By Preserve Gold Research

As Iran Tensions Rise, Oil’s Risk Premium Returns

Oil markets are suddenly flashing warning signs that have been dormant for years. In late January 2026, crude prices spiked to five-month highs on fears that a military confrontation between the United States and Iran could disrupt global supply. Brent climbed above $70 a barrel as traders weighed the consequences if a major OPEC producer were knocked offline.

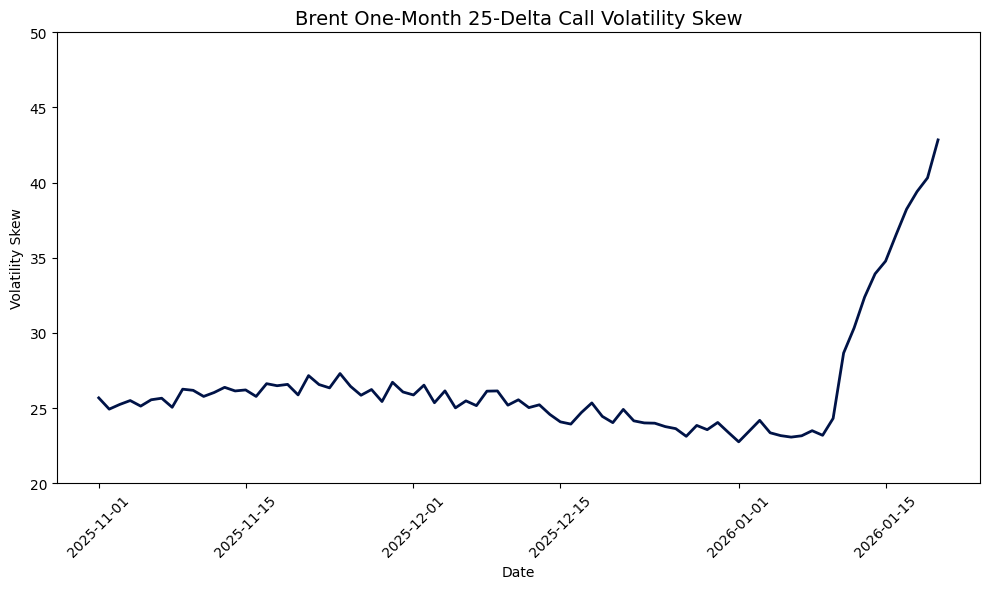

The catalyst was a dramatic escalation in U.S.–Iran tensions. President Donald Trump, returning to his “maximum pressure” doctrine, is openly weighing air strikes against Iran’s regime after Tehran’s hardline government has crushed nationwide protests, killing thousands. Washington’s talk of force, paired with new European sanctions on Iran’s Revolutionary Guard Corps for human rights abuses, is reviving the specter of conflict in the Persian Gulf and pulling a geopolitical risk premium back into oil prices. “The potential for Iran getting hit has escalated the geopolitical premium of oil prices,” Citi analysts observed in a recent note, reflecting how war worries are adding a few dollars to each barrel of crude.

For Americans who remember the energy price shocks of the 1970s, the implications feel uncomfortably familiar. Iran remains a heavyweight: it was OPEC’s third-largest producer in 2025, pumping roughly 3.3 million barrels per day, about 3% of world supply. Any conflict that curtails Iran’s output matters. Any conflict that threatens the Strait of Hormuz matters far more. The Strait is a narrow shipping chokepoint through which about 20 million barrels of oil flow daily, nearly one-fifth of global supply.

Traders are fixated on that vulnerability because it’s both physical and psychological. “The immediate market concern…is the collateral damage done if Iran takes a swing at its neighbors or, possibly even more tellingly, if it closes the Strait of Hormuz to the 20 million barrels per day of oil that navigate it,” explained John Evans, an analyst at brokerage PVM Oil Associates.

Even the threat of Hormuz’s closure can move prices quickly because it forces markets to price the unpriceable: a disruption that can’t be easily hedged or rerouted in real time. Energy analysts note that such an event would “likely push oil well beyond $100 per barrel, reigniting inflation and altering the current trajectory of interest rate policy in developed economies”.

So far, the sabers are still only rattling. But the market’s reaction shows that an extra margin on oil prices due to war risk has crept back into the market. For Americans already grappling with high living costs, the prospect of another conflict in an oil-rich region is just the kind of plot twist no one asked for.

