By Preserve Gold Research

First the political gridlock over the debt ceiling in June, now another budget impasse that threatens to shut down the U.S. federal government. It’s enough to make anyone’s head spin, regardless of political affiliation. With time running out before the end of the fiscal year, Congress must approve a budget or pass a continuing resolution (CR) to keep the government funded or risk a shutdown on October 1. However, with no clear path forward and partisan tensions at an all-time high, the likelihood of a shutdown has increased, according to political experts.

The threat of a government shutdown is nothing new for most Americans. Since the modern budget process was established in 1976, there have been 20 funding gaps and four government shutdowns lasting more than a day. However, with each successive shutdown, the stakes seem to get higher and the consequences more severe. For some, the political brinkmanship and uncertainty that comes with these budget battles are unnerving, especially considering the potential impact on an already vulnerable economy. For others, these shutdowns have become a predictable and frustrating part of the political landscape, highlighting the deep divisions and dysfunction in Washington and calling into question policymakers’ ability to handle financial matters without relying on last-minute, short-term solutions.

In the face of this potential shutdown, Americans may be left wondering what will happen if the government actually shuts down. Will it impact their daily lives? What impact will a shutdown have on the economy? And what steps can they take to prepare for the worst? As lawmakers in Congress struggle to find a solution before time runs out, understanding the potential impact of a government shutdown can help Americans better brace themselves for what lies ahead.

Understanding Government Shutdowns

A government shutdown occurs when Congress fails to pass appropriations bills or a continuing resolution to fund government agencies and operations. Non-essential government services grind to a halt, while essential services such as national security and public safety continue operating, albeit with reduced staffing. During a shutdown, federal employees who are deemed non-essential are furloughed, or temporarily laid off without pay, until the government is able to resume funding. In addition, national parks and museums may close their doors, visa and passport processing may be delayed, and federal loan applications may go unprocessed.

In most cases, shutdowns come as a result of partisan disputes over government spending, like spending levels and policy riders. However, in recent years, shutdowns have also been used as a negotiating tactic to push through other political priorities, like immigration reform or health care legislation. This has led to a growing sentiment among Americans that budget battles are being fought at the expense of their livelihoods, with little regard for the economic impact of a shutdown. While the vast majority of government shutdowns have been resolved within a few days, there have been instances where shutdowns have lasted several weeks — the longest being the 35 day shutdown in 2018-2019. As the deadline for a new budget draws near, the possibility of a prolonged shutdown becomes increasingly likely, and with it, potential consequences for ordinary Americans.

The Potential Effects on Americans and the Economy

In isolation, government shutdowns may not seem like a major concern. After all, the majority of essential services continue to operate and many federal employees eventually receive back pay for the time they were furloughed. However, when put into the context of an already fragile economy, the consequences of a shutdown could be more severe than many people realize. With threats continuing to mount for the U.S. economy, experts warn a government shutdown could be the straw that breaks the camel’s back as businesses, investors, and consumers lose confidence in the government’s ability to manage the country’s finances.

In the current macroeconomic climate, even a relatively short shutdown could tip the economy into recession, especially in light of other economic concerns like rising inflation, spiraling debt, and interest rates edging higher. Add to the growing list of economic woes a government shutdown, and it’s not difficult to see why economists like David Rosenberg think “it’ll be a miracle” if the U.S. can avoid a recession.

According to analysts at Goldman Sachs, a government-wide shutdown lasting just one week would reduce GDP growth by 0.2 percentage points, with the effect compounding for each additional week the shutdown lasts. This means a prolonged shutdown could shave off half a point of GDP growth or more, a significant amount for an economy struggling to overcome a flurry of headwinds. During the 2018-2019 shutdown, the U.S. economy reportedly lost $11 billion in the two quarters following the shutdown, as government contractors, small businesses, and federal employees saw their income dry up. The 16-day shutdown in 2013, similarly, resulted in an estimated $20 billion hit to the economy, equal to half a percentage point of GDP.

