By Preserve Gold Research

As the Federal Reserve’s rate cut decisions and mortgage rates play a high-stakes game, are you on the winning or losing side of the homeowner’s coin?

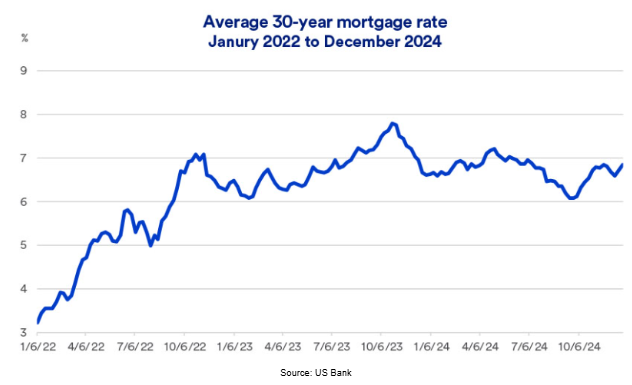

In December 2024, the Federal Reserve implemented its third consecutive interest rate cut of the year, reducing the federal funds rate by 0.25 points to a target range of 4.25% to 4.5%. In line with its monetary policy goals, the Fed’s move was intended to bring borrowing costs down for the millions of Americans struggling to make ends meet in the face of rising prices. But a troubling divergence has emerged. Despite these cuts, 30-year fixed mortgage rates have climbed, reaching an average of 7.14% by January 7, 2025—up from 6.75% just a year ago.

Why are mortgage rates rising when the Fed is cutting rates? Fed Chairman Jerome Powell hinted at the complexity during a recent press conference, stating, “I think that a slower pace of [rate] cuts really reflects both the higher inflation readings we’ve had this year and the expectations that inflation will be higher in 2025. We’re closer to the neutral rate, which is another reason to be cautious about further moves.”

Economists say the discrepancy lies largely in market dynamics. While the Fed’s actions primarily impact short-term rates, such as credit cards and adjustable-rate mortgages, long-term rates, like those tied to 30-year fixed mortgages, are heavily influenced by inflation expectations and bond market trends. “Today’s mortgage rates reflect higher yields in the bond market, but also a relatively wide premium spread between 10-year U.S. Treasury notes and mortgage rates,” explained Rob Haworth, senior investment strategist at U.S. Bank Wealth Management. Rising bond yields—driven by concerns over high inflation and economic stagnation—have pushed mortgage rates higher, creating a paradox of sorts for consumers.

Understanding this divergence and its potential implications could mean the difference between a manageable mortgage and one that strains household budgets. With mortgage rates near their highest levels in six months, many are reconsidering their homebuying plans or wondering if it’s worth waiting for rates to come back down. However, with inflation giving the Fed little wiggle room to lower its benchmark rate, it’s uncertain when, or if, mortgage rates will ever return to their historically low levels seen just a few years ago. Given the prospect of higher costs of goods amid President-elect Trump’s proposed tariffs, the dream of a sub-4% mortgage rate may just be that—a dream.

Understanding the Fed’s Impact on Inflation and Your Mortgage

As the nation’s central bank, the Fed implements monetary policy to promote maximum employment, stable prices, and moderate long-term interest rates. One of its most influential tools is the federal funds rate—the interest rate banks lend to each other overnight. By adjusting this rate, the Fed can influence the cost of borrowing for consumers and businesses, which in turn affects economic activity.

However, it’s important to distinguish between short-term rates, like the federal funds rate, and long-term interest rates, such as those tied to 30-year fixed mortgages. While the federal funds rate directly impacts overnight lending, long-term rates are shaped by a broad spectrum of market factors. The Fed can nudge market sentiment, and help set the tone for borrowing costs, but it doesn’t directly control mortgage rates—this is left to market forces.

Historically, the relationship between Fed rate cuts and mortgage rates has been consistent, with the latter often declining in response to the former. In the early 2000s, aggressive rate cuts by the Fed drove down mortgage rates, fueling a housing boom. Similarly, during the financial crisis of 2008, the central bank slashed rates to near zero in an effort to revitalize a decimated housing market, causing mortgage rates to hit record lows. Yet, the correlational relationship today is not as straightforward. Mortgage rates have grown despite the Fed’s rate cuts, defying expectations and leaving potential homebuyers scrambling for answers.

With banks pricing in risk, the spread between the federal funds rate and mortgage rates has widened, making the relationship between the two less direct. Higher credit risk and stricter underwriting standards have made it more expensive for banks to provide mortgages, leading them to pass on the costs to borrowers in the form of higher interest rates. For the spread to narrow, it will “require a change to the Fed’s current policy of reducing its mortgage-backed securities holdings,” said Haworth.

The Fed’s balance sheet, which includes mortgage-backed securities purchased during previous rounds of quantitative easing, has helped keep mortgage rates low in the past. But, as the central bank continues to unwind its assets, the impact on mortgage rates may become less pronounced. Combined with rising Treasury yields and a potential shift in inflation expectations, analysts warn that this could lead to further increases in mortgage rates in the future.

How Housing Trends Are Reshaping the Future for Buyers and Sellers

For prospective homebuyers, rising mortgage rates have dashed the already dwindling hopes of affordable homeownership for many. Coupled with higher home prices, these rates have made it more difficult for buyers to secure loans and afford monthly mortgage payments. First-time homebuyers, in particular, have felt the squeeze as they struggle to enter a competitive market with limited inventory and high prices. To put the affordability crisis into perspective, the average monthly mortgage payment in November 2024 reached $2,519, a 7.1% increase from just one year before, according to Redfin.