Sanctions, Evasion, and Distorted Energy Flows

The current standoff didn’t begin overnight. It follows a year in which the U.S. tightened sanctions on Iran in an effort to choke off its oil income in hopes of forcing political change. Officially, Iran’s exports are meant to be squeezed toward zero. In practice, global flows have rerouted rather than disappeared, creating a shadow economy of energy trade that cushions Tehran and complicates the premise of isolation.

One year into President Trump’s revived “maximum pressure” campaign, data show Iran’s oil exports remain surprisingly robust. In 2025, Iran still delivered about 1.38 million barrels per day of crude and condensate to China, a 7% drop from the prior year. Once Iran’s shipments to Syria halted in late 2024, China essentially became Tehran’s sole visible buyer of crude, blunting the intended impact of Western sanctions.

Beyond crude, Iran has continued selling fuel oil, liquefied petroleum gas, and petrochemical feedstocks to a network of regional customers. Surprisingly, even some U.S.-aligned countries have been involved. The United Arab Emirates, a close American partner, has quietly emerged as the largest importer of Iran’s fuel oil exports, taking in roughly 70% of those shipments despite Washington’s pressure.

Central to Iran’s export resilience is a sprawling “shadow fleet” of tankers built for evasion. Aging vessels switch flags, turn off satellite transponders, conduct ship-to-ship transfers on the high seas, and hide behind opaque ownership to move Iranian crude illicitly. By some estimates, roughly 1,500 tankers worldwide were involved in these shadowy operations last year, with nearly 40% of them linked to the ferrying of Iranian oil. Even after stepped-up U.S. efforts in 2025 to blacklist ships and traders, hundreds of unsanctioned vessels remain active in the network.

The result has been a distorted global oil market. Official data understate Iran’s real exports, and nominally “isolated” barrels keep finding their way to refineries in Asia. The Iranian regime still earned an estimated $60 billion from oil, gas, and fuel exports last year, after accounting for steep discounts and smuggling costs. That’s far from the collapse to a trickle that U.S. officials predicted. Sanctions have introduced inefficiencies and workarounds rather than a total cutoff.

These evasive flows carry broader implications. They blunt economic pressure on Tehran and can prolong the behaviors the sanctions are meant to curb. They also demonstrate how energy trade reorganizes itself under duress, carving new channels that bypass traditional Western-controlled systems. Iran, Russia, and Venezuela—all heavily sanctioned oil states—are coordinating in novel ways to sell to willing buyers like China, often outside the U.S. dollar system. A bifurcated market is taking shape, reminiscent of Cold War-era patterns, where sanctioned producers find lifelines through non-Western partners.

For consumers, these hidden flows have effectively cushioned global supply, which helps explain why oil prices have not skyrocketed in 2025 despite multiple geopolitical scares. But that cushion is fragile. Shadow networks rely on aging ships and furtive practices that raise accident and spill risks. And if a real conflict erupts, these hidden supply lines could unravel, producing sudden shortages in unexpected places.

Sanctions have effectively created a parallel oil universe that masks fragilities. Officially, no one is buying Iranian oil; in practice, millions of barrels continue to change hands. That contradiction has suppressed prices for now, but it also means no one truly knows the depth of the world’s spare capacity when the system is truly tested.

Markets Misaligned with Geopolitical Reality

If the ghosts of 1970s-style shocks haunt oil markets, recent investor behavior shows little sign of it. Over the past year, markets have repeatedly shrugged off dangerous flare-ups. Even as tensions mount in the Middle East, many financial indicators continue to project calm. The result has been a growing misalignment between geopolitical risk and market pricing, driven by a mix of complacency and structural shifts in energy markets.

Consider last summer’s escalation. In June, Israel launched airstrikes on Iranian nuclear facilities. The United States joined the offensive days later in “Operation Midnight Hammer,” marking the first direct U.S. strikes on Iranian soil since the 1980s.

In theory, a direct U.S.–Iran clash is the kind of scenario meant to send crude into triple digits overnight. Brent did jump more than 7% in a single day when news of the initial strikes broke. But the feared spiral faded fast. Despite the open hostilities, oil prices peaked at around $78 per barrel and then retreated to pre-conflict levels after a ceasefire was brokered following 12 tense days. By month-end, crude was trading in the mid-$60s, lower than before the bombs fell. One of the most dreaded shocks imaginable produced only a modest, fleeting move in oil.

