By Preserve Gold Research

The American Dream once promised a leisurely retirement after decades of hard work—a time to enjoy grandchildren, hobbies, and hard-earned rest. But as we step into 2025, that dream is cracking. Nearly half of Americans aged 55 and older have no retirement savings at all. Over half of today’s seniors survive on less than $30,000 a year, with one in four scraping by on under $15,000. Far from golden, these years have become a struggle for millions of retirees who thought their hard work would be rewarded with a comfortable and secure future.

What might this signal for the future of the U.S. economy? Experts say it could mark the unfolding of a slow, grinding social and financial crisis. In 2025 alone, a record-setting 4.2 million Americans will reach age 65, stepping into retirement just as the nation’s economic foundation feels more unsteady than ever before. Less than half of today’s non-retirees now believe they will enjoy financial comfort once they leave the workforce. There is a growing sense that something has gone deeply awry within the American retirement system. And the numbers may well support that suspicion.

The American Dream Deferred

In the mid-20th century, the image of a secure retirement seemed almost standard. A steady pension from one’s lifelong employer, Social Security payments, and a modest cushion of personal savings often provided enough to uphold a reasonable standard of living. But today, that vision has fractured, perhaps beyond repair. Decades of shifting financial burdens onto individuals and unpredictable economic swings have left most Americans alarmingly unprepared for retirement. Millions of households now appear to be veering off course, far from any path to a stable retirement.

According to Boston College’s National Retirement Risk Index, around 50% of U.S. households will not be able to maintain their pre-retirement lifestyle once they leave the workforce, even if they work until age 65 and turn all their assets into an annuity. In blunt terms, half of Americans could face a sharp drop in living standards the moment they stop working. Researchers from the National Institute on Retirement Security (NIRS) warn that the typical American household may fall short by $400,000 to $500,000 of what it needs for a comfortable retirement. That gap may be nearly impossible to close for an average middle-class worker approaching retirement age. This shortfall suggests tens of millions could be forced to drastically downgrade their retirement expectations or continue working far longer than they ever intended.

The generational outlook is even more unsettling. Generation X, now entering their 40s and 50s, is the first cohort largely without the safety net of traditional pensions. Within this group, the bottom half of earners have saved only a few thousand dollars, while the median Gen X household holds just about $40,000 in retirement savings. For a retirement that could stretch over two decades, that’s a woefully inadequate amount.

Such figures portend an epidemic of financial fragility among tomorrow’s retirees. For context, the average Social Security benefit today is only about $1,862 per month ($22,344 a year)—a foundation, yes, but hardly enough by itself to sustain a comfortable life, especially with rising costs. Yet for a majority of retirees, Social Security provides the lion’s share of income. It’s little wonder that over 5.9 million Americans aged 65+ live below the poverty line, and over half of seniors subsist on less than $30k per year. For these Americans, retirement is not a time of ease but of scraping by and difficult choices about which bills or essentials to forego.

The End of Pensions and the 401(k) Experiment

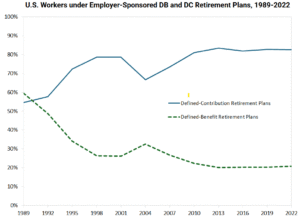

How did we get here? A big piece of the puzzle is the gradual demise of traditional pensions and the rise and faltering of the 401(k) system. For past generations, a defined-benefit pension provided a guaranteed income until death, taking the complexity and risk out of retirees’ hands. But today, pensions in the private sector have become a rarity, replaced by do-it-yourself defined-contribution accounts like 401(k)s and IRAs, a shift that has often left workers unprepared for retirement’s financial demands.

In 1975, nearly 30% of the U.S. workforce enjoyed pension coverage. Today, that share has plunged to roughly 13.5% or about 12 million Americans. Meanwhile, over 85 million workers now participate in defined-contribution plans—accounts whose outcomes fluctuate with market tides and individual savings habits. This shift has effectively transferred longevity and investment risks from employers to ordinary people. And most people, understandably, struggle to manage those risks over a lifetime.

Source: Federal Reserve Bank of St. Louis

For the middle class, the effects have been particularly punishing. Estimates suggest a typical pension may carry a 49% cost advantage over a 401(k)-style account when it comes to delivering retirement income, thanks to better investment pooling, lower fees, and the guarantee of not outliving one’s savings. With pensions largely out of reach for most private-sector workers and 401(k) balances falling painfully short of even modest middle-class needs, an entire generation of Americans may now be approaching retirement not with optimism or anticipation but with a rising tide of anxiety, regret, and deepening fear about what their future could hold.

