By Preserve Gold Research

As 2025 passes its midpoint, the precious metals market has found itself at a crossroads. While gold has been glittering at or near all-time highs, silver has quietly trailed behind. Trading at only a fraction of its historical ratio to gold, the white metal’s price has raised eyebrows from Wall Street to Main Street as investors have begun to question whether it’s silver’s time to shine. Some analysts insist that this quiet stretch could be the coil set to send silver toward new heights. But if silver truly sparks a “bigger rally,” what does that say about the nation’s financial health? And what does it mean for everyday investors?

Precious Metals at a Crossroads in 2025

As of mid-2025, gold stands as one of the year’s best-performing assets. It spent the last year climbing relentlessly and briefly touched record highs around the mid-$3000s per ounce. Despite a mild pullback from those peak levels, gold is up roughly 25% year-to-date (following a strong 2024 in which it gained over 26%). Silver has told a quieter story. Though it trades higher in 2025, its rise equals barely half of gold’s gain. At a price in the mid-$20s per ounce, silver remains far below its 2011 peak near $50. This disparity is reflected in the gold-to-silver ratio, which measures how many ounces of silver equal the value of one ounce of gold.

That ratio has ballooned to historic levels, soaring to about 100:1 or higher in recent years. To put that in perspective, a century ago, the ratio was often around 15:1, and over the past several decades, it has averaged closer to ~60:1. Historically, any ratio above 90 has signaled underlying economic tension, and today’s levels are flashing red. Experienced investors know that when the ratio peaks at such extremes, silver often stages a catch-up rally – and sometimes a spectacular one.

Why is gold soaring while silver struggles to catch up? Part of the answer lies in market dynamics and perception. Gold is often seen as the ultimate safe haven: a shiny insurance policy against crises. Lifted by record central bank buying, stubborn inflation fears, currency-debasement worries, rising geopolitical rifts, and a steady global drift away from the dollar, the yellow metal’s ascent has become a barometer of growing global unease. “It’s not one thing; it’s everything,” said Brien Lundin, CEO of Jefferson Financial, responding to gold’s latest rally. On the other hand, silver’s price hasn’t fully reflected the same level of demand. However, analysts believe this could soon change given silver’s strong correlation with gold and the metal’s key role in the industrial sector.

Plenty of Silver, Until There Isn’t

Silver has trailed gold throughout this bull market, and its lag owes much to the fact that, unlike gold, silver isn’t being snapped up by central banks. Without that price-insensitive sovereign demand, silver’s floor depends on private investors and factories, leaving the metal vulnerable to sentiment swings and short-term speculation. In a sense, silver trades with less of a safety net than gold does, with its price action heavily dependent on industrial demand and investor sentiment.

About 50–60% of silver’s annual demand comes from industrial applications, giving the metal a dual role as both a monetary and industrial commodity. When the global economy is humming, industrial demand for silver increases, often pushing its price higher. On the other hand, when growth slows, or interest rates climb, manufacturers often trim orders, holding back silver’s price even as gold rises. In 2024 and early 2025, high interest rates and slowing growth in key manufacturing economies like China and Germany dampened industrial consumption of silver. Despite obvious inflation-hedging motives that should have favored silver, its industrial linkage has acted as a headwind over the past 18 months. Gold, with far fewer industrial uses, hasn’t had this problem.

As Francisco Blanch, head of commodities research at Bank of America, notes, “Silver is half precious, half industrial…the precious aspect has been driving it higher, the industrial side has been taking a back seat, but this will eventually change.” According to Blanch, silver’s industrial drag is likely temporary; once the economic cycle turns or markets look beyond a soft patch, the white metal could play rapid catch-up.

The silver market’s small size compounds its volatility. At roughly one-tenth the size of the gold market by market capitalization of above-ground supply, it takes relatively little buying or selling pressure to move the price. A few large trades may slam prices down in a panic or lift them skyward when confidence returns, as seen in the dizzying ride of early 2020 as the COVID-19 shock hit. This volatility tends to scare off conservative investors, creating a bit of a self-fulfilling situation: because it’s more volatile, institutions tend to avoid it, which in turn leaves price discovery more to retail investors and short-term speculators. But, the flip side is that when silver finally attracts broad investor interest, its small market size can cause prices to soar.

