By Preserve Gold Research

In the 21st century’s great power contest, a sharp contrast has emerged between Beijing’s strategic focus and Washington’s political paralysis. China is pouring resources into innovation, infrastructure, and global influence, methodically building for the future. Washington, by contrast, finds itself mired in brinkmanship and stalemate, arguing over budgets and policy. It’s not just a comparison of two governments. It reflects competing visions of how prosperity, resilience, and influence are to be secured and maintained in the world today.

While China expands its high-speed rail networks and deepens its diplomatic footprint, the United States struggles to break free from recurring debt-ceiling showdowns that weaken confidence in its economic governance. These patterns hint at an uncomfortable question. China might be building the future it intends to lead. The US may still reclaim its global leadership position, but the window for doing so is narrowing as political divisions harden. The real test now is whether America can confront its internal fractures and act with purpose before the long game slips to someone else.

Inside China’s High-Speed Ambition

China’s economic rise over the past four decades has been significant by any historical measure. From being a primarily agrarian society, it has transformed into the world’s second-largest economy and a global superpower in just over 40 years. Yet the pace of growth often masks the intention behind it. Beijing has concentrated investment in select industries and large-scale infrastructure that it believes will secure long-term strategic advantage. The evidence appears in new airports, expanding urban tech districts, and a high-speed rail system that stretches across much of the country. China now operates more than 25,000 miles of genuine high-speed rail that connects major population centers, while the United States has almost none.

The contrast raises concerns about how American priorities have drifted as other nations move ahead with projects that strengthen their future economic position. American lawmakers have spent years debating a single high-speed rail project in California. Meanwhile, China keeps laying track across regions at a breakneck pace.

China’s infrastructure ambitions reach far beyond its borders, but even within its borders, industry analysts say the scale is striking. In terms of energy and transportation, China builds ultra-high-voltage power lines and new subway systems in the time it takes the US to conduct feasibility studies. A single electric transmission line in the United States could take 10 to 20 years for approval and construction, while China completes similar projects in less than 5 years.

The consequence is clear. Projects that rely on advanced computing, massive energy loads, or next-generation manufacturing are built in China on timelines that seem unrealistic to most in the West. Chinese energy expert David Fishman captures the divide bluntly, saying China is “set up to hit grand slams” while “the US, at best, can get on base.” The comparison may be uncomfortable, but comfort doesn’t win races. China’s system, despite its rigid structure, allows it to push large-scale plans forward in a fraction of the time it takes the US to get even a small project off the ground.

Beijing’s future-focused investments aren’t limited to hardware either. The country has also fostered an education and industrial policy ecosystem geared toward next-generation technologies. Initiatives like “Made in China 2025” (announced in 2015) set explicit targets for global leadership in industries such as robotics, biopharma, aerospace, and electric vehicles. A decade ago, China was a minor player in electric cars; today, it is the world’s largest EV market and home to several of the top EV manufacturers and battery producers. The same pattern appears in 5G deployment, quantum communications, and an expanding share of artificial intelligence research.

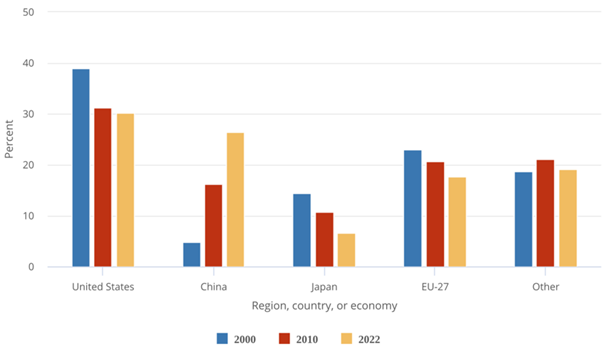

How Much the World Invests in R&D: Comparing Major Countries in 2000, 2010, and 2022

China’s rise in research spending has reshaped the global landscape. While the US share of global R&D has slipped since 2000, China’s has surged, narrowing the gap and signaling a power shift in global innovation. Source: National Science Board

To be sure, China’s fast-paced push hasn’t been without challenges. Years of heavy construction have raised concerns about excess capacity and the debt burdens tied to local governments. Major property developers have slipped into crisis as liabilities piled up. Growth has slowed from the double-digit surges of the 2000s, and China now faces demographic pressures that could weigh on future productivity. Despite this, Beijing’s response hasn’t been to pull back from long-term investment, but to double down on it. Even as GDP growth cooled in recent years, China increased spending on R&D and advanced manufacturing, aiming to climb the value chain rather than fall into complacency.