Nigel Green, CEO of deVere Group, bluntly described the mood during the Iran–Israel clashes. Markets, he argued, were treating a major regional war as background noise. “This isn’t resilience, it’s a mispricing of risk. Investors are leaning into a narrative that no longer fits the facts.” Oil and gold reacted in line with fear, while equities recovered quickly and volatility gauges barely moved. In Green’s view, that divergence is “out of sync” with reality. It implied a bet that conflict would remain contained and that the global economy could absorb shocks without broader repricing.

The reaction was not an anomaly either. Through 2025, as crises and wars flared, rallies often proved limited and short-lived. Traders braced for turmoil when Ukraine struck Russian oil export facilities and when Western sanctions targeted major Russian energy firms. Yet, crude stayed range-bound between roughly $60 and $80 a barrel, a relatively narrow band by historical standards.

Why the calm? Partly because the story of the past decade has been one of abundance. U.S. shale keeps surprising to the upside, and new barrels from places like Guyana and offshore Brazil have reinforced the idea that if one region stumbles, someone else can step in. Traders have grown used to the cushion. Add in softer demand growth (thanks to slower economies and better efficiency), and the market narrative starts to feel almost comfortable.

But calm has a habit of overstaying its welcome. Markets often look orderly right up to the moment they’re forced to price a real break in the pattern. Helima Croft of RBC Capital Markets has cautioned that traders are behaving “as if everything is just fine,” despite thin spare capacity. “If we actually had a test of spare capacity and needed additional volumes, we are not in the best shape,” Croft noted. Each incident that doesn’t escalate trains the market to shrug at the next one. That works until it doesn’t.

Underlying Fragilities in an Era of Abundance

Beneath today’s narrative of energy abundance sits a constellation of fragilities that experts say a major shock could expose. The global oil system is more diverse and adaptable than it was in the 1970s, but it’s not invincible. Some of the forces that have kept prices moderate could also amplify damage when things break.

Start with spare capacity. For much of the past year, oil markets have been described as well-supplied, even slightly oversupplied. Forecasts of multi-million-barrel daily oversupply sound reassuring. But paper surplus and usable surge capacity are not the same thing. Most of the true spare barrels sit in Saudi Arabia and a small circle of OPEC producers. If Iranian exports suddenly disappear, or if conflict spreads across multiple Gulf suppliers, those “available” barrels could be spoken for overnight, and what looks like a cushion can turn into crowding fast.

The second fault line is the broader geopolitical backdrop. This flare-up with Iran is not happening in isolation. The war in Ukraine drags on, keeping a major energy exporter constrained. U.S.–China tensions remain elevated, with Taiwan a constant tripwire. Political risk inside the United States has also risen, with sharper policy swings and less predictable alliance management. Any single pressure might be manageable; several at once can interact in messy ways. Coordination becomes harder. Policy responses slow. Markets, which prefer clean storylines, get uncertainty instead.

There’s also a quieter vulnerability inside the industry itself. Years of middling prices have made producers more cautious. U.S. shale companies, in particular, have shifted from “drill at any cost” to “return cash or lose investors.” Balance sheets are healthier, but growth reflexes are weaker. Executives talk more about discipline than expansion. That’s rational, but it means surge supply is less automatic than it once was. Ramping production takes rigs, crews, financing, and confidence that prices will hold. Add in years of underinvestment in large, long-cycle projects, and the pipeline of future supply looks thinner.

Echoes of Past Oil Shocks

Today’s tensions carry an uncomfortable sense of déjà vu for many Americans. While the details differ, the cast has changed, and the energy system is more sophisticated, the outline of the risk feels familiar. When Middle East crises collide with tight oil markets, the economic fallout tends to travel far beyond the oil patch.

The 1970s remain the benchmark case. In 1973, Arab OPEC members imposed an embargo after U.S. support for Israel, and prices roughly quadrupled in short order. The shock hit the daily lives of millions. Gas lines stretched for blocks. Stations ran dry. Inflation surged, and recession followed. It was the moment energy stopped being background infrastructure and became a front-page economic force.