There are other quirks, too. A large overhang of above-ground silver inventories (held in coins, bars, and exchange-traded products) creates an illusion of a deep market, even though much of that silver does not come to market at current prices. Miners consistently produce less metal than the world consumes, and the gap is bridged only by drawing down inventories. Experts say this “psychological weight” reduces urgency among investors as many believe “there’s plenty of silver around” until suddenly there isn’t.

Why Some Insiders Expect One Hundred Dollar Silver

Despite the forces keeping silver’s price in check, experts say the situation is laden with bullish tension. Like a spring being compressed, the longer silver consolidates while gold runs ahead, the more potential energy builds. And when silver finally breaks out, many believe that it could be a historic move given the setup it has built up over the years.

Today, the gold-to-silver ratio hovers near 100:1, far above its historical norms. When the gap finally narrows, silver usually runs faster than gold because either gold retreats, silver climbs, or both move toward balance. A slide toward 80 often marks the moment silver starts to outperform as traders pile into the metal. Even a modest drift from 100 into the nineties could spark momentum buying, and a full reversion to the long-term average of 60 might lift silver roughly seventy percent from current levels, pushing it beyond its old record price.

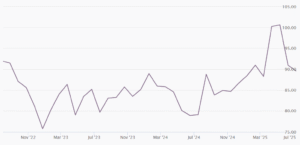

Gold keeps widening the gap, with the ratio climbing from roughly 70 to 1 in 2022 to 100 to 1 by mid-2025, a signal experts say could soon unleash a swift silver catch-up Source: Chards

Beneath that technical picture lies a fundamental squeeze. Global demand for silver has outstripped new mine supply for four straight years, leaving a 2024 shortfall of nearly 149 million ounces or about seventeen percent of annual consumption. According to the Silver Institute, cumulative deficits since 2020 may reach half a billion ounces or more (equal to about 10 months of mine production). Experts say such a drawdown can’t continue indefinitely without consequences.

While the market has been slow to price in these fundamentals, reality has a way of asserting itself suddenly in commodity markets. If demand keeps exceeding supply, inventories could reach critically low levels, and it follows that silver prices would have to adjust sharply upward to ration demand. Some industry leaders believe the market might require triple-digit silver to restore equilibrium. Triple-digit – as in over $100 per ounce – a nearly three-fold increase from current prices.

Arguably, the most interesting element of silver’s current state is that investor demand has been relatively weak in recent years. In 2024, as silver’s price rose modestly, global investment demand for silver (bars, coins, and exchange-traded products) actually fell by 22% to a five-year low. Meanwhile, U.S. demand plunged almost 46% as retail buyers shifted to the sidelines. What does this tell us? Experts say it implies that silver’s up-move so far was driven largely by industrial use and some strength in Asian investment, without Western investors fully participating. If that’s the case, the real silver fireworks show might start only when Western investors return to the market.

It’s a classic setup where the crowd hasn’t bought in yet. Should silver break above a key price like $30 or $35 and grab headlines, experts say a wave of latecomers could rush in, driving the price to suddenly overshoot. For now, this lack of enthusiasm has been a damper, but it also represents pent-up potential energy. Silver has been climbing the proverbial wall of worry largely alone; if the crowd joins, the move could turn parabolic.

Flight to Safety Intensifies Precious-Metal Demand

Surging gold and silver prices rarely appear in a vacuum. They flourish when investors sense gathering storms, and few clouds look darker than America’s swelling debt. Today, the federal ledger has topped thirty-six trillion dollars, a figure so large that every major rating agency has taken notice. Following Fitch’s credit rating downgrade in 2023, Moody’s removed the last triple-A badge from U.S. Treasuries in May, citing doubts about governance and sustainability. Shortly thereafter, yields on ten-year notes pierced five percent as lenders demanded richer compensation and revealed deeper skepticism. At the same time, warnings from the highest ranks of finance have grown sharper as the years have passed. JPMorgan Chase chief Jamie Dimon has called the debt trajectory “a real problem” and has cautioned that bond markets could one day balk at funding Washington’s appetite for borrowing. If investors decide the government may not regain fiscal discipline, they might dump Treasuries or dollars in a swift, destabilizing rush.

Such abstract numbers carry concrete consequences for households. A mountain of debt could translate into high inflation if the Federal Reserve expands the money supply to cover deficits, or it could trigger a credit crunch if the government struggles to roll its obligations. Experts say that either path could erode economic stability. When a great nation’s credit slips into doubt, many investors reach for assets they view as real money, free of counterparty risk. Gold and silver have filled that role for centuries, and they may do so again if confidence continues to fray.

