By Preserve Gold Research

The stock market could plunge by more than 60% in the coming months, according to renowned hedge fund manager and investor, John Hussman. In a recent note to investors, Hussman warned that high stock market valuations and excessive optimism could lead to a severe crash reminiscent of the dot-com bubble in the late 1990s. Hussman’s concerns are echoed by other market experts, like billionaire investor Jeremy Grantham, famous for correctly predicting the 2000 and 2008 market crashes.

Warnings of an impending market crash are not new, but they have intensified in recent months as stock valuations continue to climb. The S&P 500 price-to-earnings ratio, a measure of how expensive stocks are relative to their earnings, currently stands at 29.7, well above its historical average of 20.2. With valuations hovering around 40% higher than usual, the divergence between stock prices and economic fundamentals has raised eyebrows among investors and analysts alike.

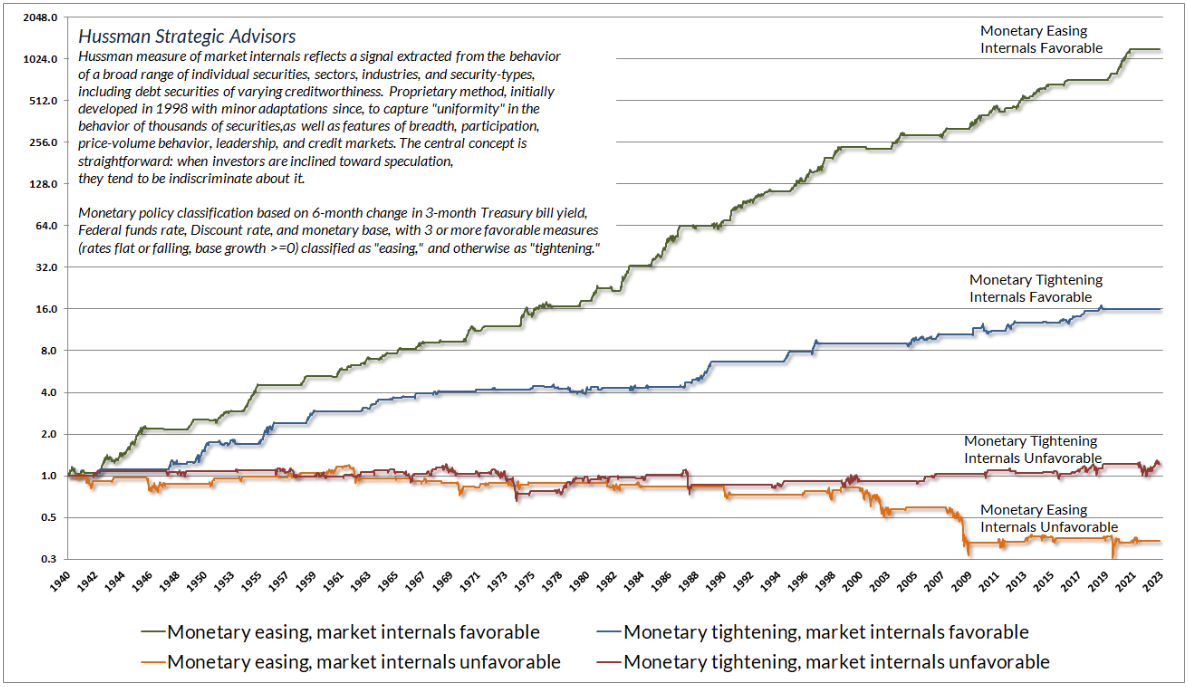

According to Hussman, “Market valuations stand at one of the three great bubble extremes in US history,” the other two being in 1929 and 2000. This level of market overvaluation, combined with unfavorable “market internals” such as declining market breadth and an increased level of speculative activity, has led Hussman to predict a sharp decline in stock prices in the near future.

Valuations Misaligned with Fundamentals

While market crashes aren’t uncommon, current stock valuations suggest that a major correction is overdue. Market valuations refer to the price investors are willing to pay for a company’s stock compared to its earnings. When market valuations are high, it indicates that investors are willing to pay a premium for the stock relative to its earnings. Over-extended valuations can be a warning sign of an impending market crash, as investors become increasingly speculative and irrational.

