By Preserve Gold Research

In early July, the leaders of Brazil, Russia, India, China, South Africa, and their new partners convened in Rio de Janeiro for the seventeenth annual BRICS summit. Once a loose coalition of emerging economies, the BRICS bloc has rapidly evolved into a formidable alliance with expanding membership and an ambitious economic agenda. At this summit, the group not only embraced new members and policy initiatives but also charted plans aimed at challenging Western dominance in trade and finance, signaling the emergence of a more multipolar world order.

Evolution of the BRICS Bloc

In 2001, economist Jim O’Neill coined the term BRIC, before South Africa was added, to highlight the rising economic potential of Brazil, Russia, India, and China. By 2009, what began as casual dialogue had matured into an official forum. From the start, these nations championed a multipolar vision. Their message to the world was clear: power should not rest solely in the hands of the West. Instead, emerging economies, especially those across the Global South, deserve a greater say in shaping global affairs. What started as a symbolic grouping is now “the first-ever transregional association of non-Western states,” as the Brazilian Center for International Relations (CEBRI) recently observed.

Throughout the 2010s, the BRICS nations tightened their bonds. In 2014, the bloc launched a $100 billion Contingent Reserve Arrangement, a currency pool designed to shield members from financial shocks. A year later, it opened the doors of the New Development Bank with $50 billion in capital, signaling a serious push to fund infrastructure projects and bypass the influence of the IMF and World Bank. These initiatives were designed to provide alternative sources of financing for developing nations, reducing reliance on the U.S.- and European-led IMF and World Bank.

By the early 2020s, geopolitical shifts gave new momentum to BRICS cooperation. Unilateral actions by major powers, such as U.S. tariff wars and financial sanctions, underscore the need for collective self-reliance among emerging economies. The BRICS members coalesced as a voice for the Global South, championing concepts of fairness and multipolarity in global forums. “At a time when global governance and multilateralism are losing relevance due largely to unilateral interventions,” the BRICS has been “championing stronger, equitable, and inclusive multilateralism“ to protect the interests of poorer and weaker states, noted the Council on Foreign Relations.

BRICS’s Break from Symbolism to Strategy

On July 6–7, 2025, Brazil hosted the 17th BRICS Summit in Rio de Janeiro, a gathering widely seen as a turning point for a bloc once dismissed as symbolic. The agenda addressed global challenges ranging from public health and climate change to AI governance and trade. Yet it was the bloc’s sharpened cohesion and the articulation of a shared vision for the future that left the most lasting impression. The leaders issued a joint “Rio de Janeiro Declaration” aimed at reinforcing unity and “common ground” at a time when BRICS membership was broadening.

The Rio Declaration reasserted that development remains the core mission of the BRICS. This was not business as usual. Reaching a unanimous agreement across such politically diverse nations and on issues as complex as climate finance, poverty, and AI governance was more than diplomacy. It was proof that BRICS could move beyond rhetoric and govern through consensus. At a moment when global systems have felt brittle and fractured, BRICS has offered a sense of direction. And not just for its members, but for a growing list of partners eager to chart a course beyond the grasp of Western-centered financial and political norms.

The declaration also carried warnings. Without naming the United States directly, BRICS issued a clear rebuke of rising trade barriers, voicing “serious concerns” over the spread of unilateral tariffs and restrictions that distort global commerce. The criticism was unmistakable. And so was the timing, coming just weeks after U.S.-led airstrikes on Iran, which the bloc condemned as violations of international law. Though diplomatically phrased, these statements pulled no punches. BRICS is willing to challenge Western behavior where it sees overreach.

The atmosphere in Rio also showcased the bloc’s new breadth. For the first time, heads of state from newly expanded BRICS members, including Egypt, Ethiopia, Indonesia, Iran, and the United Arab Emirates, sat alongside the founding five. Their presence offers visual proof that BRICS no longer speaks for a narrow set of emerging economies. The invitation list stretched beyond formal members. Saudi Arabia’s foreign minister attended. Observers from across the Global South filled the hall. And even the G7 and G20 were invited to engage with BRICS, signaling that the bloc professes to be “against no one” and open to dialogue across old divides.