Then there’s the issue of confidence. Shutdowns create uncertainty for businesses and investors, who may put off major decisions until the shutdown is resolved. Without critical data from federal agencies like the Bureau of Labor Statistics, assessing the health of the economy becomes more difficult, making it harder for investors to make informed decisions. This can lead to a “wait-and-see” approach, which can have a cascading effect on hiring, investment, and consumer spending across industries — something that could lead to lost jobs and a slowdown in economic activity.

“Rising odds of a government shutdown and associated uncertainty, along with the resumption of student loan repayments are additional downside risks to the outlook,” cautioned Ernst and Young economists in a September economic outlook report. Coupled with Fitch’s recent downgrading of the U.S. sovereign credit rating from AAA to AA+ due to a “deterioration in standards of governance” among other factors, the potential consequences of a government shutdown could be much more far-reaching than just missed paychecks and shuttered national parks.

The risk of a shutdown also looms over everyday Americans, as federal services and programs they rely on for their well-being hang in the balance. Beyond the macroeconomic implications, a shutdown could have real-world consequences for individuals and families who depend on government services like food assistance and government-backed mortgage loans. Federal employees who are furloughed or forced to work without pay may struggle to make ends meet, as their primary source of income is temporarily cut off. Meanwhile, small businesses that rely on government contracts may be forced to lay off workers, or at the very least, put off hiring. The Joint Economic Committee estimates that $13 billion a week in federal contracts could be at risk during a shutdown, with $3 billion of that directly supporting small business contracts. Without access to government services, small businesses may also face delays in obtaining necessary licenses and permits, stalling their growth and expansion plans.

These effects are compounded further by the fact that Americans’ savings rates continue to decline amid rising prices and soaring borrowing costs, making it harder for impacted households to weather the storm. Should a shutdown occur, furloughed federal workers could be faced with tough decisions about which bills to pay and which necessities to cut back on, potentially leading to a rise in personal bankruptcy filings—another headwind the economy could do without.

Preparing for a Shutdown

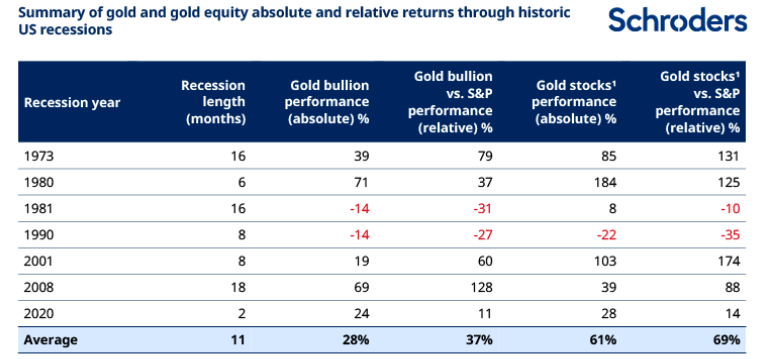

As the deadline for a new budget draws near, the specter of a shutdown looms ever larger in Washington as the debate over government spending rages on. With the potential for a shutdown to ripple through the economy and impact the lives of everyday Americans, preparing for this contingency can help mitigate its effects. Should the shutdown be the proverbial straw that breaks the camel’s back and tips the economy into a recession, savers may want to consider assets that have traditionally served as a hedge against economic downturns, such as gold. Owing to its low correlation to other asset classes and its reputation as a reliable store of value, gold can help protect savings from the volatility that a shutdown and potential economic downturn may bring. According to data from Schroders, gold has “returned 28% on average and outperformed the S&P 500 by 37%,” when looking at the six months leading up to and following the last seven recessions dating back to the 1970s.

SOURCE: SCHRODERS

While past performance is not indicative of future results, gold has a track record of holding its value during times of economic uncertainty, making it a potential asset to consider in the event of a shutdown. With a slew of market indicators pointing to a downturn in the near future, experts are recommending Americans take a close look at their savings and consider adding gold as an insurance policy against the potential effects of a government shutdown and its aftermath.