By Preserve Gold Research

For all the political drama they create, federal government shutdowns have historically been more bark than bite. Stock traders often dismiss shutdown talk as yet another Washington standoff, while economists shrug off short funding gaps as temporary nuisances. This time, though, could be different. With the government shutdown in full swing, the sharper risk now sits in plain sight. Investors, policymakers, and everyday Americans may soon find themselves flying blind, deprived of the information they rely on to navigate an already fragile economy. Decisions could slow. Volatility could climb. Confidence might slip. Should the shutdown carry on, it could leave even deeper scars in its wake. Americans are left with a hard question hanging in the air: what happens when the nation’s economic dashboard goes dark while everyone is still on the road?

Why Markets Often Shrug Off Short Shutdowns

Markets have often met shutdowns with a shrug, given their relatively short durations. Since the mid-1990s, these funding showdowns have recurred periodically, usually ending before they inflict lasting damage. Markets and growth tend to take shutdowns in stride, especially when the disruptions are brief. As Doug Beath, global equity strategist at Wells Fargo, noted in a recent note, “History suggests that a government shutdown will have limited economic and financial market impact.”

There are good reasons for this historical calm. Many shutdown effects are quickly reversed once federal workers return and delayed spending resumes. Furloughed employees typically receive back pay, allowing their personal spending to rebound. “Historically, not-super-wide shutdowns that don’t last very long kind of do nothing to the aggregate economy,” explained Austan Goolsbee, President of the Federal Reserve Bank of Chicago. Households don’t sharply cut spending if they expect lost wages to be repaid soon. Business contracts with the government often just get pushed out a few weeks. For most families and firms, a short lapse feels like a delay rather than a hit that lasts.

Financial markets have largely treated past shutdowns the same way. Stocks may wobble around headlines, but the record doesn’t show a clear or lasting pattern that ties directly to shutdowns. Interest rates and the dollar have historically shown mixed reactions, with 10-year Treasury yields often dipping slightly and the U.S. dollar sometimes softening during funding lapses.

Of course, scale and duration matter. A shutdown affecting only a sliver of agencies for a few days barely registers, whereas a longer, wider-ranging stoppage can pinch more parts of the economy. The longest on record, a 35-day partial closure from 2018 to 2019, shaved approximately $3 billion off U.S. GDP, according to congressional estimates – a hit that was quickly recovered from once the government reopened. Analysts at Goldman Sachs estimate that each week of shutdown trims quarterly economic growth by roughly 0.15 percentage points, with the lost activity made up in the following quarter if the government promptly reopens.

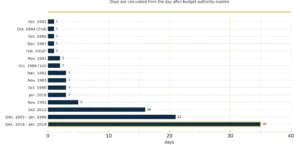

Length of Funding Gaps Since 1981

Past shutdowns were usually brief, but more recently scope and duration have widened, threatening key data releases and policy visibility. Source: US House of Representatives

This history invites a comfortable conclusion. If shutdowns end quickly, the damage looks limited. It’s a view reinforced by decades of data and experience. However, that very history of shrugging off shutdowns could breed complacency. The fall of 2025 has brought a convergence of conditions that don’t align with the old playbook. The past still matters, but it might not be enough, according to some experts.

Key Economic Data at Risk

One glaring difference in the current shutdown standoff is the very real threat of a freeze in the flow of economic data. In a modern economy, data is like the dashboard of a car. It shows speed, fuel level, engine temperature, and warning lights. If the government shuts down, many of those gauges will go dark, leaving drivers (investors, businesses, policymakers) unsure of what’s happening under the hood of the economy.

The Bureau of Labor Statistics has made it clear that it will “suspend all operations” during a shutdown and that reports scheduled during the lapse “will not be released,” with data collection also halted. That means some of the most closely watched indicators could be delayed or missing entirely for the duration of the shutdown. The September monthly jobs report, a bellwether of labor market health, would be the first major indicator not to be released as scheduled on October 3rd. “Any delay in releasing essential economic data, such as the monthly jobs report, directly impacts the decision-making abilities of consumers, investors, business leaders, and policymakers alike,” said Mark Hamrick of Bankrate. Given the “high degree of uncertainty” in today’s economy, the absence of these data is “especially ill-timed.”

This report isn’t just trivial news. It’s a critical snapshot of hiring, unemployment, and wage growth that guides everything from the Federal Reserve’s monetary policy to the forecasting models used by financial analysts. With recent figures already pointing to employment strain, any delay in the jobs report could send markets into a tailspin if key assumptions are left untested.