Still, it was the economic subtext that rattled markets. The summit gave new life to plans for alternative payment systems, and floated again the prospect of a common BRICS currency. Russian President Vladimir Putin declared that “the use of national currencies in trade among our countries is steadily growing,” noting that in 2024, 90% of Russia’s trade with other BRICS nations was settled in rubles or partner currencies rather than dollars. He announced that intra-BRICS trade had reached a “$1 trillion” milestone, largely independent of the dollar.

Behind the scenes, technical progress has continued on the so-called “BRICS Bridge,” a payment platform designed to facilitate cross-border transactions without relying on Western banking rails. While a full-fledged BRICS common currency remains a distant (and contentious) prospect, Brazil’s Lula has explicitly proposed a new BRICS currency, potentially gold-backed, to undermine the dollar’s dominance. Whether these developments mature quickly or slowly is beside the point. The intent is now clear. The bloc is building a financial system that can bypass Washington altogether.

Throughout the summit, BRICS leaders insisted they are not forming an anti-Western bloc. Their rhetoric emphasized win-win partnerships rather than confrontation. And yet, Washington’s response told a different story. As the summit unfolded, President Donald Trump unleashed a barrage of tariffs, threatening to impose a sweeping 100% tax on BRICS imports should the bloc create a rival currency. He labeled BRICS’s moves as “anti-American” and promised a new round of penalties for countries that align with the group. His warnings may have been intended to deter. Instead, they confirmed what BRICS has become.

Is the World Aligning Beyond the West?

At the heart of the 2025 Rio summit was a message too large to ignore: BRICS is no longer a tight club of five—it is becoming a global coalition. In just two years, the bloc launched its most ambitious expansion to date. What began in Johannesburg in 2023 with invitations to six nations (Saudi Arabia, the United Arab Emirates, Egypt, Ethiopia, Iran, and Argentina) has since transformed BRICS into a force spanning every inhabited continent. By January 2024, Egypt, Ethiopia, Iran, and the UAE had joined. Then, in 2025, Indonesia, Southeast Asia’s economic heavyweight, entered the fold.

With ten full members, the bloc now reflects a geopolitical mosaic. Energy powerhouses, maritime chokepoints, and some of the world’s most populous nations all sit at the same table. Three major oil producers, two critical North African economies, and one sprawling Asian democracy have turned BRICS into a force to be reckoned with on the global stage. And the appetite for expansion isn’t waning.

As of 2025, 44 countries have either applied for membership or signaled their interest. BRICS has responded with a new structure: a “BRICS+” status for aspiring members, granting formal partnership without full integration—yet. At an October 2024 meeting in Kazan, 13 countries were granted this designation, including Algeria, Belarus, and Saudi Arabia. Dozens of other nations, including Nigeria, Thailand, Mexico, Turkey, and even Afghanistan, have appeared in discussions, seeking to align with a group seen as a rising counterweight to Western dominance.

This surge is no accident. Many in the Global South now view BRICS as a chance to “diversify their partnerships,” escape dependence on Western institutions, and access new capital streams, especially from China. For dozens of governments, the benefits outweigh the costs. As one analyst put it, BRICS offers “few downsides” and multiple upsides: infrastructure investment, trade access, diplomatic visibility. It’s an open door many are choosing to walk through.

For the BRICS core members, expansion serves both pragmatic and strategic aims. It’s a move to consolidate influence and shape global rules. The addition of Egypt and Ethiopia extends BRICS’s footprint across the Red Sea and Suez Canal, key arteries of world trade. With Saudi Arabia, Iran, and the UAE involved, the bloc would oversee more than 40% of global oil production. It’s not just about clout. It’s leverage. Leverage over supply chains. Over shipping lanes. Over the markets that run the modern world.

And while the raw power matters, the symbolism cuts just as deep. Chinese and Russian leaders have described this wave of growth as a “defining moment,” a sign that the post-Western world is no longer a theory, but a reality in motion. Taken together, the current and aspiring BRICS nations represent the majority of the planet’s population and natural resources. On some economic metrics, particularly purchasing power and growth, they’ve already eclipsed the G7. Whether BRICS+ becomes a cohesive alliance or a sprawling network of partners, its very momentum tells the story. The world is no longer waiting for Western approval.

