securities and derivatives) exploded in use. The result was the 2008 financial crisis, hundreds of bank failures, and a $700 billion taxpayer bailout (TARP) needed to prevent systemic failure.

Each time, regulators responded to a crisis by re-imposing rules: FIRREA in 1989 after the S&L debacle, Dodd-Frank in 2010 after the Great Recession. And each time, as the years passed and memories of the crises faded, pressure built to loosen up again. By 2018, the narrative was that the post-2008 rules had done their job too well and were now holding back growth. Rules were eased, particularly for mid-sized banks assumed to pose little systemic risk. As we know, Silicon Valley Bank and its peers proved otherwise in 2023. When interest rates surged and risky concentrations blew up, we saw three of the four largest bank failures in U.S. history occur practically over a weekend.

What sets this moment apart is that, for the first time in modern banking history, the U.S. is responding to a crisis not with more oversight but with less. In 2023, we had a banking shock, which would typically lead to tighter regulations. Instead, pressure has grown to relax them. Bankers say banks are resilient and models are more sophisticated today. But every financial cycle has that moment where participants start to think the old rules don’t really apply because “this time, we’re smarter” or “this time is different.” It’s the same kind of language heard in 2006 that lulled people into believing the housing boom could never bust, or that tech stocks in 2000 had reached a permanently high plateau, or that subprime risk was contained thanks to clever structuring.

Memories of 2008 are fading, and a new cohort of financiers has come of age in the unusually calm markets of the 2010s. Aside from the brief shock of the 2023 bank failures, the decade offered few sustained tests of the system. As deregulation advances, that calm risks breeding collective amnesia; a belief that stability is inherent rather than conditional, and that the lessons of past crises no longer fully apply. Incremental changes matter because they accumulate. A little less capital here, a bit of leverage there—each adjustment defensible in isolation. But one day, conditions shift, and what seemed safe in isolation becomes dangerous in aggregate.

Why Investors Are Paying Attention and Hedging Accordingly

While regulators may be focused on the immediate gains of looser rules, many investors have one eye on the exit. Deregulation, especially late in an economic cycle, tends to coincide with increased risk-taking but also rising anxiety among those who think long-term. It’s no surprise, then, that many investors are turning to hard assets that sit outside the core of the financial system.

Gold has become the clearest expression of this instinct. It carries no counterparty risk, cannot default, and sits beyond the reach of balance sheet engineering. When confidence in policy frameworks weakens, demand for gold tends to rise, and over the past two years, that relationship has become more pronounced. By late 2025, prices reached record highs, breaching the $ 4,000-per-ounce threshold. The advance has occurred alongside rising equity markets, breaking the usual inverse pattern. That divergence suggests investors aren’t just chasing returns. They’re hedging against uncertainty. Regulatory easing, elevated leverage, and late-cycle dynamics form precisely the environment in which assets viewed as permanent regain appeal.

Rolling 3-Year Correlations Signal a Shift in Market Stability

Rolling 3-year correlations show stocks and bonds moving together more often, while the dollar–gold relationship weakens during stress. These shifts point to fading diversification just as bank safeguards thin. Source: Bloomberg Finance, State Street Investment Management.

As Wall Street publicly toasts to deregulation, a meaningful share of capital is edging toward safety, positioning defensively rather than assuming the levees can be lowered without consequence. That caution reflects a deeper truth about who ultimately bears the risk when policy bets misfire. Everyday Americans have far more at stake than they may realize. They may enjoy slightly easier loan approvals or marginally better rates if banks pass on some of their profit. But they also stand to lose the most if the gamble fails, through job losses, lost wealth, or bailout costs.

It’s a classic case of concentrated gains and diffuse risks. The average household might not gain enough in good times to even notice, but if the downside materializes, the consequences could be devastating. This asymmetry is why bank regulation, dull as it can be, is ultimately about social choices. Do we prioritize a bit more growth now, or do we prioritize protection against a possibly worse bust later? That trade-off will play out not in forecasting models, but in the lives of workers, homeowners, and retirees when the economic cycle shifts.