Americans Are Worried, For Good Reason

If the financial indicators are bleak, the psychological ones are even more unsettling. In 2024, the National Institute on Retirement Security (NIRS) conducted a broad survey of working-age Americans, and the message was clear: an overwhelming majority are worried about their retirement security. When asked outright if the country faces a retirement crisis, 79% of Americans said “yes”—a sharp increase from 67% just a few years ago. It’s almost a consensus. More than half of Americans (55%) are personally concerned that they won’t be able to achieve financial security in retirement. Think about that: every other person you meet is unsure they can ever afford to retire or will have to radically downsize their life if they do retire. Such widespread anxiety is unprecedented in modern times.

A big trigger for this surge in worry has been the economy’s recent gyrations. Inflation, especially, has dealt a gut punch to confidence. After decades of relatively low inflation, the price spike in 2022–2023 (to 40-year highs) reminded everyone that even saved money could lose purchasing power quickly. According to the NIRS poll, 73% of Americans said that recent inflation has made them more concerned about retirement, and it’s not hard to see why. If your grocery and utility bills shoot up, your fixed income or savings suddenly cover a lot less.

But it’s not only inflation. Stock market swings have also taken their toll. Many retirement savers have seen their account values whipsaw unpredictably, a grim reminder that a poorly timed downturn could erase years of careful saving. At the same time, rising interest rates (the Federal Reserve’s remedy for inflation) have made borrowing more expensive and threatened to slow the economy, creating fears of layoffs or recession that could hit older workers hard. And let’s not forget the lasting impacts of the pandemic: some people retired earlier than planned due to health concerns or job loss in 2020-2021 (often with insufficient savings), while others delayed retirement and drained savings while unemployed or caring for family.

The NIRS survey found retirement jitters across practically all demographics—young and old, Republicans and Democrats, men and women. Other surveys echo these findings. The long-running Retirement Confidence Survey by the Employee Benefit Research Institute (EBRI) recorded a steep drop in Americans’ retirement confidence in 2023, the largest one-year decline since the 2008 financial crisis. Just as the Great Recession shook people’s faith 15 years ago, the combination of pandemic disruptions, inflation, and market volatility has would-be retirees deeply rattled about their retirement prospects. The result? A growing sense that, barring a miracle, they may never be able to afford to retire.

Soaring Inflation, Healthcare, and Housing Costs

Why are Americans so gripped by fear? Because even for those who manage to tuck away some retirement savings, the costs they face have risen relentlessly, making the goalpost of a secure retirement drift further and further out of reach. While inflation cooled by 2024, its cumulative effect remains: everything costs markedly more than it did pre-pandemic.

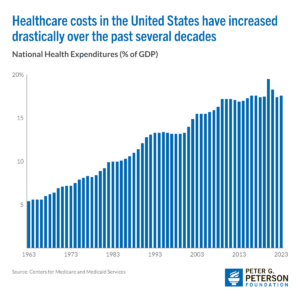

Retirees, who typically live on fixed incomes, and future retirees, who must save even more to afford the same standard of living, have been hit especially hard. The NIRS survey drilled down into specific cost concerns and found that 87% of Americans are deeply concerned about rising retirement costs. Healthcare looms largest, with 66% of respondents worried about being unable to afford medical care in retirement.

Source: Peter G. Peterson Foundation

Housing is another pain point, with 75% of Americans concerned that they cannot afford their current housing costs in retirement. This could mean rent for those who don’t own a home or property taxes and maintenance for those who do. As home prices and rents have surged, many worry they won’t be able to keep a roof over their heads on a reduced income.

Zooming out, nearly every essential component of a retiree’s budget is projected to rise faster than fixed incomes. Medical costs historically inflate faster than general CPI. Housing affordability is an issue for all ages but can be acute for seniors on fixed pay. Even basics like food have seen price jumps that strain low-income seniors, many of whom rely on Social Security checks that only adjust once a year (and only partially offset inflation).

Social Security: The Coming Storm

If there is one pillar still holding up the retirement security of Americans, it is Social Security—the New Deal program that provides a guaranteed floor of income to virtually every retired worker. Social Security has kept tens of millions of seniors out of extreme poverty for decades. But even this bedrock is facing uncertainty, and Americans are rightly anxious about its future in the 2025–2026 horizon.