And that’s just the beginning. Other data releases would quickly fall victim to a shutdown, especially if it were to drag on. Key inflation metrics, like the Consumer Price Index (CPI), due mid-October, could be delayed. Important figures on construction spending, factory orders, and international trade, all scheduled for early October, would also be put on hold. Even the Bureau of Economic Analysis might be unable to produce its initial estimate of third-quarter GDP on time if the impasse persists into late October. What is usually a steady torrent of information could shrink to a trickle.

Analysts have warned about this scenario for years. “A shutdown…could deprive policymakers, business leaders and investors of critical data they need to assess the state of the U.S. economy,” noted one Bloomberg analysis. Without official reports, investors may turn to private proxies for information. Payroll processor surveys, card spending trackers, and satellite-based measures may help, but they don’t fully replace the breadth and rigor of government data. As Wells Fargo’s Doug Beath noted, private-sector job and inflation gauges “may not be conclusive” without the authoritative releases that anchor them.

This data void doesn’t just concern Wall Street elites or economists. Average Americans are affected as well. Retirees watch for their yearly cost-of-living adjustment (COLA) in the fall, once inflation data is released. If the September inflation report (CPI) is delayed due to a shutdown, the Social Security Administration may need to postpone announcing the COLA increase that seniors rely on to plan their budgets. That creates anxiety for millions of households awaiting news about their benefits. Similarly, businesses, both big and small, plan their inventory, hiring, and investments around economic trends. With official data delayed, planning becomes harder, and caution can spread.

All of this sets up a very different dynamic from past shutdowns. Historically, a short funding lapse didn’t meaningfully disrupt data flow or, by extension, the information artery of the economy. This time, the data freeze itself is a primary concern. It’s as if, in addition to parks closing and paychecks pausing, the nation’s economic x-ray machine is turned off. The potential consequences go beyond inconvenience. They strike at our ability to understand and respond to economic changes in real time. The economy may keep moving, but more of us could be steering by feel should the government remain shut down for an extended period.

Markets Brace For A Data Blackout As Shutdown Anxiety Builds

Financial markets hate uncertainty above all else, and a data vacuum creates plenty of it. If key economic reports suddenly vanish, investors will be left second-guessing the true state of the economy, potentially overreacting to rumors or less reliable signals. It’s no surprise, then, that Wall Street is increasingly on edge as a shutdown nears, not just because of the political melodrama, but because of what they won’t know if Washington’s lights go out.

“A shutdown is an expected event…like the slow car crash that we’re all watching happen,” said Callie Cox, a market strategist at Ritholtz Wealth Management. Many are already positioning defensively, hedging against the unknown. Cox notes that investors are considering various ways to brace themselves by holding more cash, buying volatility protection, or shifting into assets that might weather a storm. Nobody wants to be caught off-guard if suddenly the usual guideposts (like the jobs report or inflation rate) aren’t there to inform trading decisions.

Volatility could spike in the absence of data. Gennadiy Goldberg of TD Securities warned that a longer lapse could trigger “a cascade effect where data just gets pushed back and pushed back,” a problem given how heavily the Federal Reserve leans on real-time indicators. In practical terms, if October 3rd comes and goes without a new employment report, traders who had bets tied to those numbers may need to unwind their positions. Analysts note that a missed employment report could force repositioning in Treasuries and rate derivatives, with price action turning choppy as positions are closed or recut. Data usually anchors expectations, even when the numbers disappoint. In a blackout, imagination can fill the gap.

With fewer hard facts, markets might latch onto any scraps of insight, or even rumors. Analysts suggest that in a data blackout, more attention will turn to things like companies’ earnings reports, private surveys, and statements from Federal Reserve officials as surrogate indicators of economic health. But those aren’t perfect substitutes. Private payroll firms may release their own employment estimates, but investors recall instances when those diverged from the official figures. Whipsaws often follow when conviction rests on provisional signals alone.

The prospect of a key data freeze has put markets on notice in a way past shutdowns seldom did. Traders can live with Washington squabbling, but they have a harder time living without the steady drumbeat of numbers that usually guide their moves. As the impact of the shutdown stretches, Wall Street’s typical calm could give way to a storm of volatility sparked not by what investors learn, but by what they don’t.

The Federal Reserve Could Be Flying Blindfolded

Few institutions are more wary of the looming data stoppage than the Federal Reserve. Its job is to steer the economy with rates and balance sheet tools, and it builds those decisions from hard evidence on inflation, jobs, spending, and credit. And in late 2025, the stakes couldn’t be higher. After a turbulent period of inflation and an economic cooldown, the Fed has been considering shifting its policy stance. Markets have been widely anticipating a quarter-point interest rate cut at the Fed’s upcoming Oct. 28-29 meeting, on the heels of an earlier rate cut in September. But what happens if, by meeting time, the data that would usually justify (or argue against) that move isn’t available?