The 1979 Iranian Revolution delivered a second blow and offers the closest historical parallel to what policymakers worry about now. As unrest shut down Iranian production, global output fell sharply—about 7% of world supply at the time before offsets. Even after other producers tried to compensate, the net loss was enough to send prices more than doubling, and fear did the rest. Buyers hoarded. Spot prices spiked far above contract levels. Shortage psychology took over, and once that mindset sets in, price moves tend to overshoot the math. The panic becomes part of the supply shock.

Later episodes, while less impactful, reinforce the pattern. The 1990-91 Gulf crisis pushed oil prices sharply higher ahead of a U.S. downturn. In 2008, crude reached $147 per barrel just as the financial system was cracking, intensifying the squeeze on consumers. In 2022, Russia’s invasion of Ukraine drove prices above $120 and helped ignite the worst U.S. inflation in four decades.

There are material differences today. The United States is now the world’s largest oil producer, thanks to shale, which provides a degree of insulation that didn’t exist in the 1970s. More energy spending tends to stay inside the domestic economy. Global supply is also more geographically diverse, reducing reliance on any single region.

Yet, diversification is not immunity. Supply and demand have not been repealed, and the United States remains tightly linked to global markets. A serious disruption, say, a prolonged closure of Hormuz, would quickly stress even a modernized system. Strategic reserves could soften the blow, and markets would adjust, but prices would not wait for the result.

What’s at Stake for Americans

Geopolitics can feel distant until it hits household budgets. The stakes of an escalating Iran conflict are real for the financial well-being of American households and businesses, especially at a time when many people already feel stretched by high prices and borrowing costs.

The most immediate channel is consumer prices, particularly gasoline. Even with oil relatively contained, pump prices in many areas have been hovering around $3–$4. When fill-ups cost noticeably more, household budgets adjust just as quickly, often by cutting elsewhere. Lower- and middle-income families feel that squeeze first and hardest because energy and transportation take a bigger bite of their income. And fuel costs don’t stay in their lane. Higher diesel and jet fuel prices ripple through freight, food distribution, and retail logistics.

Then comes monetary policy. The Federal Reserve has been looking for room to ease if growth softens, but an energy-driven inflation flare-up muddies that path. Rate cuts that once looked plausible get pushed out. Some could disappear from the calendar altogether. That matters because borrowing costs are already high. Mortgage rates near multiyear highs continue to weigh on housing turnover and new construction. A renewed inflation pulse tied to energy would make it harder for rates to come down, keeping pressure on buyers, builders, and anyone hoping to refinance out of older debt.

For businesses, the squeeze can come from both sides at once: rising input costs and stubbornly high financing costs. Margins narrow. Hiring plans get postponed. And expansion projects get shelved. This is what makes oil shocks particularly difficult for central banks. They raise prices while often weakening demand, leading to the stagflationary mix policymakers dread.

The Fed’s job becomes a tightrope walk. Fight inflation too aggressively and risk recession; ease too soon and risk letting price pressures re-embed. History isn’t especially comforting here. Many postwar U.S. recessions have featured some version of the same sequence—an oil spike, tighter money, and a stalled expansion. It’s a familiar one-two punch, and it has landed more often than forecasters like to admit.

Financial markets could feel it too. Stocks have shown an impressive ability to look past geopolitical flare-ups. But risk often gets priced gradually, then all at once. Energy producers may benefit from higher oil prices, but rate-sensitive stocks do not. A broader market pullback doesn’t just bruise Wall Street egos; it hits retirement accounts, pensions, and household wealth. There are second-order risks as well. Higher oil prices strain oil-importing emerging markets, and if enough of them wobble at once, credit stress can travel faster than expected.

Diversification in a Fragile Global Environment

The brewing Iran crisis is a reminder that the distance between overseas conflict and your household budget is shorter than it looks on a map. Right now, markets and policymakers are enjoying a fragile calm, supported by healthy inventories, creative sanctions workarounds, and the institutional memory of past shocks. But calm often sits atop weak foundations. Distortions and hidden tightness don’t always show up in the data until they all appear at once. From gas prices to inflation to interest rates, a lot of what happens next at home depends on decisions and events unfolding far away. Americans are right to pay attention, not because panic is warranted, but because complacency has a cost. The hope is that cooler heads prevail and the worst outcomes are averted. But hope is not a strategy, and prudence, however imperfectly practiced, is still a virtue.