By Preserve Gold Research

American consumers are beginning to feel uneasy about their financial future. Recent surveys show a sharp decline in economic confidence, with many expecting to be worse off next year rather than better. In a Primerica survey of middle-income households for Q3 2025, only 21% said they expect to be better off next year, while 34% believe they might be worse off, and nearly one-third anticipate no real change. Five years ago, the same group felt far more optimistic about their prospects.

This shift tracks with broader indicators. Consumer sentiment indexes have fallen hard, and worries about rising living costs continue to spread. The numbers point to a sobering conclusion: Americans are bracing for hard times ahead, and a convergence of economic pressures, from stubborn inflation to higher interest rates, is fueling their concerns.

Consumer Sentiment Plunges to Historic Lows

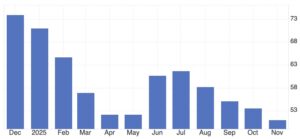

One of the most evident signs of Americans’ gloom is the cratering of consumer sentiment. The University of Michigan’s consumer sentiment index, a long-running gauge of household optimism, has fallen to levels not seen in decades. In early November 2025, the index dropped to 50.3, its lowest reading since June 2022 and near a record low in the survey’s history. For perspective, Americans haven’t expressed this degree of pessimism since the late 1970s, when the index began consistently tracking consumer attitudes. Such a collapse suggests that Americans across the board are apprehensive about the direction of the economy.

University of Michigan’s Consumer Sentiment Index

October 2025 marked the steepest single-week decline in total crypto market cap as panic selling swept across the sector. Source: Coin Gekko

Why has there been a collapse in confidence? Part of the answer lies in recent events. When the November survey went into the field, the federal government was locked in a prolonged shutdown, the longest ever recorded. For more than a month, essential services slowed or stalled. Food assistance delays rippled through vulnerable communities. Air travel disruptions reminded even well-positioned households that the system could seize without warning. Every headline reinforced the sense that political gridlock might spill into real economic harm.

“With the federal government shutdown dragging on for over a month, consumers are now expressing worries about potential negative consequences for the economy,” noted Joanne Hsu, director of the University of Michigan survey. The decline in sentiment has been broad-based, spanning Republicans, Democrats, and independents; young and old; lower-income and middle-income alike. Economic worries have become a bipartisan, universal experience, and experts say these concerns are likely to linger for the foreseeable future.

The “Inflation Hangover” Is Now a Daily Reality

Inflation’s bite has eased from its peak, but its sting still lingers in household budgets. Families continue to face grocery bills, utility charges, and daily essentials that sit far above where they were just a few years ago. Middle-income households feel this pressure most acutely. They often earn too much to qualify for assistance, but lack the financial buffer that wealthier families rely on when prices surge.

Since January 2021, the cost of necessities like food, gas, and utilities has jumped by 32.7%, while wages for these middle-income households have risen by only 23.5%. Prices have moved faster than paychecks. That widening gap has deepened the “inflation hangover” many Americans are living through, a lingering sense that no matter how hard they work, the basics keep slipping further out of reach.

It’s not just anecdotal. Hard data confirm that incomes haven’t kept pace with expenses. When Primerica first began polling middle-income Americans in 2020, half said their earnings were falling behind the cost of living. Now that figure has swollen to 69% who feel their income lags behind rising expenses. This sentiment has held stubbornly high for the past two years, underscoring that many families can’t seem to get ahead. Any wage gains they receive are quickly eaten up by pricier groceries, higher rent, costlier insurance, and other bills that never seem to stop climbing.

“The economy has been fluctuating month to month and sometimes week to week for years, but one thing is clear–the higher cost of living isn’t going away,” says Glenn J. Williams, CEO of Primerica. His caution reflects a widespread recognition that the inflation-driven surge in prices has become the new baseline. The necessities that households rely on will likely stay expensive, even if inflation rates cool, effectively locking in a lower standard of living unless incomes catch up.