Valuations can be measured through several metrics, including the so-called Buffet Indicator, a ratio of the total market capitalization to the GDP. Using this model, Hussman estimates that “a market loss on the order of -63% in the S&P 500” would be needed to bring valuations back to historical averages. Other experts, like Ned Davis Research, point to traditional valuation methods such as the Shiller P/E ratio and the ratio of the S&P 500 earnings yield relative to cash yields as evidence of an overvalued market. According to the Shiller model, which compares stock prices to their 10-year average earnings, the market is currently overvalued by 40%. Similarly, the earnings yield to cash yield ratio, used by Ned Davis Research, suggests that stocks are the most overvalued they’ve been since the dot-com bubble.

Both Hussman and Grantham have highlighted that years of market speculation and excessive risk-taking amid historically low interest rates have led to a misalignment between stock prices and economic fundamentals. Grantham, who co-founded the investment firm GMO, warned in a recent note that the “market suffers from attention deficit disorder, so it always thinks every rally is the beginning of the next great bull market.” This irrational exuberance, combined with the aforementioned factors, could be the tipping point for a market crash. “Sooner or later, the simple arithmetic suggests that you’ll either have a dismal return forever, or you’ll have a nice bear market.”

Market Internals Showing Signs of Weakness

In addition to high valuations, Hussman also points to unfavorable market internals as a warning sign for a potential crash. Market internals refer to the underlying health of the market, including measures like market breadth and trading volume. When market internals are weak, it can signal a lack of conviction among investors, making the market more vulnerable to a major correction.

According to Hussman, trend uniformity between market internals and valuations is key to assessing the market’s overall health. “Historically, when trend uniformity has been positive, stocks have generally ignored overvaluation, no matter how extreme,” says Hussman. “When the market loses that uniformity, valuations often matter suddenly and with a vengeance.”

In other words, when market internals are strong and in line with high valuations, the market will often continue to climb despite the warning signs. However, when market internals start to weaken or diverge from valuations, herd mentality can lead to a stampede toward the exit. Even small changes in market sentiment can be enough to trigger a major sell-off and create a “trap door” effect, as Hussman describes it.

Source: Hussman Trust

The growing disparity between market valuations and market internals suggests that we are nearing a tipping point, where investors will start to lose confidence in the market. “When the bough breaks, my sense is that it may break abruptly,” said Hussman, who sees the S&P 500 posting negative returns over the next 10-12 year period.

Banking Woes and a Debt Powder Keg

Adding fuel to the fire of overvalued markets and weakening market internals are the losses that banks are facing and their potential impacts on the broader market. With 10-year Treasury yields having increased by over 34% since April, banks are facing significant losses on their investments in long-term bonds. Data from the FDIC shows that unrealized losses on securities increased by $42.9 billion, or 8.3%, in the second quarter of this year, a sign that banks may be facing more pain ahead.

Today, US banks could be facing over $650 billion in unrealized losses on their investment portfolios, according to estimates by Moody’s. While the losses themselves may not be enough to trigger a market crash, they could impact bank balance sheets and limit their ability to lend. Like the 2008 financial crisis, mounting losses could have a domino effect on the market, as banks tighten lending and reduce liquidity, leading to a potential credit crunch. Hussman and Grantham both point to this risk as a potential catalyst for a market crash, citing the interconnectedness of the financial system and its potential to amplify losses.

Beyond potential losses on securities, the growing federal debt is also a cause for concern. The Fed’s balance sheet is nearly $2.5 trillion in the red, and total US debt now stands at a staggering $32.3 trillion. While there is no immediate impact on the market, the sheer amount of debt could restrict monetary policy options and weigh on economic growth, according to Hussman. With the “persistent trickle of expanding debt, loose policy, extreme overvaluation, and banking losses” the US could be facing an economic powder keg that could quickly ignite into a market crash. “Ponzi schemes can go on for years,” said Hussman, but “when a confidence bubble finally breaks, it tends to break abruptly.”

Help Protect Your Savings

With warnings of a potential market crash looming, diversification and risk management are key when it comes to helping protect your savings. As Hussman notes, “shifts in herd behavior are essentially impossible to predict,” so being prepared for potential market downturns could help reduce the impact on your savings. For Americans approaching retirement, this is especially important, as they may have less time to recover from a market crash.

Market correlation, or the degree to which two assets move in tandem, can also play a role in portfolio diversification. Highly correlated assets, like stocks and index funds, tend to move in lockstep with each other, meaning that a downturn in one asset class could impact the entire portfolio. According to experts, diversifying with assets that have a low correlation to the stock market, like gold, can help mitigate this risk and provide more stability to your savings.

With market signals flashing red and financial pundits like Hussman, Grantham, and billionaire investor Leon Cooperman warning of a potential market crash, taking steps to help protect your savings now could help you keep your hard-earned money safe in the long run. As the expression goes, “expect the best but prepare for the worst.”