By Preserve Gold Research

As President of the Federal Reserve Bank of Chicago and a voting member of the Fed’s policy-setting committee, Austan Goolsbee has a front-row seat to America’s economic cross-currents. In a recent address at a chamber of commerce event in Illinois, he cautioned that the U.S. economy faces a delicate inflection point: inflation has cooled from its pandemic peak, but price pressures remain far from contained. With memories of 1970s stagflation looming and new headwinds, like import tariffs raising prices, Goolsbee hinted the central bank would only consider cutting interest rates once it’s confident inflation is truly under control.

The backdrop to Goolsbee’s warning is a post-pandemic economy still finding its balance. In 2022, consumer prices reached their highest levels in 40 years, peaking at an annual inflation rate above 9%. Fueled by supply disruptions and stimulus-driven demand, the inflation shock prompted the Federal Reserve to launch its most aggressive rate-hiking campaign in a generation, spanning 2022 and 2023.

While headline numbers have moderated since then, most Americans remain wary of ongoing price pressures. Gasoline prices have eased, but the costs of services and groceries continue to rise, cutting into household budgets month after month. A nationwide survey in spring 2025 found that 43% of Americans ranked inflation as their top economic worry, while 29% pointed to tariffs as their next concern. These figures underscore how raw the memory of the recent cost-of-living shock remains—a scar that economists warn may shape consumer behavior for years to come.

A Surprising Surge in Wholesale Prices

Goolsbee’s message gained sharper definition just days earlier, when the Producer Price Index (PPI), a bellwether for wholesale inflation, surged in July 2025, well beyond expectations. According to the Labor Department, wholesale prices leapt 0.9% from the prior month, the steepest monthly gain since June 2022. Economists had penciled in only a 0.2% rise. The surprise signaled that cost pressures are building beneath the surface, threatening to filter into consumer prices at a time when headline inflation had appeared to moderate. Because the PPI tracks changes before they reach retail shelves, July’s data suggests that households may soon feel a heavier burden in their day-to-day expenses.

What unsettled analysts most was the breadth of the increase. Service costs, responsible for more than three-quarters of the jump, rose 1.1%, the sharpest climb since early 2022. Trucking rates advanced, trade margins swelled, hotel prices rebounded, and financial service fees spiked. When pressed about the surprising jumps in the CPI and PPI for July, Goolsbee admitted “that makes me a little uneasy,” adding that it’s an “area of concern” that will require close monitoring. Goods prices rose as well, led by a 1.4% increase in food. Fresh and dry vegetables skyrocketed nearly 39% in a single month, a surge partly attributed to labor shortages resulting from tightened immigration policies. Beef, eggs, coffee, steel, and aluminum all became costlier as well.

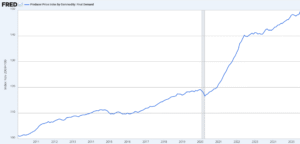

Producer prices surged in July 2025, rising far faster than economists expected. The sharp uptick in the Producer Price Index (PPI) highlights mounting cost pressures that could soon filter into consumer inflation. Source: FRED

For economists, the July PPI report offers confirmation of a fact long denied and downplayed by the current administration: tariffs come with concomitant costs. “This is a kick in the teeth for anyone who thought that tariffs would not impact domestic prices,” warned Carl Weinberg, chief economist at High Frequency Economics. He added that the figures reinforced the case for caution, noting that the data vindicated the Fed’s “wait-and-see” posture on interest rates. Chris Larkin of Morgan Stanley’s E*TRADE echoed that sentiment. While the numbers don’t “slam the door” on a rate cut, he said, they have narrowed the opening considerably.

Tariffs and a Renewed Inflationary Impulse

Experts say a central factor behind the resurgence of price pressures is the trade policy environment. Over recent months, the U.S. government’s tariff regime has expanded, part of a high-profile effort to reshape global trade deals. The current administration’s wide-ranging import tariffs, covering everything from steel and electronics to foodstuffs, have increasingly fed into domestic prices. The July PPI data strongly suggest these tariffs are now driving up costs at a significant clip.

Earlier in the year, some businesses had managed to shield customers by stockpiling inventory or swallowing costs. But those stopgaps are running out. Analysts at Oxford Economics noted bluntly that “tariff-exposed goods are rising at a rapid clip, indicating that the willingness and ability of businesses to absorb tariff costs may be waning*.” In other words, companies that once shouldered the burden are now passing it forward, rippling higher prices throughout the economy.