Families seem to be anticipating little relief on the horizon. A majority of respondents in Primerica’s survey expect prices for everyday essentials to continue rising in the coming months. Close to 80% believe food and grocery prices could climb further. Another 74% anticipate higher utility bills. About 63% think gasoline prices may rise. These expectations matter as they can become self-fulfilling. When households expect their dollars to go further, they often adjust by cutting spending or delaying purchases, and that shift can weaken the broader economy.

After two years of punishing inflation, Americans remain wary, bracing for prices to spike again with little warning. This heightened vigilance reflects what policymakers describe as “inflation expectations,” a mindset that can be difficult to unwind once it takes hold. Its persistence may complicate the Fed’s attempts to cool the economy without triggering broader harm. Expectations can become self-reinforcing, and current surveys suggest that many households still have not recovered from the inflationary shock of 2022.

Even Small Unexpected Costs Now Threaten Household Stability

Americans are increasingly turning to debt and shrinking savings accounts to bridge the gap between what they earn and what they owe each month. Credit cards have become the most common fallback. By Q3 of 2025, total U.S. credit card balances reached a record $1.233 trillion, up from $1.209 trillion in Q2 and the highest level ever recorded by the New York Fed. Since credit card debt bottomed at $770 billion in Q1 2021, balances have surged by $463 billion, a jump of about 60% in four years. That total now stands $306 billion above the pre-pandemic record set in late 2019. Families may not think of themselves as part of a national debt wave, but the numbers suggest they are borrowing heavily just to cover ordinary expenses.

In early 2021, roughly 47% of middle-income households said they paid their credit card balances in full each month, avoiding interest by settling the bill. By the third quarter of 2025, that share had plunged to 29%. With average credit card interest rates now above 20% annually, those who can’t pay in full are snowballing their debt even if they don’t borrow more. Lower interest rates might help at the margins, but “even with Fed rate cuts, credit cardholders should expect rates to stay high for the foreseeable future,” noted Matt Schulz, chief consumer finance analyst at LendingTree.

Savings have taken a hit, too. The pandemic-era stimulus had briefly bolstered Americans’ savings accounts in 2020-2021, but that cushion is gone for most. Today, many households report dipping into emergency funds to pay for regular expenses. Primerica’s research shows that while 58% of middle-income families maintain at least $1,000 in emergency savings, half of them have drawn from those funds in the past year. The rainy day fund has become the everyday fund, increasing vulnerability to even the smallest disruptions. A car repair or medical bill could be enough to tip a family into deeper debt or force a decision between competing necessities.

“Families are dipping into emergency funds more often, struggling with rising credit card debt, and feeling less confident about retirement—all signs that today’s challenges are long-lasting and reshaping household budgets in significant ways,” explained Amy Crews Cutts, Ph.D., an economic consultant to Primerica. Her view highlights how deeply rooted these pressures have become and suggests they could alter the way families plan, save, and spend for years to come.

The result is a pervasive sense of instability. People know their financial buffer has thinned. Surveys show that 55% of middle-income Americans feel stressed by inflation, while roughly 46% cite debt and basic day-to-day expenses as major stressors. About 47% doubt they could cover an emergency cost without difficulty. Only 12% report feeling no financial stress at all.

Financial Milestones Like Homebuying and Retirement Are Being Pushed Back

It’s not only everyday expenses that have Americans worried. Big-ticket goals and purchases like buying a home, replacing a car, or funding a college education have become far more intimidating. Housing, in particular, stands out. Over the past several years, would-be buyers have confronted a painful combination of surging home prices and sharply higher mortgage rates. National home prices have climbed about 60% since 2019, reaching record highs even after a slight cooling. By 2024, the median price for an existing single-family home reached roughly $412,500, a figure that a Harvard housing report describes as “a shocking five times the median household income.” For decades, affordability benchmarks suggested that homes priced at three times income were manageable.