How China Is Reshaping Global Influence Through BRI, BRICS+, and the Rising Yuan

China’s global strategy is as bold and ambitious as its domestic plans. It rests on expanding its economic and diplomatic footprint across Asia, Africa, Latin America, and parts of Europe through trade, investment, and large-scale infrastructure projects. The Belt and Road Initiative (BRI), launched in 2013, anchors this effort. Between 2013 and 2022, China invested about $679 billion in overseas infrastructure, while the US spent roughly $76 billion on similar efforts. This wave of Chinese-built projects around the world has bolstered China’s influence in many developing nations, which welcome the roads and bridges, even as some worry about the dependencies they create.

Beyond bilateral projects, China has also led the formation of new multilateral groupings and financial institutions that challenge Western-dominated ones. The New Development Bank and the Asian Infrastructure Investment Bank now offer alternatives to the World Bank and IMF, creating the outline of a parallel system not centered on Washington.

And then there’s the BRICS bloc. With new members such as Saudi Arabia, the UAE, Egypt, Iran, Argentina, and Ethiopia, BRICS+ represents well over 40% of the world’s population and over a third of global GDP. At the August 2023 BRICS summit in Johannesburg, Chinese President Xi emphasized “We must strengthen the voice and representation of developing countries in global governance,” and called for greater cooperation among BRICS countries. This BRICS+ expansion dovetails with China’s narrative of representing the interests of the Global South and promoting a more inclusive world order.

Currency trends deepen this challenge. For over 75 years, the US dollar has reigned as the world’s primary reserve currency, giving Washington enormous influence (and the ability to impose powerful financial sanctions). Beijing, along with Moscow and other partners, has made a concerted effort to promote the use of the Chinese yuan in international trade and investment. By 2024, over 90% of China-Russia trade had settled in rubles or yuan. Likewise, China’s trade partners, including Iran, Pakistan, and several African nations, have begun settling trade in yuan. Even Brazil, the largest economy in Latin America, agreed in 2023 to start using the yuan for some trade with China. Such deals, though still modest in scale, send a signal that alternatives to the dollar are viable. And when an ever-present threat of sanctions looms, many countries are eager to explore those alternatives.

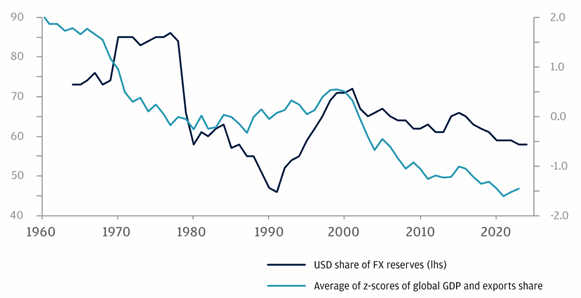

USD Share of Global FX Reserves vs. Relative US Economic Weight (GDP + Exports), 1960-2023

Foreign buyers have been retreating from US Treasuries for over a decade, a trend that raises borrowing costs, weakens dollar dominance, and signals a broader shift in global capital flows. Source: J.P. Morgan

No development in de-dollarization is more symbolic than the moves to shake up the petro-dollar system. Since the 1970s, virtually all oil sales worldwide have been denominated in USD, cementing the dollar’s indispensable role. But cracks have begun to appear. In early 2023, China struck a deal for a cargo of liquefied natural gas to be settled in yuan. Major oil exporters such as Saudi Arabia are now considering accepting yuan for oil sold to China, though the Saudi-US relationship makes the prospect sensitive. By late 2023, roughly one-fifth of global oil trade was reportedly conducted in non-dollar currencies.

