By Preserve Gold Research

If you had bought a 1-ounce gold bar about a year ago for roughly $2,500, that same bar would be worth close to $3,600 today. Gold prices have surged to record levels, breaching the $3,500 per ounce milestone and setting fresh highs. Its rapid growth, over 40% higher than a year ago and more than 30% year-to-date, has captured the attention of investors and the media alike. But behind gold’s glittering rally lies an undercurrent of economic anxiety. Investors have been flocking to the precious metal in droves, driven by a perfect storm of sliding bond yields, a weakening dollar, insatiable central bank demand, and deepening concerns about the future of the economy. Far from a simple speculative spree, gold’s rise is flashing a warning about global financial unease and the challenges facing the U.S. economy.

Falling Yields Ignite Gold’s Rise

After years of tightening, the Federal Reserve has reversed course, setting in motion a chain of events that has sparked a rally in gold. Markets now price roughly a 90% chance of a September cut as signs of labor market weakness pile up. Following a weak jobs report, Treasury yields slipped to multi-month lows, with the 10-year yield near 4.08% and the 2-year yield around 3.47%. For gold investors, the direction of rates matters. Bullion pays no interest, so falling yields reduce the opportunity cost of holding it. Analysts suggest the latest surge partly reflects growing confidence that the Fed will continue easing, a move that could weaken the dollar and compress cash returns. Those conditions often send capital searching for alternative stores of value like gold. “We continue to expect new record highs,” said Suki Cooper, a precious metals analyst at Standard Chartered Bank, pointing to the Fed’s shifting stance alongside seasonal demand strength.

Gold’s Relentless Rally: Breaking Above $3,500 to New All-Time Highs

Gold has surged to over $3,600/oz, over 40% higher year-over-year, reflecting safe-haven demand amid a weaker dollar, falling yields, and robust central-bank buying. Source: TradingEconomics

Cooling inflation and a softer labor market have given the Fed room to consider cutting rates, which could validate the wagers investors have already placed. The unemployment rate recently edged up to 4.3%, the highest in more than three years, while monthly job creation has slowed to a crawl. “These employment data give the Fed all the reasons it needs to shift its balance of risks and lower rates,” noted Jamie Cox of Harris Financial Group after August’s weak payrolls report. At the same time, inflation, though still above target, has come off its peak, easing pressure to keep rates high.

Falling yields have also undercut real interest rates (inflation-adjusted yields), which is typically a green light for gold. Earlier this year, high real rates were a headwind that kept gold prices in check. But that dynamic has changed over the summer. The Fed’s policy shift has markets looking past the once-relentless rate hikes toward an era of cheaper debt, fueling a “buy the dip” mentality.

Abroad, sliding yields in some places and sharp volatility in others have worked in tandem to increase bullion’s appeal. In Europe and Japan, long-term bond yields spiked to multi-year highs amid fiscal worries, only to add to fears and drive some investors out of bonds entirely. When the asset class that is supposed to be the safest wobbles, gold starts to look like bedrock. Experts say the risk and reward have skewed in gold’s favor as seesawing yields and uncertainty rule the markets.

Greenback Weakens, Gold Strengthens

Hand-in-hand with the drop in yields has come a notable weakening of the U.S. dollar. Since gold is priced globally in dollars, a softer dollar makes gold cheaper (and more attractive) for investors holding other currencies. Throughout 2025, the dollar’s value has steadily declined, a trend intensified by the same rate-cut expectations that have boosted the value of gold. The U.S. Dollar Index, which measures the greenback against a basket of major currencies, slid to around 98.0 in early September, hitting multi-week lows. Having already declined by around 11% in the first half of 2025, Morgan Stanley Research estimates that the dollar could lose an additional 10% by the end of 2026.

Unsurprisingly, gold has responded in kind. Investors often use gold as a hedge against dollar weakness and potential currency debasement. With the dollar’s purchasing power in question, that hedging motive has come back to the forefront. “Supportive for gold is the bearish dollar outlook underpinned by expectations of Fed cuts,” said Ricardo Evangelista, senior analyst at ActivTrades. As the dollar’s slide has gathered momentum, gold’s price in dollar terms has climbed even faster. It’s the classic inverse dance that we see play out time and time again.