High interest rates haven’t helped. As the Fed moved to contain inflation, average 30-year fixed mortgage rates climbed into the 7% to 8% range, the highest levels seen in more than twenty years. The typical monthly payment on a median-priced home jumped to more than $2,500 with a standard loan and a modest down payment. To comfortably support that payment, a household would need an income of nearly $126,000. Only a narrow slice of renters, roughly 6 million out of the nation’s 46 million renters, meet that threshold. The rest remain firmly priced out.

As a result, home sales recently plunged to a 30-year low, and the national homeownership rate slipped in 2024 for the first time in years. Redfin’s data paints an even starker picture. Only 28 out of every 1,000 U.S. homes changed hands in the first nine months of 2025, the slowest turnover recorded since the 1990s. For those who already own homes with fixed low interest rates, the pain is less direct—although many homeowners face rising property taxes and insurance premiums, which add to the cost of staying put.

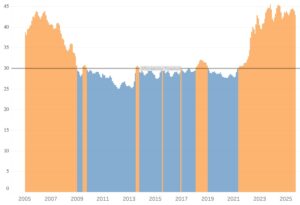

Homeownership Costs Now Consume Over 30% of Income for Many Families

In many parts of the country, owning a median-priced home now requires more than 30% of the local median household income. That crosses the traditional affordability line and leaves less room for savings, debt repayment, and everyday expenses, which explains why so many renters feel locked out of homeownership. Source: The Atlanta Fed

But for aspiring homebuyers and many renters, the housing crunch continues to push the American dream further out of reach. Young adults feel this shift most directly. They remain in rentals or move back in with family, postpone starting families, or relocate to cheaper regions, all because homeownership has become prohibitively expensive. In Primerica’s survey, respondents made clear that milestones like buying a home or retiring on time now feel out of reach under today’s financial pressures. The emotional weight of watching these pillars of the American Dream drift away can be profound. It reinforces a growing belief that “we’re worse off than our parents’ generation,” a sentiment that spans income levels, ages, and regions.

These forces act like a tax on future plans. Primerica’s research shows that many have responded to financial strain by deferring big investments and hoping to “get back on track” later. But deferral has its own cost. As Primerica warned, delaying critical steps, such as retirement contributions or major life decisions, can widen the financial gap over time, making it harder to close. A family that postpones buying a home in their thirties may lose years of equity and asset building. Someone who delays retirement investing must save far more later to reach the same goal.

A “K-Shaped” Economy Is Leaving Middle- and Lower-Income Families Exposed

Rising anxiety about the job market is another reason Americans are nervous about the future. On paper, the employment situation still looks relatively strong. Though up from its historic lows, the unemployment rate remains in the mid-4% range, not a reason for concern by itself. But these headline numbers give a misleading sense of stability. Underneath, the labor market is softening in ways that households can clearly feel.

One red flag is the expectation of rising unemployment. The University of Michigan’s survey found that 62% of households now anticipate the jobless rate will increase in the next year, the highest share with that view since 1980. Such a grim outlook on jobs hasn’t been seen in over four decades. It suggests that people see storm clouds on the horizon, perhaps remembering that inflation-fighting episodes (like the early 1980s) often precede recessions and layoffs.

This pessimism was echoed by a Federal Reserve Bank of New York survey, which similarly found more respondents bracing for harder times finding work and a tougher job market ahead. In other words, Americans are mentally preparing for a potential rise in unemployment, even if it hasn’t yet materialized in official statistics.

There are some concrete reasons for these jitters. Corporate layoff announcements jumped sharply in late 2024 and 2025, with headlines magnifying fears. One report showed that U.S. employers announced more than 153,000 job cuts in October, a 175% increase from the same month a year earlier and the highest October total since 2003. High-profile cuts in technology, finance, and other white-collar sectors have reminded workers that even jobs once viewed as stable can be vulnerable. When people watch major companies reduce headcount by the thousands, they naturally wonder if their own job might be at risk.

Economists describe the current landscape as bifurcated or “K-shaped.” Wealthier households continue to benefit from stock market gains, secure jobs, and savings built earlier in the decade. Middle- and lower-income families, by contrast, face the lingering effects of inflation, shrinking savings, and rising costs.