The currency pressure doesn’t stop there. BRICS members, including Russia, have discussed creating a joint reserve currency or a payments system that would allow trade in their own currencies, possibly with a digital component. Analysts continue to debate the feasibility of such a currency, but the intention behind it is clear. “There is no doubting the commitment, particularly by China and Russia, to the creation of an alternative to the existing financial architecture underpinned… by the U.S. dollar,” wrote global crises expert Michael Corbin.

For the United States, these developments signal a slow erosion of the advantages built into a dollar-centric world. The dollar still dominates reserves and global finance, but momentum now exists behind alternatives that could dilute US leverage over time. China’s long game is visible in each of these moves. It’s building networks that allow it to trade and invest on its own terms while insulating itself from political turmoil in Washington. As China quietly works on these systemic changes, Washington’s ability to set the rules gradually declines.

Debt Ceiling Brinkmanship and the Cost of America’s Political Instability

On the other side of the Pacific, the United States has been grappling with domestic challenges that threaten to undermine its global standing. American democracy has long been admired for its capacity to self-correct and build consensus. But, in recent years, it appears riven by deep polarization, frequent gridlock, and a toxic political atmosphere. Partisan divisions have reached a point where even routine governance can become a battle. “The United States is already the world’s most divided and dysfunctional advanced industrial democracy,” observed the Eurasia Group, a global risk consultancy, in a 2024 analysis. This dysfunction drains the nation’s ability to plan, invest, and assure allies that Washington will remain reliable.

Nothing illustrates the paralysis more clearly than the federal budget and debt ceiling crises that have unfolded again and again. The statutory debt limit, meant to be a formality, has become a bargaining chip in partisan standoffs. In 2011, brinkmanship pushed the country to the brink of default and triggered the first S&P downgrade of US debt. The following decade brought repeated shutdowns, close calls, and another debt ceiling crisis in 2023. Each time, a last-minute deal averted disaster, but not before eroding confidence in America’s political system.

By 2023, the pattern of governance-by-crisis had grown so alarming that another rating agency, Fitch, finally acted. In August that year, Fitch Ratings downgraded the United States from AAA to AA+, citing the government’s instability and these recurring debt standoffs. Fitch pointed to “fiscal deterioration” and, pointedly, “repeated down-to-the-wire debt ceiling negotiations that threaten the government’s ability to pay its bills.“ In Fitch’s assessment, the very standards of US governance have steadily deteriorated over 20 years, despite the temporary suspension of the 2023 debt limit.

Moody’s, which shifted the US outlook to negative in late 2023, became the last of the three major credit rating agencies to issue a downgrade in May 2025. Sharing a similar assessment as Fitch, Moody’s warned that “successive US administrations and Congress have failed to agree on measures to reverse the trend of large annual fiscal deficits and growing interest costs…The US’ fiscal performance is likely to deteriorate relative to its own past and compared to other highly-rated sovereigns.” Such language from apolitical credit agencies implies that the dysfunction in Washington is not an aberration but part of a systemic decline in how the country is governed.

Analysts note that while America’s economy remains large, these political crises leave scars. “The move shows the depth of harm caused to the United States by repeated rounds of contentious debate over the debt ceiling, which pushed the nation to the brink of default,” one analyst commented after the Fitch downgrade. The US Treasury bond, long considered the safest asset on earth, only retains that status as long as investors believe American politics will not allow a default. Each showdown tests that belief. The risks may not show up immediately in borrowing costs, but they accumulate quietly in the country’s reputation.

