By Preserve Gold Research

September 2025 has arrived with the world on edge. Conflicts have multiplied from the Middle East to Eastern Europe to the Western Pacific, with pressure spilling into already uneasy markets. Policy teams have scrambled, paused, and scrambled again, because each headline has had the power to change the calculus for investors. Many have reacted in the oldest way they know by reaching for safe havens like gold. Prices have breached record highs as a visible war premium has settled into valuations, a reminder that fear has priced risk faster than models have.

While the economy has shown pockets of resilience, a wary mood has taken root across the US. Many Americans sense that distant conflicts could circle back home through higher fuel costs, fresh inflation, tangled supply lines, and volatile financial conditions. One strategist put it bluntly: “geopolitical uncertainty…is going to keep a floor under the market for safe-haven bidding.” Memories of oil shocks and stubborn price spirals have had a long half-life, and they may shape behavior again.

Below, we examine four flashpoints that could push the US economy closer to the edge. In each case, we assess how these risks might re-stoke inflation pressures, unsettle funding markets, and strain supply chains, and why those dynamics could channel even more demand into gold. Nothing is certain, but the past few years have taught us that unlikely events are still possible, and with strong forces at play today, it’s prudent to be prepared for all scenarios.

Geopolitical Risk Rises as Qatar Strike and Gaza Bombing Boost Gold

What began as a localized war in the Middle East has started to spiral into a wider regional crisis. The conflict’s expansion took a turn when Israel conducted an airstrike in Doha, Qatar, targeting exiled Hamas leaders. The strike, which killed several people, including a Qatari intelligence officer, shattered assumptions about the sanctity of Gulf state neutrality. Qatar’s ruler called it “state terror”, and even rival Gulf capitals rallied in outrage. Meanwhile, Israel’s bombardment of Gaza has intensified, and rhetoric between Israel and Iran has escalated. With powerhouses snarling across capitals and proxies clashing, investors have begun to price a war premium into key assets, especially oil and gold.

In this febrile atmosphere, gold prices have climbed steadily as safe-haven demand has swelled. Each new headline out of the region, whether a deadly airstrike, a diplomatic collapse, or a hint of wider war, has sent ripples of anxiety through markets. Gold, the traditional stronghold in times of turmoil, has naturally benefited from these jitters. By mid-2025, spot gold hovered just shy of its record after jumping about 4% in a single week during a major flare-up in June. The immediate spark came from reports that Israeli jets struck Iranian targets, which stoked fears of a broader Iran–Israel confrontation that could pull in great powers.

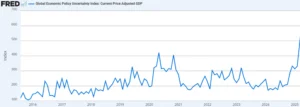

Global Economic Policy Uncertainty Index: Current Price Adjusted GDP

Source: Federal Reserve Bank of St. Louis

Oil has compounded the stress. Talks of a war premium on crude, an extra layer in price that reflects supply-shock risk, have resurfaced amid attacks on tankers and oil infrastructure in the region. Brent crude rallied nearly 20% in June, and every dollar increase in oil filters into higher costs for fuel, transportation, and ultimately consumer goods. While crude prices have since eased, the ongoing tensions between the two countries continue to pose a threat to global oil supplies. The last thing the US economy needs is an external energy shock that could undue the Fed’s efforts to keep US inflation in check.

It’s important to note that uncertainty itself feeds gold’s rise. Gold thrives on a lack of clarity about the future, and in the Middle East, uncertainty abounds. Will the Israel–Hamas war draw in Hezbollah on Israel’s northern front? Could Iran, openly incensed by the Gaza campaign and the strike in Qatar, directly enter the fray? Might the United States, which has troops and bases across the region (and now faces seething anger from Gulf partners for not preventing the Qatar incident), become more militarily engaged if its allies or interests come under threat? These questions have no easy answers, and their mere existence has been enough to send some investors running for cover.

Ukraine Hits a Major Russian Refinery as Moscow Fires Hypersonics

Half a world away from the Middle East, another conflict grinds on with potential consequences that have kept many awake at night. In Eastern Europe, Ukraine’s war to repel Russia’s invasion has not only dragged on into its fourth year but has escalated in ways that carry global ramifications. In mid-September 2025, Ukraine launched one of its most audacious operations to date: a drone assault deep into Russia that targeted the Kirishinefteorgsintez refinery in Russia’s Leningrad region. Kirishi is one of Russia’s largest oil refineries, processing roughly 355,000 barrels of crude per day (about 6.4% of Russia’s total refining capacity).

Within days, the Russian military test-fired a Zircon hypersonic cruise missile over the Barents Sea, a bristling display of advanced weaponry clearly intended to warn the West and Ukraine against further provocation. The Russian Defense Ministry also publicized joint military drills with Belarus featuring these hypersonic weapons and supersonic bombers. Both sides have been flexing their muscles as tensions continue to escalate in the region: Ukraine by hitting a strategic Russian economic asset on Russian soil, and Russia by brandishing next-generation armaments. For markets, this double escalation has raised the risk of an energy shock and, by extension, the chance of wider NATO entanglement.

The immediate economic risk runs through oil. By targeting Kirishi and other energy assets, Ukraine has shown that it may try to squeeze the revenue machine that funds Russia’s war. Russia remains a top oil exporter, and any credible threat to output or export logistics could tighten a market that already looks sensitive. Even a brief outage or fear of one can add a few dollars to the price of each barrel of oil. And every sustained $5–$10 rise in oil, if it materializes, translates to higher gasoline prices, steeper diesel and jet fuel costs, and added inflationary pressure worldwide.

Energy analysts at JPMorgan warned that these refined tactics by Ukraine indicate “a growing willingness to disrupt international oil markets, which has the potential to add upside pressure on oil prices.” In other words, what might have once seemed a localized European war is now directly threatening to spill over into global energy security. For Americans already grappling with elevated living costs, this is a concerning prospect: higher fuel costs can ripple through to the price of everything from food to airfare, undermining the hard-won progress in cooling inflation.

From the vantage of global investors, all these maneuvers add up to heightened uncertainty and potential for stagflationary shock. If the war in Ukraine intensifies and energy becomes a weapon (on top of the sanctions and counter-sanctions already in play), experts say we could see a scenario reminiscent of the 1970s in some ways—supply-driven inflation spikes colliding with a slowing economy. That’s a nightmare for central bankers and a textbook case for gold to shine. The mere possibility has been enough to keep gold well bid. Gold’s appeal is historically strong in environments of high inflation and geopolitical crisis, and here we have a credible risk of both. Traders also know that if an energy shock hits and inflation rebounds while growth slows, the Federal Reserve may face limits in its ability to respond (they can’t cut rates easily if inflation is flaring, but high rates won’t help against a war-driven supply shock either).