Even the surge in services inflation carried a tariff imprint. Goolsbee and others pointed out that the tariff regime isn’t a one-off event but a continuous “drip-drip” of new announcements, with each new measure injecting more uncertainty into the outlook. Businesses, wary of how high tariffs might climb or how long they might last, are quicker to raise prices preemptively. Goolsbee warned that without clarity on the endgame of trade policy, the Fed “will need more time to decide if rate cuts are appropriate.” He called tariffs a “stagflationary” force, capable of driving up inflation while slowing growth. That dual threat, he argued, is “the worst position that a central bank could be in,” since there is no obvious policy remedy when both sides of the Fed’s mandate are under assault.

The data reinforced his unease. Import prices rose 0.4% in July alone, adding fresh pressure on top of the broad domestic increases already captured in the PPI. Samuel Tombs of Pantheon Macroeconomics observed that “the new tariffs are continuing to generate cost pressures in the supply chain, which consumers will shoulder soon.” Michael Hanson of J.P. Morgan echoed the warning, pointing to “clear evidence that prices of a number of durable goods are being passed through to consumers.” Tariffs, once cushioned by corporate balance sheets or hedging strategies, are now landing squarely in consumers’ laps. The result is an inflationary rekindling at precisely the moment when many hoped the fire was dying down.

Goolsbee acknowledged that tariffs could, in theory, deliver only a one-time level shift in prices. However, he also raised the risk of something far more corrosive—a persistent upward spiral in costs, particularly if duties on critical components, such as semiconductors, force price hikes across entire supply chains. The uncertainty, he stressed, is what makes the situation so perilous. Every new tariff measure risks unleashing another wave of inflation, pushing the Fed further from its 2% target. As he put it, anything that muddies the path back to stable prices “is extending the timetable of when [rate cuts] can happen.”

Fed Faces Its Toughest Balancing Act in Years

All of this leaves the Federal Reserve facing its most uncomfortable position in years. By law, the Fed must safeguard both stable prices and maximum employment. But tariffs and the July surge in wholesale costs threaten to push those goals into direct conflict. The economy is showing signs of slowing, and policymakers know that leaving rates elevated for too long could choke growth. At the same time, inflation remains above target. Cutting prematurely could undo the Fed’s hard-fought progress and allow price pressures to flare again. It’s a perilous balancing act. Tip too far one way and years of inflation-fighting may be squandered. Tip the other and the Fed risks stalling an economy and labor market that, for now, remain somewhat resilient.

Other officials have joined Goolsbee in urging patience. Raphael Bostic, head of the Atlanta Fed, stressed that with unemployment still relatively low and only a modest cooling in hiring, the central bank has “the luxury to wait and see” before making any decisive move. Bostic warned against repeating the missteps of the 1970s, when the Fed’s quick reversals—easing too soon and then tightening again—ended up deepening the pain. Once you’ve slammed the brakes on inflation, you don’t take your foot off until you’re sure you won’t have to slam them on again.

On the other hand, some argue that the Fed needs to act more aggressively to prevent potential future issues. President Trump has been especially vocal, blasting the central bank for not cutting rates quickly enough. He recently posted that Powell is “always TOO LATE AND WRONG,” adding that his “termination cannot come soon enough.” The President’s remarks came just a day after Powell warned that tariffs imposed by the Trump administration could raise prices while slowing growth. The rhetoric highlights how easily monetary policy can become entangled in politics at a moment when the Fed is facing both immediate challenges and longer-term structural issues. Regardless of the noise, experts say the Fed has no clear path forward. Its credibility now hinges on resisting both complacency and panic, waiting out the fog until the right course reveals itself.

Mixed Economic Signals Cloud Outlook

Complicating the Fed’s decision-making is a raft of mixed economic signals. On one hand, some inflation gauges appear to justify optimism. July’s Consumer Price Index showed a 2.7% annual increase, a number that was closer to the Fed’s target than the average for the previous three years. Core inflation, which strips out food and energy, had also been trending lower, reinforcing the belief that past rate hikes were finally biting. These reports fueled expectations in financial markets that a rate cut might arrive as soon as September. And by early August, investors had priced in nearly a 100% chance of a cut.

But the Producer Price Index tells a different story. July’s biggest wholesale price jump in three years has dealt a blow to the “inflation is over” narrative. Economists noted that much of July’s disinflation stemmed from temporary factors, such as lower gasoline prices. Service costs, often tied to wages, remained stubbornly high, a detail that Goolsbee singled out as troubling despite the headline’s reassuring appearance.

Meanwhile, the labor market and growth figures tell a divided story. Job creation has slowed to a crawl compared to last year’s pace. Over the summer, monthly gains averaged only 30–40 thousand, a fraction of the hundreds of thousands posted in 2021 and 2022. Business investment has cooled, and higher interest rates have dampened interest-rate-sensitive industries, such as housing and construction. These point toward the need for relief.