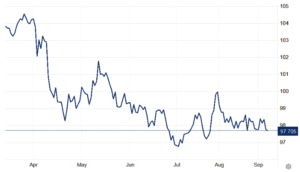

The U.S. Dollar Index Slides to 97.5 in September 2025

The U.S. Dollar Index slid steadily through spring – summer 2025, falling from 104 in April to less than 98 by early September Source: TradingEconomics

It doesn’t help the dollar’s cause that the White House has sent mixed signals on currency and trade policies. In August, the administration floated tariffs tied to currency values, rattling foreign exchange markets. At the same time, several major economies have pushed to reduce their dollar reliance as part of a long-term de-dollarization strategy. While the greenback remains dominant, it no longer looks untouchable. “Concerns about the dollar’s status as a safe haven” have begun to creep in, observed Carsten Menke of Julius Baer, pointing to political interference and deficit worries as factors. In this environment, gold stands out as a stateless store of value. No one can print it. No party can manipulate it by decree. Each step the dollar takes lower brightens bullion’s appeal to savers who want protection from currency risk.

To be sure, the dollar’s weakness is both a cause and effect of gold’s rise. As investors shift into gold and other currencies, it adds pressure to the dollar. That, in turn, pushes gold higher in dollar terms—a feedback loop of sorts. We saw this dynamic in play when the U.S. credit rating was downgraded by Fitch in 2023 over fiscal concerns; gold spiked higher while the dollar wobbled. Now in 2025, with U.S. debt levels and deficits still mushrooming, some are once again questioning the dollar’s long-term stability.

Political Turbulence and the Safe-Haven Scramble

Beyond pure economics, political uncertainty and geopolitical risks have also been driving gold prices in recent years. Headlines often carry more weight than models, and the current administration’s unorthodox tariff policies have set global markets on edge. While supporters argue these moves strengthen negotiating leverage and protect domestic industry, critics fear that higher costs will inevitably be passed along to consumers and that retaliation could quickly spiral into an all-out trade war.

Then, there’s the global backdrop of international conflict to contend with. Russia’s invasion of Ukraine in 2022 ushered in a new era of great-power tensions, NATO expansion, and sanctions, all of which underscored gold’s role as a crisis asset. Then, late in 2023, war erupted in the Middle East (with a major conflict flaring between Israel and militant groups), sending oil prices and fear gauges higher. Each of these episodes saw investors worldwide bid up gold.

By early 2024, as fears of a wider Middle East conflagration and even talk of a possible U.S.–China confrontation over Taiwan circulated, gold was pushing to then-record levels above $2,100. Fast forward to 2025, and those geopolitical tensions remain largely unresolved. Many countries now worry about the reliability of the U.S. as a global partner amid America-first policies. This broad backdrop of international instability has only reinforced gold’s allure as a stateless asset insulated from any single country’s troubles.

Even within the U.S., domestic political strife has fed into gold demand. Partisan standoffs over funding and the debt ceiling have come perilously close to the edge. In mid-2025, a close call on the debt ceiling (and an ensuing credit rating downgrade of U.S. Treasury debt) rattled confidence in the nation’s finances. “Fiscal worries” contributed to a sell-off in long-term U.S. bonds, pushing yields up and sowing worry that investors might lose appetite for U.S. debt.

All of these events have sent a clear signal to markets that the road ahead is rocky, with volatility and doubt crowding the horizon. And when uncertainty becomes the norm, investors often lean harder on gold as a hedge. Mark Haefele, Chief Investment Officer at UBS Global Wealth Management, noted that elevated political and geopolitical risks will continue to strengthen the metal’s appeal. In his view, prices might reach about $3,700 by next June, and he did not rule out $4,000 per ounce if conditions worsen.