An analysis found that the top 20% of households by income now account for roughly 40% of all consumer spending, supported by wealth and investments. Meanwhile, families with limited reserves have exhausted their pandemic-era savings and struggle to keep up with prices. This divergence means that aggregate economic indicators (such as total consumer spending or average unemployment) can mask underlying weakness. Families living paycheck to paycheck feel the economy’s cold winds much more directly than the well-off, whose stock portfolios have been rising. So, while official data might not scream “recession” at the moment, the lived experience for a vast swath of the population is that things are tough and could get tougher.

It’s also important to remember that low consumer sentiment doesn’t automatically trigger an immediate downturn. Households can continue to spend even while feeling pessimistic, especially when essential costs leave little room for cutbacks. Consumer spending in 2025 has held up better than sentiment would imply, largely because higher-income households remain active spenders. But sentiment matters. If more Americans begin fearing job loss, or if layoffs spread beyond isolated sectors, spending could fall quickly. And since consumer activity accounts for about two-thirds of GDP, any sustained pullback raises the risk of a recession.

Financial Stress Has Become a Constant Companion for Millions

The cold numbers only tell part of the story. Equally important is how these economic pressures feel to everyday people. Financial stress often keeps people up at night, and the emotional toll it’s having shows up clearly in the surveys. When asked to describe their current feelings about money and finances, most Americans use negative words. In the Primerica poll, the most commonly selected feelings were “stressed” (about 60% of respondents) and “discouraged” (44%).

These words paint a picture of households living under a cloud of worry. Stress builds when every month feels like a balancing act: choosing which bills to pay first, cutting corners, or asking creditors for more time. Discouragement grows when, despite all that effort, families see no real progress and fear the future may look as difficult as the present. Hopeful sentiments are much rarer by comparison; far fewer described themselves as “confident” or “secure” financially.

It’s telling that those who do express confidence often are the ones who have some help. The Primerica report found that respondents who work with a financial professional were twice as likely to feel confident about their finances as the average person. Even though advisors can’t lower the cost of living, they can help families plan, budget better, and strategize about debt. But for the majority who don’t have such support, feelings of anxiety fill the void.

The erosion of confidence appears in more concrete expectations as well. A core American ideal is the notion of upward progress—the belief that hard work eventually pays off and next year will be better than this one. Today, that belief is weakening. Only 21% of middle-income respondents expect to be better off financially a year from now. Four out of five expect to tread water or fall behind. Just 18% believe they are saving enough for a comfortable retirement, compared with 31% five years ago.

Views of the broader economy reflect the same shift. Around 63% of middle-income Americans expect the national economy to be worse next year than it is today. This stands in sharp contrast to late 2020 and early 2021, when the country was emerging from the pandemic recession and many believed a strong rebound could quickly lift households. Back then, far fewer expected the economy to worsen. Today, cautious optimism has been replaced by cautious pessimism. People are bracing for bad news because they prefer not to be surprised. Expecting hardship has become a form of protection, a way to prepare emotionally for whatever comes next.

No One Can Predict 2026, but Families Can Prepare for It

As 2026 approaches, many Americans find themselves moving through an economy that feels increasingly fragile. Costs keep rising, savings keep thinning, and a job market that appears steady on paper feels less secure with each passing month. For some, it has already felt like a personal recession, even if no official label has been applied. The optimism that once helped families push through difficult stretches has faded, replaced by a quieter, more defensive posture. Households are reassessing their financial exposure, cutting back where possible, delaying major decisions, and reshaping their saving strategies to buffer themselves against risks that may intensify.

Given this shift in mindset, it’s not surprising that many are rethinking how they protect their assets. Precious metals like gold have long served as a stabilizer when financial systems strain, and they may offer a prudent layer of protection for those who want to safeguard part of their savings. No single choice can remove uncertainty entirely, but taking thoughtful precautions could help families feel more anchored as they move through an unpredictable year.