Yet, the headline unemployment rate, which has remained in the low-4-percent range, suggests that the market is still strong and that most people who want a job can still find one. But this statistic alone masks the cracks beneath. Underemployment remains a nagging concern, as many Americans are stuck in part-time roles despite wanting full-time work. Discouraged workers, too (those who have slipped out of the labor force altogether after repeated setbacks), complicate the picture. In reality, the labor market is not as resilient as the surface numbers suggest—steady, but not whole.

This ambiguity leaves the Fed in a bind. Markets, hungry for easier money, may be overly confident about a quick pivot while policymakers, by contrast, see a murkier picture. One data set says inflation is easing. Another says it could reignite. Hiring is slowing, yet consumers continue to spend (primarily on credit). As Richmond Fed President Thomas Barkin summarized, “We may see pressure on inflation, and we may also see pressure on unemployment, but… the balance between the two is still unclear.”

For American households and businesses, the mixed signals have translated into daily unease. Families wonder whether mortgage rates, car loans, and credit card costs will ease this year or remain punishing into 2026. Workers question whether jobs will stay plentiful or if layoffs could spread. Businesses debate whether to invest for growth or brace for weaker demand. Consumers have proven resilient so far, spending even as they dip into savings, but confidence remains fragile. The longer uncertainty lingers, the more likely both consumers and firms will retreat, feeding a slowdown of their own making. It is precisely this risk of a self-fulfilling downturn that makes the Fed so intent on maintaining steady communication: to anchor expectations while remaining ready to support the economy if needed. It’s a delicate dance of communication aimed at keeping everyone’s nerves calm.

Patience Now, Relief Later?

Looking ahead, the economy’s path hinges on whether inflation continues to bend steadily downward or if new shocks intervene. The optimistic case is that steady energy prices, easing bottlenecks, and possible trade de-escalation allow inflation to drift toward the target. Goolsbee has expressed hope that recent flare-ups are merely “a blip“. Oxford Economics projects that cuts may not come until December, when inflation is securely near 2% and unemployment only slightly higher. In that world, the Fed achieves a “soft landing,” and patience pays off.

The risks, however, remain real. A resurgence of tariffs, a spike in commodity prices, or geopolitical instability could harden inflation. The Fed might then face the wrenching choice of hiking again or leaving rates high as growth fades. Still, most officials believe the greater danger lies in cutting too soon. The consensus among Fed officials is that it’s easier to repair a growth shortfall with cuts later than to tame an inflation surge that gets out of hand now. In practice, this means the bar for cutting rates in September or even November is high. The data in the coming weeks will need to show a convincing downtrend in inflation, and no further shocks, such as the July PPI, for the Fed to feel comfortable pivoting.

For now, experts say Americans should brace for higher borrowing costs in the short term. Housing may remain sluggish as mortgage rates stay near multi-year highs. Businesses may be more selective about investments, knowing the era of cheap money isn’t returning just yet. And while savers could benefit from higher yields, confidence remains fragile. Consumer sentiment has historically dipped whenever tariffs or price anxieties resurface, and policymakers like Goolsbee worry the conflict could spiral.

Why Fed Caution Could Be Bullish for Gold

The repeated calls for patience from Goolsbee and his colleagues highlight just how fragile America’s economic path remains. Each new data release adds another layer of uncertainty, leaving the Fed to steer cautiously through a fog with no clear horizon. For investors, that hesitation carries an unmistakable signal: volatility is not over. Inflation could reawaken, growth could falter, and the Fed may be forced to hold rates higher for longer than markets are willing to accept. In such conditions, traditional assets often stumble.

Gold, however, has a different story. It tends to shine when central bankers sound uneasy. Higher interest rates can weigh on stocks and pressure bonds, but gold is not tied to corporate earnings, debt repayments, or government balance sheets. It carries no counterparty risk. In past cycles, from the 1970s stagflation to the 2008 financial crisis, Fed caution and market turbulence coincided with strong demand for bullion. Today’s environment, with its sticky inflation, tariff-driven shocks, and slowing growth, has similar hallmarks.

Goolsbee’s warning that tariffs could deliver a “stagflationary” shock underscores why gold matters now. If inflation lingers while growth weakens, the Fed’s tools are limited, but investors are not without defenses. Gold hedges both outcomes. It can help preserve purchasing power if prices accelerate and provide stability if the economy stalls. Unlike paper assets that rely on policy credibility, gold draws strength from its scarcity and independence from the monetary system itself. For households trying to safeguard savings, the takeaway is clear. The Fed’s caution is an admission that uncertainty remains embedded in both the economy and policy. That very uncertainty is the soil in which gold thrives. As Goolsbee himself acknowledged, there is “not an obvious answer” to the challenges ahead. But history shows one choice investors return to when faith in the dollar wavers: they buy gold.