A Global Power Shift Toward Multipolarity

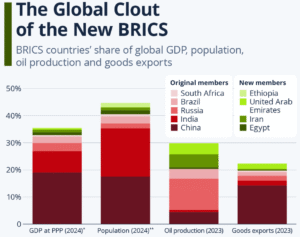

As of 2025, the ten-member bloc accounts for more than 40% of the world’s population and nearly one-third of global economic output, surpassing the G7 by this measure. And that gap is expected to widen. Projections suggest BRICS could decisively overtake the G7’s economic weight by 2030. But BRICS’s influence extends far beyond GDP charts. Together, its members control nearly half of global oil production and almost three-quarters of the world’s rare earth minerals—critical assets in a century defined by energy security and technological supremacy.

BRICS nations have also been responsible for more than half of global GDP growth in recent years. Such figures underscore why many experts view the rise of BRICS as part of a fundamental rebalancing of global economic power. The post-Cold War era of U.S.-Europe dominance is giving way to a more distributed power structure in which emerging economies are assuming leading roles. As one commentator put it, BRICS’s ascent symbolizes “the Global South’s push for a more multipolar order, challenging Western dominance.”

Source: Statista

The implications of this shift go beyond economics. BRICS’s growing clout lends momentum to calls for restructuring international institutions. For instance, BRICS countries have advocated for reforming the UN Security Council to include more voices from the developing world. They have increased coordination in forums like the G20, often taking common positions on issues like trade fairness and climate funding. The bloc’s New Development Bank, meanwhile, offers developing nations an alternative source of project finance that doesn’t come with the political strings often attached to IMF or World Bank loans.

For many leaders in Africa, Asia, and Latin America, BRICS now represents more than a coalition. It is a counterweight to the dominance of Western powers in global decision-making. And it gives voice to nations once sidelined in international forums. In negotiations over climate finance, debt relief, and digital governance, the West can no longer set terms unilaterally. The presence of BRICS reshapes the very architecture of global diplomacy.

To be sure, the multipolar world that BRICS advocates is still in formative stages. The United States remains the largest single economy and retains unmatched military reach, and U.S. allies (Europe, Japan, etc.) still command a significant share of global GDP. But despite these caveats, the trend toward a “multipolar” distribution of power is unmistakable. Even countries not in BRICS are beginning to assert their interests more forcefully on the world stage, using the threat of a pivot eastward to win concessions from Western partners. The U.S. National Security Strategy has explicitly acknowledged the emergence of “strategic competition” with a coalition of major powers, noting that China and Russia seek to “make the world safe for autocracy” and build alternative spheres of influence.

As BRICS Gains Momentum, the U.S. Risks Losing Economic Leverage

For decades, the United States has occupied a central position in the global financial system, issuing the currency the world trusts, shaping the institutions that set the rules, and financing its deficits with relative ease. That era, while not over, is no longer unchallenged. The rise of BRICS and its ambition to construct parallel systems of trade, finance, and diplomacy signals a slow but deliberate shift. What was once unthinkable is now on the table: a world in which the dollar no longer reigns supreme.

At the 2025 Rio summit, BRICS made its intentions clear. From settling trade in local currencies to exploring alternative payment networks, the bloc is moving toward autonomy. These efforts strike at the core of U.S. financial power. The dollar’s dominance has long been the linchpin of American global influence. It underpins sanctions, lubricates trade, and enables Washington to borrow at low interest rates. Undermining that foundation, even gradually, could alter the entire structure of U.S. economic life. “It marks a significant step toward a multipolar global economy,” one international trade attorney told the IBA, “reducing the dominance of the U.S. dollar and creating a more balanced trade environment.” The shift will not happen overnight. But experts say it is happening.

Already, fault lines are forming. President Trump’s threat of a blanket 10% tariff on BRICS-aligned nations, issued during the Rio summit, marked the beginning of what could become a grinding, retaliatory cycle. Trade barriers may rise. Supply chains could splinter. And U.S. exporters, especially in agriculture and energy, may lose ground to BRICS partners who begin settling deals in yuan, rupees, or dirhams instead of dollars.