Central Banks Can’t Get Enough

While individual investors are seeking safety in gold, the biggest gold enthusiasts lately have been central banks themselves. Around the world, central banks have embarked on an accumulation spree that experts say could reshape the bullion market for years. In 2022, they purchased about 1,136 tons, the largest annual haul since records began in the mid-twentieth century. Their voracious appetite continued through 2023 and 2024, each of which saw well over 1,000 tons of central bank gold purchases. To put that in perspective, central banks used to buy only about 400-500 tons per year in the early 2000s. Now they are buying double or even triple that amount annually, and early reads for 2025 point to more of the same. According to the World Gold Council (WGC), “central banks have accumulated more than 1,000 metric tons of gold in each of the last three years”, and nearly all central bankers surveyed plan to keep or increase their gold reserves in the coming year.

Why the urgency? Diversification sits at the center of the story. The freezing of roughly half of Russia’s foreign exchange reserves in 2022 jolted policymakers in many emerging economies. If sanctions can restrict dollar assets and Treasuries, then holding a larger slice of reserves in gold seems prudent. Gold carries no counterparty risk, and a foreign government can’t block it. Unsurprisingly, buyers have included China, Turkey, India, and several others that prefer to limit exposure to the U.S. financial system.

There is also a portfolio logic at work. Many central bank officials view gold as dry powder for rainy days. The metal’s share of overall demand has climbed as official sector purchases have grown, contributing nearly a quarter of total annual gold demand on average from 2022 to 2025. By some measures, the value of official gold reserves now exceeds $4.5 trillion at current prices. Analysts have pointed out that, for the first time since the mid-1990s, the gold now held by central banks is worth more than their U.S. Treasury holdings. If that trend holds, it would mark a striking vote of confidence in bullion and a quiet warning for Washington.

China offers a telling case. The People’s Bank of China has reported consecutive monthly additions through mid-2025. Other central banks across Asia and the Middle East are following suit, often without fanfare. The World Gold Council notes that a large share of 2022 buying, roughly two-thirds, was not disclosed at the time. That pattern suggests some accumulation may be happening off stage, which could reflect a desire to avoid telegraphing geopolitical hedges. Many observers believe Russia and China have been among the heaviest buyers, in line with their goal to reduce reliance on the dollar.

Even some U.S. allied countries have joined the gold rush. Poland has expanded its hoard substantially in the last few years. India, Turkey, and several Gulf states have also increased their allocations. As Ipek Ozkardeskaya, senior analyst at Swissquote Bank, put it, “The share of U.S. Treasuries held by foreign central banks has been declining for more than a decade, but that shift into gold accelerated this year amid U.S. debt concerns, ratings downgrades, trade tensions, and geopolitical risks.” The motives look mixed. Some of it is finance, some of it is politics, but the writing on the wall is clear. When the entities that themselves print money are opting to hold more gold, it’s an unmistakable vote of no confidence in the dollar.

This shift is even altering the composition of global reserves. Recent accounts suggest gold has overtaken the euro as the second-largest holding among central banks worldwide. It’s a remarkable turn for an asset that critics once dismissed as a relic. For Americans, there is a double-edged sword here. On one hand, robust central bank demand supports gold prices and validates gold’s role in the monetary system. On the other, it reflects ebbing confidence in U.S. financial leadership. When foreign central banks trade out of Treasuries and into bullion, it can be seen as a referendum on U.S. fiscal and monetary stewardship. And the verdict, evidenced by thousands of tons of gold buying, is that many are hedging their bets.

ETFs and Retail Demand Resurge

It’s not just central banks fueling gold’s record run. Institutional and retail investors have also joined the gold rush, adding further momentum. Gold-backed exchange-traded funds have roared back in 2025 after a tepid 2024. In the first half of the year, global ETFs added approximately 397 tons to vault holdings, marking their largest first-half inflow since 2020, according to World Gold Council tallies. By the end of June, ETF hoards stood near 3,616 tons, the highest in almost three years.

Analysts have welcomed the return of ETF demand, with some projecting over 500 tons of net inflows for 2025. Such a reversal indicates that big money is flowing back into gold through these investment vehicles, and this alone could keep upward pressure on price. “Central bank buying can continue to hold the floor for gold, but a re-ignition of ETF inflows is needed for prices to break out higher once again,” explained Natasha Kaneva, head of commodities strategy at J.P. Morgan. That is essentially what happened this year: central banks laid the groundwork by quietly accumulating, and once the price began gaining steam, ETF investors rushed in and propelled the rally to new heights.