The U.S. Federal Reserve, which largely dictates the short-term fate of the economy through interest rate policy, has hitherto offered little reassurance. After aggressively raising rates throughout 2022–2024 to combat inflation (one of the sharpest hiking cycles in Fed history), it now faces a damned if you do, damned if you don’t scenario. Inflation, while lower than the 9% peak of 2022, persists above comfort levels, especially in services and wages. The Fed has indicated it might need to keep rates “higher for longer” to truly break inflation’s back. However, keeping rates high comes with a price. It risks choking off economic growth, tanking the stock market, and even triggering a wave of loan defaults (from mortgages to corporate debt) due to higher borrowing costs. Cutting rates, on the other hand, risks a fresh inflation flare-up. It’s a Catch-22 situation with no clear exit; whichever path the Fed takes might propel gold higher and, in time, pull silver with it.

Beyond any one metric, there is a broader erosion of trust at play – trust in institutions, in leadership, and in the trajectory of the country. Polls show a public increasingly pessimistic about the economy’s future, even when current data isn’t terrible. Part of this gloom is fueled by political dysfunction. Partisan gridlock has made it harder to address long-term issues like entitlement reform, infrastructure decay, or education, indirectly affecting economic strength. Geopolitical surprises (like Ukraine’s recent drone attack on Russia) also feed into a narrative of a world entering a more chaotic phase. All this vague unease coalesces into a simple outcome: demand for safety increases. Gold and silver benefit. They are assets one can hold outside the banking system, free of political interference. In times of deep uncertainty, that is priceless.

Gold Moves First, Silver Often Follows Hard

While gold often headlines first when fear rises, history shows that silver may seize the spotlight once momentum builds. In the late 1970s, amid stagflation and economic malaise, gold shot up roughly 2.5x (from about $200 to $500/oz). But silver famously went parabolic, rising about 8x (from $6 to nearly $50/oz) in the same period as speculators piled in. A generation later, after the 2008 crisis, a similar pattern emerged. From the market bottom in late 2008 to its peak in 2011, gold climbed about 166%, but silver skyrocketed 444%, from around $9 to $49. Silver’s beta to gold in bull markets is very high, meaning it tends to rise much more than gold when precious metals are in favor. At a much lower entry price, it’s psychologically more accessible and prone to speculative frenzies once momentum sets in. In a way, silver tends to act like a leveraged version of gold during precious metal bull cycles. It may start slow, but eventually momentum builds.

Whenever fear peaks, silver’s catch-up can be explosive. The shaded bands show two striking examples: in the late-1970s the white metal vaulted about eight-fold—triple gold’s gain during stagflation—while after the 2008 crisis silver again outpaced gold four-to-one. Today’s near-record ratio hints that another snap-back could be forming. Source: Macrotrends

It’s worth highlighting that a number of respected analysts and investors remain steadfast in their conviction that silver’s day is coming. A few have been mentioned already. Another is Lobo Tiggre, who argues that if gold continues climbing, silver’s upside will be “even more explosive” and that simply reverting to historical norms could take silver above $60. Echoing this sentiment, well-known precious metals analyst Florian Grummes from Midas Touch Consulting has been extremely bullish on silver in recent interviews. He noted in April 2025 that “everything is on the table now” in terms of upside, given how strong gold was and how cheap silver remained by comparison. Grummes predicted silver could hit $40 to $50 in the near term, calling it “extremely undervalued,” and pointed to the technical base and the macro environment as aligning in silver’s favor.

And then there are the institutional moves. Some mining CEOs, like Keith Neumeyer of First Majestic Silver, are holding back some production, effectively waiting for higher prices. Sprott Asset Management, a prominent precious metals investment firm, has been accumulating physical silver in its trusts. We’re also seeing increasing industrial lobbying for silver (for example, solar panel manufacturers are concerned about future supply). These subtler signs suggest that those in the know are positioning for a scenario where silver becomes significantly more valuable.

Glimmers of Hope or Alarms in the Night?

The forces driving investors toward gold and, by extension, silver form a complex lattice of anxieties. Inflation might stay stubborn; federal debt may swell without restraint; global flashpoints could flare. Individually, each threat seems manageable. But together, they fuse into a broader conviction that tomorrow may not echo the reliable calm of yesterday. Rarely do so many risk cylinders fire at once in a way that favors precious metals, yet that is what appears to be unfolding today. As the saying goes, forewarned is forearmed. And in 2025, the old metals are providing plenty of warning.