By Preserve Gold Research

In the heated atmosphere of an election year, incumbents often become convenient scapegoats for societal woes, especially the visible and painful rise in consumer prices. While it’s easy to point fingers at presidents, Congress, or even corporations, the real culprit is hidden in plain sight.

After decades of access to cheap credit and lax monetary policies, the U.S.’s fiat currency system has become the true culprit behind years of simmering inflation—quietly and insidiously eroding the value of Americans’ hard-earned money.

With no intrinsic value, backed by little more than government promises, using fiat currency as legal tender is a dangerous game of smoke and mirrors. Despite its widespread acceptance, it’s an inherently unstable form of currency that can easily bloat, crash, and burn—as we’ve seen throughout history.

A confidence game, with the people’s faith in its value, being the only thing keeping it afloat, fiat currency is like building a house of cards with no foundation.

Unlike commodity-backed currencies, which were once the norm, fiat currencies allow governments to print money at will without sufficient backing. Like an unchecked printing press churning out new dollars with no end in sight, this expansion of the money supply dilutes its overall value.

In other words, the more dollars in circulation, the less each individual dollar is worth. And while blame is often placed on corporate greed or global market forces, it’s this constant influx of new money that ultimately drives up prices.

For many Americans, the price increases come with a heavy toll, especially for those on fixed incomes or those struggling to make ends meet. John Maynard Keynes once warned, “By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

A hidden cost imposed by the Federal Reserve’s monetary policies and the government’s failure to address underlying economic issues. A silent tax that is felt daily at the gas pump, grocery store, and utility bill, until a tipping point is reached and the people’s faith in their currency crumbles.

Redefining Inflation Won’t Solve the Problem

To understand the true root cause of inflation, it’s important to first address its conventional definition. Historically, “inflation” referred to the creation of new money, not rising prices.

A rise in the amount of paper currency in circulation relative to the real money—gold and silver coins, for example—that backed it. Subsequently, inflation came to describe the relationship between the volume of money in circulation and the actual amount required for trade.

In recent years, however, economists and politicians have attempted to redefine the term to refer solely to rising prices. This not-so-subtle shift confuses cause and effect, allowing policymakers to mask the true source of the problem.

When people complain about inflation, they are usually lamenting the higher prices they see in the market, not realizing that those prices are a symptom of a deeper issue—the devaluation of their currency.

While redefining inflation may make it easier for governments to justify their actions and manipulate public perception, it does nothing to address the underlying issue of an expanding money supply.

As renowned economist Milton Friedman famously said, “Inflation is always and everywhere a monetary phenomenon.” Simply put, inflation occurs when there is an increase in the money supply that outpaces growth in the production of goods and services. This leads to a decrease in the purchasing power of each unit of currency, resulting in higher prices for goods and services.

Making matters worse, still others have come to equate high prices with inflation, leading to a misguided focus on controlling prices rather than addressing the root cause. A misconception that has been perpetuated by mainstream media, that couldn’t be further from the truth. Inflation is not a natural occurrence in a market-based economy, but rather a result of government intervention in the form of central bank policies and deficit spending.

It’s a symptom of an unhealthy monetary system that relies on constant money creation to sustain itself. Attempting to redefine inflation as anything other than a monetary phenomenon only serves to divert attention away from the real issue at hand.

Common Misattributions of Rising Prices

Operating under the misguided belief that real inflation is caused by rising prices, policymakers often employ tactics such as price controls and subsidies in an effort to artificially lower prices. To shift blame away from the true cause of rising prices, fingers are pointed at supply shocks, market failures, and greedy businesses.

“A loaf of bread costs 50 percent more today than it did before the pandemic. “Ground beef is up almost 50 percent. Many of the big food companies are seeing their highest profits in two decades.” This quote from the Democratic Presidential-nominee Kamala Harris during one of her recent campaign events is a prime example of this misattribution and the common rhetoric used by politicians to justify inflation.