The world’s largest gold ETF, the SPDR Gold Trust, saw its holdings jump to about 1061 tons in late August, a 12% increase for the year and the highest level of holdings since 2022. This kind of institutional buying creates a positive feedback loop, as rising prices attract more inflows, which in turn push prices higher. By crossing key thresholds (like $2,500, $3,000, and then $3,500), gold has repeatedly enticed a fresh wave of investors who might previously have stayed on the sidelines.

Meanwhile, retail investors and the general public have not been left out of the gold rush. In many countries, small investors have been snapping up gold coins, small bars, and even jewelry (despite record prices). WGC data show that while coin buying dipped in 2024, gold bar demand actually rose 10% that year, and the trend has continued into 2025.

What stands out in 2025 is how wide the net has become. It’s not just the “gold bugs” or central banks. It’s pension funds, hedge funds, retail buyers, and even corporate treasurers in some cases. Everyone is allocating a bit more to gold. While the motives differ, the end result converges to higher demand and therefore higher prices. UBS Wealth Management now estimates total gold demand could rise about 3% this year to roughly 4,760 metric tons, the highest in more than a decade. Gold has become a “mainstay allocation in a well-diversified portfolio,” as the WGC puts it. And the queues of buyers attest to that.

How High Can Gold Go?

With gold sitting at historic heights, what happens next hinges on the same levers that lifted it: real rates, the dollar, official sector demand, and global stability. Many experts still see a friendly backdrop. UBS’s base case suggests a glide toward roughly $3,700 by mid-2026, with a path to $4,000 if stress deepens. Other analysts have floated even more bullish possibilities. In September, Goldman Sachs analysts suggested that if the Fed’s credibility were to erode further under political pressure—essentially if monetary policy becomes unmoored—gold could even spike toward $5,000 in a few years. It’s not a prediction, but it shows the upper-bound scenarios being contemplated.

Experts say policy will likely call the tune. If the Fed cuts in measured steps that stabilize growth, gold could climb in a choppier, more orderly fashion. If inflation reaccelerates or officials pivot back to hawkish, momentum might stall, and sharp corrections could follow. The metal tends to perform best when real yields fall and liquidity loosens. A surprise jump in real yields would work in the opposite direction.

The dollar matters too. A soft or sideways dollar would keep the wind at gold’s back. A sudden dollar rebound could bite, especially if a non U.S. shock drives safe haven flows into greenbacks. The interplay between gold and the dollar is complex. They often move inversely, but during acute crises, they can briefly rise together as all safe havens are bid. On balance, the multi-year trend has been dollar weakness, and if, as many believe, that trend persists (thanks to U.S. twin deficits and diminishing yield support), experts say gold stands to benefit.

Central banks remain the quiet swing vote. Surveys indicate ongoing accumulation, which would keep a floor under prices. Even if purchases slow from the torrid pace of 2022-25, experts say central banks are unlikely to become net sellers en masse. The painful lessons of the 1990s (when some Western central banks sold a lot of gold at low prices, missing out on the subsequent bull market) haven’t been forgotten. And given that emerging market central banks have strategic reasons to hold gold, the likelihood of major sales by these countries is low.

Geopolitical risk, while impossible to forecast, remains an upside wild card. The world is not exactly entering an era of calm. Unresolved conflicts, great power rivalry, and unforeseen crises (from pandemics to wars) have a way of rearing their heads when least expected. That’s why prudent investors and central banks hold a certain percentage of gold as insurance. If tensions in any hotspot escalate in 2026, or if a new crisis emerges, gold could see additional safe-haven flows that push it beyond current forecasts. While a genuine détente could reduce risk premia and cool enthusiasm for the yellow metal, such developments seem unlikely given the current state of affairs.

The mix of U.S. economic strain and global unease has created fertile ground for gold. Low or falling real rates, a softer dollar, cautious central bankers, and skittish investors echo one another, and that chorus has been drawing capital toward bullion. The very fact that gold is hitting all-time highs tells us that there is a profound lack of confidence in other alternatives. Whether it’s confidence in currencies, in governments managing their debts, or in peace and stability, something is lacking, and gold has become the repository of those collective concerns.

secure.