The immediate concern is that Social Security’s trust fund is running out of time. Every year, the Social Security Trustees release a report on the program’s long-term health. In 2024, they delivered a chilling update: the main trust fund for retirement benefits (OASI) is projected to run dry by 2033, a full year earlier than previous forecasts. That sets the country on a collision course with a grim deadline less than a decade away. Without intervention, benefits could be slashed by roughly 20–25% to match incoming payroll tax revenues. Imagine a monthly check of $1,800 suddenly shrinking to around $1,400. It’s a blow that could devastate retirees already scraping by on modest incomes.

The NIRS poll found virtually unanimous sentiment that Social Security must be protected: 87% say the program must remain a priority, regardless of state or federal budget deficits. In other words, Americans are saying: “Don’t use deficit concerns as an excuse; keep Social Security strong.” Despite the solvency concerns, there is even majority support (about 52% in the survey) for expanding Social Security benefits beyond current levels.

Compounding the issue, a new and worrisome trend has emerged: Americans are claiming Social Security benefits earlier than before, potentially out of economic necessity. In the first half of fiscal year 2025, the Social Security Administration saw record growth in retirement benefit claims. From October 2024 to April 2025, over 276,000 more people claimed benefits than the same period a year prior. That’s a 13% jump in claims, putting SSA on track for nearly 4 million new retirement claims in FY 2025, about half a million more than in 2024, a 15% surge year-over-year.

Why the rush? Early data suggest several forces at play. Some older workers are leaving the workforce because of health concerns or burnout, continuing the so-called “great retirement” trend that followed the pandemic. Others are fearful about the future of Social Security, a kind of “use it before you lose it” mentality, thinking they should claim it as soon as they’re eligible (age 62) in case the program’s finances worsen. And then there are those who simply can’t make ends meet. With inflation and job insecurity, they grab Social Security as soon as possible because they need the income.

The problem is claiming early locks in a permanently reduced monthly benefit. Someone who claims at 62 might receive only about 70% of the full benefit they’d get at their full retirement age and just 50–55% of what they’d receive by waiting until age 70. This wave of early claiming could set up millions of Americans for leaner, more fragile financial conditions in their 70s and 80s, particularly if they outlive their personal savings.

This surge in early retirements also has macro implications. If more people in their early 60s exit the workforce, that could exacerbate labor shortages and reduce economic growth potential. It could also put near-term strain on Social Security’s finances (more being paid out earlier than expected). In the big picture, it reflects a kind of pressure release valve: when the private retirement system fails to support older workers, many will fall back on Social Security as soon as they’re able. But Social Security was never meant to be the sole source of support for most people, yet it has become exactly that for many older Americans.

The Slow-Motion Collapse of Retirement Security

Taken together, the trends of 2024–2025 paint a somber picture of the future: a growing class of older Americans unable to afford basic needs, working well into old age, or facing hardship if they can’t. The retirement insecurity crisis is no longer a distant warning; it is here, now, measured in both data and human stories. And experts say it’s poised to get worse before it gets better unless major reforms are made.

What might the United States look like a decade from now if current patterns persist? We could see a scenario where millions of elderly Americans rely almost entirely on Social Security, which itself may have been trimmed if no funding solution is found in time. Many could be forced into gig work or part-time jobs deep into their seventies just to survive. Charities and social services may be overwhelmed by the needs of destitute seniors for food, housing, and medical assistance. The economy could feel the strain as well. If a large portion of the population has minimal disposable income, overall consumer spending could weaken, dragging on growth. We might see younger generations burdened with supporting their parents and grandparents financially, further squeezing the middle class. In the worst case, “retirement” as a phase of life could disappear for all but the affluent.

Every uptick in inflation, every surge in medical costs or rent adds strain to a population already stretched thin. It creates a somber feedback loop: people worry about affording retirement, so they work longer or cut back on spending now. But working longer is not always possible (due to health or job loss), and cutting back only goes so far when prices climb. The result is a creeping dread and ambient anxiety that the future may hold painful compromises: choosing between medication or food, between heating the home, or paying the property tax.

With the writing on the wall, one would expect a flurry of policy activity to address this escalating crisis. Although some efforts have been made, many remain too small or too early-stage to meet the moment’s urgency. As things stand today, it may be difficult to argue that America is genuinely steering toward a better retirement future. It’s a quiet crisis that doesn’t grab headlines like a stock market crash or a bank failure, but its implications are far more widespread in the long run.

In light of this uncertain landscape, millions of Americans are searching for ways to shield their savings from market turmoil and inflation’s corrosive effects. Experts say one strategy that could help diversify and strengthen retirement portfolios is the use of a precious metals IRA. By allocating a portion of savings to assets like gold or silver, retirees might gain a hedge against currency devaluation and economic volatility, adding a layer of protection when traditional investments alone may no longer feel secure.