Fed officials pride themselves on being “data-dependent.” It’s a mantra that’s often been repeated by Fed Chair Jerome Powell and his colleagues as a sign of discipline. But a government shutdown throws a wrench into this strategy. If a prolonged funding lapse delays the September jobs report, the CPI inflation reading, and possibly other stats, the Fed will head into its late-October policy meeting with a hazier view of the economy’s momentum than usual. As Callie Cox put it, “Fewer pieces of data can cloud the Fed’s view,” making it harder to gauge whether price pressures are easing or the labor market is softening in line with their goals.

“If no data comes out, they won’t really have any information to deviate in either direction from that baseline,” observed David Seif, chief economist for developed markets at Nomura. In his view, lacking fresh evidence, the Fed might be more likely to stick with its prior plans, in this case, a rate cut, simply because there’s nothing new to disprove the assumptions behind them. Paradoxically, a data freeze could lock the Fed onto a path (like cutting rates) even if the economy by then didn’t warrant it, or conversely, dissuade them from acting if they feel uneasy about the unknowns.

Federal Reserve officials themselves acknowledge the dilemma. They can parse real-time anecdotes and private surveys, but those are no match for comprehensive government reports. “The shutdown suspends government data publication at a time when the Federal Reserve is watching data carefully,” noted Wells Fargo’s Beath. The Fed has been trying to assess whether inflation is truly licked and if the job market’s cooling is for real – questions that government data answer best. Lacking that input, policymakers could become more cautious and delay big decisions, or they might rely more heavily on models and forecasts (which carry their own uncertainty).

There’s also a communication challenge. The Fed’s credibility partly rests on explaining its actions in light of evidence. How do you justify a policy move to the public when you don’t have fresh evidence to cite? It’s a scenario that could further unnerve markets. If Chair Powell were to say, “We decided to hold rates steady because frankly we’re in the dark on the latest data,” that’s hardly reassuring. On the other hand, acting boldly without data might seem risky or politically charged. It’s a lose-lose proposition for the central bank’s typically methodical approach.

In past shutdowns, the Fed usually stayed on the sidelines, and the brief nature of funding gaps meant the impact on monetary policy was negligible. But officials like Austan Goolsbee caution that it “depends how long this goes. It depends how wide it is. If there are reasons why this shutdown looks different than previous ones, then we would have to revise [our view],” he said in late September. A short, partial shutdown might barely register; a long, comprehensive one is another story.

When Washington Stalls, Main Street Pays

Markets and macro headlines grab attention, but a sustained shutdown could seep into the daily lives of millions of Americans. Initially, many of these effects tend to be subtle or localized, which is why short shutdowns leave only faint footprints on broad economic measures. But the longer Washington’s spending lapse continues, the more those small disruptions can accumulate into something larger and more concerning.

Past shutdowns were usually brief, but more recently scope and duration have widened, threatening key data releases and policy visibility. Source: US House of Representatives

One immediate consequence is the furlough of hundreds of thousands of federal workers without pay. In the short run, as Goolsbee noted, many workers will curtail spending only slightly (knowing they’ll get back pay later). Let the gap run for weeks, and households could postpone big purchases, cut discretionary outlays, or draw down savings. Lunch counters near federal buildings feel it first. Then, car dealers. Then the family that decides to skip a weekend trip. Consumer confidence could take a hit if people begin worrying that the political stalemate will hurt their wallets.

Small businesses waiting on federal loans or contracts may also be left in limbo. During previous shutdowns, the Small Business Administration was unable to approve new loans, and agencies were unable to sign off on contract awards. Each week that passes, more entrepreneurs may find themselves frustrated by their inability to move forward, perhaps forgoing expansions or new hires. Homebuyers may run into trouble, too. If IRS income verification is offline, mortgage approvals can slip, and closings may fall through.

Then there’s the case of the official unemployment rate. If furloughed workers are off the job through the survey reference period, they might be counted as unemployed (on temporary layoff) in Labor Department statistics. This could cause the jobless rate to tick up, not due to underlying economic weakness but simply the shutdown’s technical effect. Ironically, once the government reopens and workers return, the rate is likely to fall back. But such statistical noise could spook markets or feed misleading narratives about a weakening economy if not interpreted carefully.