While it may be true that prices have risen for these items, the root cause lies in the excessive money creation and inflationary monetary policies of the government. External factors may cause temporary price fluctuations but each can be logically dismissed as the primary cause of inflation.

Energy Policy

Energy policy, for instance, can certainly impact the cost of transportation and production, but it’s only a small piece of the puzzle. Yes, policies that reduce oil supply, like restricting drilling, can increase oil prices. However, without the creation of new money, rising oil prices would simply lower demand for other goods, leading to falling prices elsewhere.

Imagine a scenario where the cost of oil surges; consumers would have to cut back on other expenses to accommodate their fuel budgets. This shifting of limited funds between categories – known as ‘the substitution effect’—would counteract any potential demand-driven inflationary pressure.

Supply and demand mechanics further illustrate this point. Consider a simple model where the economy has a fixed amount of money. If the price of oil increases, the same money cannot stretch to cover increased costs across all sectors. Price increases in one area must result in decreased demand elsewhere if the money supply is constant.

The complexity of the U.S. economy doesn’t negate these principles. To the contrary, even in a complex economy, an increase in prices in one area necessitates a decrease in demand in others unless new money is created.

Corporate Greed

Another frequent scapegoat for inflation is corporate greed. Politicians often argue that avaricious corporations are hiking prices to boost profits and exploit consumers. However, this ignores the basic incentive for businesses—competition.

In a free market economy, consumers can choose between multiple suppliers offering similar products at varying prices. If one company increases prices excessively, consumers will likely turn to a competitor with lower prices.

This competition keeps businesses in check and prevents them from ratcheting up prices without justification. As Joshua Hendrickson, an economics professor at the University of Mississippi, points out, “If prices are rising on average over time and profit margins expand, that might look like price gouging, but it’s actually indicative of a broad increase in demand.” According to Hendrickson, “Such broad increases tend to be the result of expansionary monetary or fiscal policy — or both.”

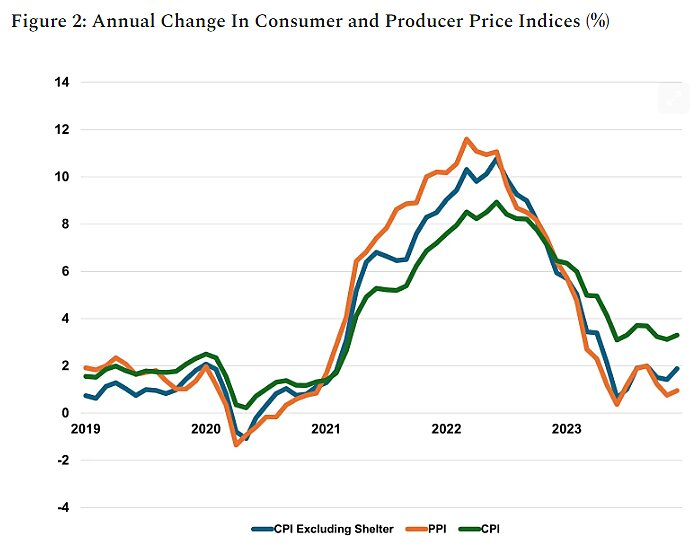

Figure 1: Annual Change in Consumer and Producer Price Indices (%) | The Cato Institute

Further dispelling the notion of corporate greed as a major cause of recent inflation in the U.S. is the difference between the Consumer Price Index (CPI) and the Producer Price Index (PPI). The CPI measures price changes at the consumer level, while the PPI tracks prices at the producer level.

If corporate greed were truly driving inflation, we would see a divergence between these two indices. However, the data indicates that both indices have moved in tandem in recent years, with the spread between them remaining relatively constant over time.

Supply Shocks

There is also the argument that current inflation is caused by supply shocks—sudden disruptions to the supply of goods and services. Most recently, during the COVID-19 pandemic, supply chains were severely disrupted as factories shut down and transportation was limited. Lockdowns reduced the supply of goods and services, but they also reduced demand as people lost their incomes.