Underlying these episodes is a level of partisan hostility that makes even basic compromises difficult. Major legislation on infrastructure, for example, which should be an area of common ground, often falls victim to partisan point-scoring or gets watered down. It’s worth noting that in 2021, the US did pass a significant bipartisan infrastructure law, a $1.2 trillion package, which was a rare moment of agreement. But even that sum pales in comparison to the scale of investment many experts believe is needed to truly modernize America’s aging roads, bridges, and grids, and it took years of debate to secure. On issues from healthcare to immigration to education, policy oscillates back and forth as administrations change. Businesses and foreign governments alike find it hard to predict policy beyond the next election, which in turn makes them hesitant to rely on American consistency.

Foreign leaders, for their part, have begun to hedge in ways they once considered unnecessary. Allies in Europe and Asia still rely on the United States, yet many now voice quiet doubts about Washington’s reliability. And competitors like China amplify those doubts. Chinese state media routinely points to US shutdowns or chaotic elections as proof that Western democracy may be faltering. The propaganda lands because it builds on an uncomfortable truth. When domestic turmoil dominates US headlines, American diplomats struggle to defend the stability of the model they promote.

The strategic cost grows with each crisis. A Carnegie Endowment study warned that Washington’s dysfunction poses “serious risks… to America’s future role in the world,” since more nations may begin to question whether the United States can keep its own house in order. That shift is already visible. During the near-default scare of 2023, global markets shuddered, and officials from Paris to Beijing quietly drafted contingency plans in case US Treasuries, long considered the safest asset on earth, were no longer risk-free. The fact that such planning occurred at all signals that the once-unassailable credibility of US commitments is now in doubt.

Two Paths and a Closing Window

The United States and China are moving along two increasingly divergent paths. China, for all its internal issues, has pursued a clear vision. It continues to invest in the industries that may define tomorrow’s economy, expand connectivity abroad, and position itself as a central pillar of the emerging global order. The US risks falling into the opposite pattern—bogged down by yesterday’s fights and repeatedly diverting its energies into internal conflicts rather than future-building.

This is not an endorsement of Beijing’s system. It is authoritarian and often repressive, and many of its accomplishments come with caveats. But it’s hard to ignore the strategic clarity with which China has moved. In the time it takes Washington to settle a single funding dispute, China has rolled out another fleet of high-speed trains, signed a resource deal in Africa, or brokered a diplomatic agreement in the Middle East. Beijing isn’t winning through military parity. It’s winning by pouring resources into the future as Washington continues refighting the past.

For Americans, this moment serves as a wake-up call. The US still has immense strengths: a dynamic economy, world-class universities, innovative companies, and a network of alliances that China in many ways envies. But those advantages require sustained investment and competent governance. History is unkind to powers that let internal renewal lapse. The British Empire entered the late 19th century with unmatched naval strength, yet it fell behind industrial rivals such as the United States and Germany. Military dominance could not offset technological stagnation.

The same lesson applies today. A country burdened by decaying infrastructure, declining schools, and unsustainable healthcare costs can’t hold onto global leadership indefinitely, no matter how strong its military. Real strength begins at home, in the laboratories that drive innovation, the factories that anchor supply chains, the classrooms that cultivate talent, and the legislatures that function without crisis.

It also begins in households that recognize the risks embedded in political drift. When trust in fiscal management weakens, when the dollar’s long-term stability faces questions that would have seemed unthinkable a generation ago, prudent individuals often look for assets that exist outside the political cycle. Precious metals enter the conversation here not as speculation but as a form of personal risk management and a buffer against volatility that could emerge if Washington continues to test the world’s confidence.

Is the window closing on US global leadership? Not necessarily, but experts say it is narrowing. Each year, China expands its footprint in advanced technology, strengthens its links across the Global South, and acts with growing confidence on the world stage. Each year the United States spends mired in internal conflict rather than investing in future capacity is a year of lost strategic ground. The trend is reversible, but only if policymakers shift gears quickly. Down one path lies the continuation of infighting and short-termism, a path that all but guarantees a relative decline in influence as China (and others) build the future. Down another path lies renewal, difficult but possible. The clock is ticking. The question, ultimately, isn’t whether America can afford to invest in its future; it’s whether America can afford not to.