Over the longer term, analysts warn that a successful BRICS agenda of de-dollarization and financial autonomy could have serious repercussions for Americans’ economic well-being. If enough countries reduce their reliance on the dollar, demand for dollar assets would fall relative to supply. Fewer foreigners needing dollars means the value of the dollar would likely decline, and the U.S. government could find it harder to attract buyers for Treasury bonds without offering higher interest rates.

That erosion of trade dominance would be just the beginning. A sustained move away from the dollar could ignite ripple effects deep inside the U.S. economy:

- Weakened Dollar & Inflation Risks: A diminished international demand for the U.S. dollar could lead to its depreciation, making imports more expensive for Americans. In effect, everyday goods, from electronics to clothing, might cost more, fueling domestic inflation. The dollar’s reserve status has long kept U.S. inflation in check by creating constant foreign demand; if that ebbs, the U.S. may face higher prices and need tighter monetary policy to compensate.

- Higher Interest Rates: The U.S. has benefited from the dollar’s role as the world’s safe asset, as foreign central banks and investors reliably purchase U.S. Treasuries. If BRICS countries and others diversify into non-dollar assets, the U.S. Treasury may have to offer higher yields to attract financing. In practical terms, this could translate into more expensive borrowing costs for the U.S. government and higher interest rates on everything from mortgages to business loans for Americans.

- Lost Trade Advantages: The U.S. has significant influence over global trade partly because so much of it is conducted in dollars and through U.S.-aligned networks. As alternative trade blocs form and transactions shift to other currencies, U.S. companies may lose some of their competitive edge or face new barriers. American firms may find it harder to compete if, for instance, BRICS members give preference to suppliers within their bloc or if U.S. exporters must contend with exchange rate volatility that BRICS insiders avoid. Over time, the widespread use of rival currencies for trade could reduce U.S. influence over international trade standards and terms.

- Reduced Geopolitical Leverage: A less dollar-centric global system would blunt one of Washington’s sharpest tools: financial sanctions. U.S. sanctions work largely because they can bar targets from the dollar-based system (the vast network of dollar payments, New York banking, etc.). If alternative payment channels and reserve currencies proliferate, countries like Russia, China, or others in BRICS will find it easier to bypass U.S. sanctions, diluting the effectiveness of American foreign-policy pressure. Moreover, U.S. diplomacy often relies on the carrot of access to its financial system; that incentive weakens in a world with multiple financial centers.

- Market Volatility and Uncertainty: The transition to a more multipolar currency order could introduce instability in global markets. The U.S. could see higher volatility in exchange rates and capital flows as investors adjust portfolios away from dollar assets. The dominance of the dollar has arguably been a source of global financial stability (albeit one that favors the U.S.); a breakup of that singular dominance might make markets more prone to fluctuations, which could, in turn, affect American investments and economic performance. A more fragmented international monetary system might also reduce the ability of U.S. policymakers to manage or respond to global financial crises, potentially spilling back onto Main Street.

Some point to BRICS’s internal contradictions as a brake on its momentum for de-dollarization. They’re not wrong. China’s dominance unsettles India. Saudi hedges its bets. The proposed BRICS currency has yet to materialize—and may never. Intra-bloc trade still leans heavily on the dollar. But cohesion is not a prerequisite for disruption. As one former White House economist warned, “They don’t need a common currency to swing their wrecking ball at the dollar.“

That wrecking ball may strike not all at once, but in steady blows. Every time BRICS nations settle trade in local currencies or reject U.S. terms in global negotiations, they chip away at an order the U.S. once built and led. While most economists agree that the dollar’s supremacy remains intact for now, buoyed by trust, liquidity, and institutional depth, no law says it must last forever. History offers warnings. The British pound, once unrivaled, now plays a supporting role. Its fall was slow, but irreversible.

As Global Power Fragments, Gold Remains an Enduring Anchor

In just a decade, BRICS has evolved from an acronym into a geopolitical force, giving voice to countries that were long sidelined in global affairs. For Americans, these changes carry a clear, if uneasy, message. The era of U.S. exceptionalism is evolving. A more divided global order is taking shape where the United States must compete more than it commands. In times of structural change, individuals and institutions alike may find value in anchoring a portion of their wealth in assets that lie outside the reach of shifting currency tides. Assets like gold that have weathered the collapse of empires and the unraveling of monetary regimes may offer quiet strength in an age when old certainties no longer hold.