To mitigate the economic impact, the U.S. government issued over 476 million payments amounting to a total of $814 billion, essentially creating new money out of thin air. While touted by some as a necessary “economic lifeline”, the infusion of new dollars in the economy led to higher demand for goods without a corresponding increase in supply.

According to the St. Louis Fed, 2.6% of the surge in inflation in 2022 can be attributed to the direct effects of these stimulus checks. “By stimulating demand without boosting supply, our results suggest that fiscal support contributed to increased excess demand pressures in goods markets,” the authors concluded. So, on the surface, it may seem like supply shocks are the real culprit behind current inflation, but in reality, they only account for a small part of the overall picture.

Role of New Money Creation

The creation of new money is a shadowy process that is often misunderstood. While the U.S. government has the power to create new money, it does so through the Federal Reserve, a privately owned central bank. When the government needs to inject more money into the economy, the Fed issues bonds or securities that it sells to the public.

In return, the Fed credits the government’s account with new money, a process known as “monetizing the debt.” Operating like a puppet master behind the scenes, the Fed effectively controls the amount of money circulating in the economy—and with each newly printed dollar, the dollar’s value decreases.

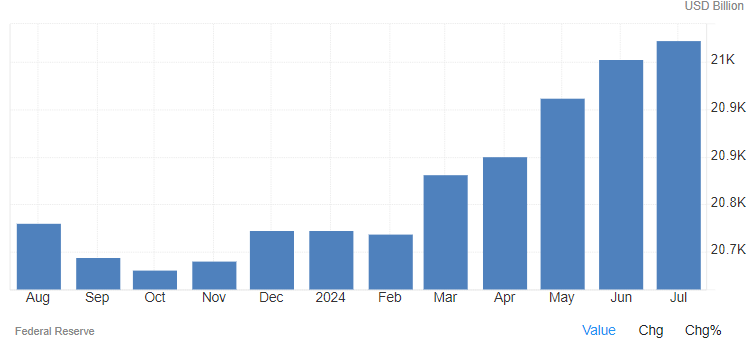

Consider this chilling fact: the M2 money supply in the United States rose by $29.3 billion in June, reaching a staggering $21.054 trillion in July 2024—the highest in 17 months. But this relentless tide of new money creation isn’t just a recent phenomenon.

Since 2009, the total money supply has ballooned by an alarming 185%, with a jaw-dropping 24% of the current supply created since January 2020. This surge has led to a massive monetary overhang, increasing the volume of money sloshing around in the economy and driving prices higher.

Figure 2: United States Money Supply M2 | Trading Economics

James A. Garfield, the 20th President of the United States, once ominously declared, “Whoever controls the volume of money in any country is the absolute master of all industry and commerce.” His words echo through the halls of history, warning us of the dangers of unchecked money creation.

The Federal Reserve’s persistent infusion of new dollars into the economy represents a double-edged sword. On one side, it sustains increased spending without reducing demand for other goods. On the other, it inflates the money supply, pushing up prices and reducing the value of each dollar in circulation.

Gold vs. Expanding Money Supply

With every new dollar injected into the economy chipping away at the purchasing power of the existing ones, it’s easy to see why central banks have been turning to gold. When you measure gold against the incessant printing of fiat money, its stability becomes starkly apparent.

Unlike fiat currencies, gold can’t be artificially increased or printed at will. This makes it a steadfast store of value, especially during times of unchecked monetary expansion.

Consider the wise words of Daniel Webster, a prominent 19th-century American statesman: “Of all the contrivances devised for cheating the laboring classes of mankind, none has been more effective than that which deludes him with paper money.” History has shown us time and again that fiat currencies are shaky foundations for economic stability.

They can be manipulated, inflated, and devalued with little regard for the impact on the average citizen. With a failure rate of 100% over time, they simply can’t compete with the stability and reliability of gold. When the presses start running, which would you rather have in your pocket?