The deeper damage often lies in a lack of confidence. Not just consumer confidence, but faith that our political system can competently manage basic functions. Each high-stakes showdown chips away at the assumption that policymakers will ultimately act responsibly. If investors or the public start to see these crises as chronic with no end in sight, it can erode trust. Credit rating agencies have already warned that repeated brinkmanship over the budget is a negative signal. In May 2025, Moody’s downgraded the U.S. government’s credit rating to Aa1, citing governance concerns as a major factor. A shutdown now, coming on the heels of a debt-ceiling scare not long ago, reinforces a narrative of dysfunction that might carry long-term costs for America’s financial reputation.

Hardline Politics Raise The Stakes As Compromise Slips Out Of Reach

Part of what makes the current shutdown threat different is the charged political backdrop against which it’s unfolding. The battle isn’t just the usual budget wrangle. It’s supercharged by deeper ideological rifts and unusual gambits that raise the stakes beyond a typical funding dispute. All this political brinkmanship amplifies the uncertainty and potential economic fallout.

In this scenario, 2025 features a President who is no stranger to disruption: Donald Trump, having returned to office, now presides over the standoff. Both his administration and opposition leaders in Congress are digging in on their demands. Each side insists the other blink first. This hardline posture has some veterans of Washington worried that a shutdown could last longer than usual because compromise is in short supply. Even Vice President JD Vance signaled low odds of a last-minute deal, saying the government looked headed for a shutdown. The message to markets and households is simple. Do not count on a tidy fix.

What truly sets nerves on edge are hints that some in power see upsides to a shutdown. Allies of the president have floated the idea that furloughs could become permanent, using the episode as an opportunity to shrink parts of the workforce. Trump himself has suggested that when workers are sent home as “non-essential,” it may prove that the government can function with fewer employees.

Reports emerged of a proposal to allow certain federal roles to remain unfilled after the shutdown, effectively turning temporary furloughs into permanent layoffs. Such talk is uncharted territory. In the past, no serious policymaker treated a shutdown as an opportunity to downsize by fiat. The mere suggestion has federal employees on edge and could undercut morale across agencies. It also heightens the partisan anger as opponents accuse the administration of holding workers hostage to force ideological changes, while supporters argue it’s a rare chance to cut waste. Either way, it injects a new volatility into the situation. If one side sees benefit in prolonging a shutdown to achieve structural cuts, the calculus for a quick resolution changes.

Meanwhile, the messaging war is in full swing. Both parties are straining to frame the narrative to their advantage. A Labor Department spokesperson (from the Trump administration) pointed the finger squarely at Democrats in Congress for any data disruptions, saying that concerns about delayed reports should be directed at lawmakers “refusing to pass a clean continuing resolution” to keep the government open. Democrats, for their part, argue that extreme demands attached to funding bills, whether related to immigration, social programs, or other hot-button issues, are effectively holding the economy hostage. This frenzy of mutual blame might usually be just political noise, but with markets jittery and critical data on hold, the war of words itself can shake confidence. It’s hard for Americans to stay calm when leaders are trading barbs on whose fault it is that vital services and information have gone dark.

We’re in a landscape where the usual playbook may not apply. In previous episodes, behind-the-scenes negotiations and public pressure typically resulted in a deal before too much damage was done. Now, the combination of a deeply polarized Congress, a president unafraid of breaking norms, and even factions within the majority willing to buck their leadership (as seen in recent spending bill showdowns) all make the outcome less predictable. Could this be a shutdown with no clear endgame? The worry is no longer just when the government reopens, but under what conditions. If a deal is only reached after financial markets react sharply or after a crucial economic milestone is missed, it might mean learning the hard way how much shutdowns really can matter.

If The Data Goes Dark, Be Ready

With the shutdown in full effect, the country has stepped into an unnerving experiment. Will this episode fade into the long list of brief disruptions, or will the mix of missing data and eroding trust leave lasting marks? No one can say. That uncertainty is the point, and it weighs on households, firms, and markets. What is clear is that the risks appear to be higher than in prior lapses. The combination of a data freeze, a sensitive economic juncture, and an unyielding political clash has created a potent mix of hazards.

Americans have weathered many episodes of political brinkmanship before. Markets have regained their footing time and again. While a quick compromise may avert the worst of it, counting on that outcome is a luxury. Preparation matters, which is why advisors are tilting the caution playbook toward gold and cash. Experts recommend keeping a cash buffer so you can act when clarity returns. Pair it with a measured gold allocation that can hedge against a more prolonged data outage or a policy misstep. Use cash for flexibility. Use gold for insurance. If the data goes dark, we will all be left to feel our way through the economic fog until light from Washington returns. And in that murk, those who prepared will have the most clarity.