“The combination of elevated mortgage rates and higher home prices means that housing affordability remains a meaningful problem,” said Haworth. This sharp escalation has pushed many buyers to the sidelines, either abandoning their search or turning to rental properties. A dream of homeownership, once within reach for many Americans, is now a distant reality that grows further out of reach with each tick higher in mortgage rates. For those who do manage to secure a mortgage, higher rates have jeopardized their ability to build savings or invest in other areas of their lives. Others have been forced to settle for less desirable homes or take on higher levels of debt—an unsettling trend when combined with the overall increase in household debt across the country.

Financial Strain Amid Inflationary Pressures

Adding to the challenge, a typical household now allocates 38% of its income toward mortgage payments, far exceeding the recommended cap of 30% that financial experts advise. Worse, according to a Harvard University’s Joint Center for Housing Studies study, the number of households paying more than 50% of their income on housing reached a record high in recent months. Such expenditures leave families dangerously close to the edge, limiting disposable income for necessities like groceries, education, and healthcare. But the financial strains on homebuyers are not expected to stop there.

According to economists, President-elect Donald Trump’s proposed 25% tariffs on imports from Canada and Mexico, paired with a 10% tariff on Chinese goods, are expected to drive up the costs of essential items—including food and clothing. “Tariffs effectively raise the price of foreign goods, which provides an umbrella of higher prices for domestic producers,” said Jeffrey Coons, chief risk officer for High Probability Advisors. These rising living expenses create a financial double-bind for homebuyers, who find themselves battling simultaneously with higher mortgage payments and the rising costs of everyday necessities.

Labor market instability could further exacerbate the crisis. Trump’s plans for mass deportations risk disrupting industries that depend heavily on immigrant labor. The construction industry, for example, is estimated to comprise 14% of undocumented labor. If undocumented workers are removed from these labor pools, construction costs could sharply increase—a cost that may be passed onto the consumer in the form of higher home prices. Families could find themselves stuck paying even more than 38% of their income toward mortgage payments. And with many American households already living paycheck to paycheck, this squeeze could potentially force struggling families out of their homes.

Fewer Buyers, Slower Sales

The ripple effects on the broader housing market are equally concerning. Elevated borrowing costs have deterred a growing number of would-be buyers, leading to a noticeable drop in housing market activity. While reduced buyer demand has put downward pressure on home prices, inventory constraints, and rising construction costs have kept the housing supply tight and prices high.

This dynamic has created a catch-22 for home sellers, who may struggle to sell their homes despite strong demand. With fewer buyers and longer listing times, homeowners hoping to capitalize on rising prices may find themselves stuck with their properties, unable to move up or downsize as planned. At the same time, existing homeowners with mortgages locked in at lower rates are hesitant to sell, unwilling to exchange their affordable payments for today’s more burdensome rates. “Higher rates are making people in homes financed with low mortgage rates reticent to move,” said Haworth. “The challenge is we ultimately need more homes.”

According to a Redfin survey, this so-called “lock-in effect” has created a vicious cycle, which revealed that more than a third of homeowners stated they would “never sell.” Another 27% indicated they wouldn’t consider selling for at least a decade. With potential sellers largely immobile, fewer homes are being listed, further suppressing already weak sales. And with less inventory to choose from, buyers have less bargaining power, allowing sellers to hold their ground on price.

Despite early signs of a cooling market in late 2023 and early 2024, home prices rebounded to new all-time highs by mid-2024 before another slight decline. Yet, these modest corrections offer little reprieve for buyers, as affordability remains firmly out of reach for the majority. Looking ahead, experts project that prices will continue to rise in 2025, albeit at a slower pace, as the supply-demand imbalance persists. “Prices will continue to see solid growth in quarter one, with the typical home value projected to average $420,000,” said Nadia Evangelou, senior economist at the National Association of Realtors.

A Widening Divide

Economists say the knock-on effects of rising mortgage rates could cascade across multiple aspects of the economy, worsening inequality and exacerbating homelessness. Housing is a fundamental need, and when the cost of owning a home becomes unaffordable for so many people, it creates a deep divide between the haves and have-nots. Lower-income families, already struggling to make ends meet, may be pushed further toward poverty as they bear the brunt of rising rental costs.

With fewer affordable options, especially in urban centers with strong job markets, many low-income families may be forced to move farther away from their jobs, making commutes longer and more expensive. What was once considered a path to upward mobility–homeownership–is now out of reach for many, creating a permanent underclass of renters with little hope of ever owning a home. Without affordable options, the housing market risks deterring not just homebuyers but also the economic activity that flows from a healthy housing ecosystem.

Help Protect Your Finances as Home Costs Climb

In the wake of these challenges, the American ideal of homeownership has faced a reckoning. Over half of the 2,047 American renters surveyed in a recent Harris Poll agreed with the statement that “The American Dream of owning a home is dead.” Elevated mortgage rates and climbing home prices have made the already daunting prospect of purchasing a home seem almost impossible for many lower-income households.

To hedge against the risk of unaffordable homeownership, some experts recommend using alternate strategies to build equity. The opportunity cost of homeownership, they argue, can be offset by diversifying with assets that offer the potential for greater returns. If renting is the only financially feasible option, time-tested assets, like precious metals, can provide a means for accruing wealth over time while providing insulation from potential shocks to the economy.

Gold, for example, grew by 28.7% in 2024—far outpacing the 4% increase in housing prices during the same period. With gold prices already having a record year last year, analysts expect its upward trajectory to continue. JPMorgan forecasts gold prices reaching $3,000 per ounce by 2025, while Goldman Sachs has echoed this sentiment, stating, “We push back on the common argument that gold cannot rally to $3,000/oz by end-2025 in a world where the dollar stays stronger for longer.”