By Preserve Gold Research

Gold often inspires passionate debate in the investment world. To some, it’s the ultimate safe haven and a timeless store of wealth to turn to when crises strike. To others, it’s a relic of the past. Amid these contrasting perceptions, a number of myths about gold investing have taken root. From claims that gold has “no yield” or only shines in crises, to assertions that it’s “too risky”, these misconceptions often deter would-be investors from considering gold as part of a well-diversified portfolio. Below, we debunk some of the most common myths about the yellow metal so that you can decide if it fits into your long-term strategy.

Myth 1: Gold Has No Yield (and Therefore No Real Returns)

It’s often said that gold “has no yield”, meaning it pays no interest or dividends. Skeptics argue that this lack of income makes gold a deadweight investment, contrasting it with “productive” assets. Despite his about-face in recent years, Warren Buffett once quipped that “gold is a way of going along on fear.” The notion is that because you can’t earn anything merely by holding gold, it has no value beyond what the next person will pay for it. However, the myth that no yield equals no returns misrepresents how investors profit from gold. While it’s true gold provides no coupon or dividend, investors can still earn returns through price appreciation. Gold’s value can and does increase over time, often enough to offer competitive long-term performance.

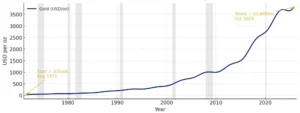

After the end of the gold standard in 1971 (when gold was freed to trade in the open market), the price of gold rose from about $35 per ounce to over $3,800 today, an annualized return of roughly 8.98%. This means that, despite zero yield, gold’s price has grown at a rate comparable to that of many other asset classes over the long term. Research shows that multi-decade returns, even without income, can compare with equities when measured across full cycles. In other words, capital gains can compensate for the lack of yield.

Gold Prices with US Recessions (1971 – Today)

Source: Macrotrends

It’s also worth noting that in certain environments, a “zero yield” asset can be quite attractive. If interest rates on cash or bonds are extremely low or negative in real terms, gold’s lack of yield is less of a disadvantage. There have been times when no yield is better than a negative one. Moreover, gold’s value doesn’t depend on a debtor’s promise (unlike interest-paying bonds); it’s a tangible asset whose price is determined by supply and demand in the market. Investors buy gold not for an interest paycheck, but as insurance and diversification, expecting that its price will hold or rise when other investments falter. That role can ultimately add to a portfolio’s total returns by offsetting losses elsewhere during turbulent times.

While skeptics may argue that gold adds nothing to growth, that critique misses the intent. Price appreciation and wealth preservation are the real “yield” of gold. As long-term data shows, gold has consistently delivered positive real returns, even without interest or dividends. The key is to view gold’s performance in totality rather than through the narrow lens of income generation.

Myth 2: Gold Is a “Crisis Asset” Only

Another common myth is that gold is only worth holding when the world is falling apart. Some say that it’s purely a “crisis asset” or doomsday hedge with no place in modern times. It’s true that gold earns its shine as a safe-haven when fear spikes. During economic downturns, financial panics, or geopolitical upheavals, gold tends to outperform. Investors historically flock to it in times of serious uncertainty: “People will tend to flock to it in periods of significant uncertainty…Gold tends to do best as insurance,” notes financial planner Robert Jeter II.

During market crashes or wartime, gold’s price typically holds steady or climbs while stocks plunge, which is why it’s called a “safe haven.” In the tumultuous 1970s, for example, stagflation and the oil crisis led to gold prices skyrocketing by more than 1800%. During the 2008 financial crisis, gold prices once again proved to be a reliable safe haven, increasing by over 25% while the stock market suffered double-digit losses. More recently, in 2020, during the COVID-19 pandemic, gold prices hit record highs as investors sought stability amidst economic uncertainty.

However, it’s a myth that gold has no value outside of crises or that one should only buy gold when collapse seems imminent. This misconception overlooks gold’s ongoing role in an “all seasons” portfolio. First, gold can provide diversification benefits in ordinary market conditions, not just during Armageddon. Because gold’s price movements tend to be uncorrelated and, at times, even negatively correlated with stocks and bonds, holding some gold can smooth out volatility year-round. It’s like an insurance policy. You don’t purchase homeowners’ insurance only when you smell smoke; you carry it because a fire could happen. Similarly, prudent individuals may want to hold some gold in reserve before the next policy mistake, liquidity crunch, or debt scare arises.

It’s also worth debunking the idea that gold only rises during crises. Currency trends often push it higher when the dollar weakens. Central banks could add to reserves. Real interest rates might fall as inflation stays sticky while growth cools. Demand from households and institutions may increase on its own. In the early 2000s, for example, gold prices surged over several years largely due to a weak dollar and emerging market demand, even as stock markets were fairly stable.

Recently, gold has rallied to record highs above $3,800/oz not because of a single crisis event, but due to a mix of factors (high inflation, geopolitical tensions, and investors preemptively hedging various risks). None required a full systemic collapse. They reflected a world where deficits are large, policy signals may conflict, and individuals want a store of value that can outlast regimes.

Many experts therefore suggest holding an allocation of gold as a form of insurance, beneficial in times of economic distress, and benign in times of economic prosperity. Famed hedge fund manager Ray Dalio argues that to shield against various systemic risks, a “well-diversified portfolio would have somewhere between 10% and 15% in the portfolio of gold,” even in normal times. Dalio’s views are echoed by many other investors and economists who point to a simple truth: gold’s value extends beyond immediate catastrophe scenarios. Its role as a stabilizer and diversifier means it can quietly add value even when skies are blue, and be there for you when storms arrive.

Myth 3: Gold Is Too Volatile or Risky

Critics often point to jagged price charts and say gold whips around too much to count as a safe choice. The short term can, at times, look jumpy. After reaching then-record highs in 2011, gold fell by roughly 30% over the next few years. Such moves prompt the claim that gold is “too risky,” especially for conservative investors. Superficially, gold’s price chart can appear more erratic than that of a steady bond.

But look closer, and the story shifts. Volatility depends on the lens through which you view it. While gold experiences short-term volatility, over longer periods its price variability has been in the same ballpark as, or even lower than, that of many asset classes, including equities. Gold’s day-to-day fluctuations tend to average out to a moderate level over time, similar to those of a stock index. From 1970 to 2020, the annualized volatility of gold clustered around 15-20%, which is comparable to that of major equity indices over the same span. Gold’s worst year in recent decades saw a decline of approximately 30 to 35%. Painful, yes, but still less severe than the S&P 500’s nearly 37% decline in 2008. This context matters as it dispels the notion that gold is some uniquely capricious gamble.

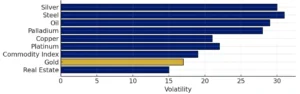

Gold Versus Other Real Assets 10-Year Volatility

Looking across the full decade from September 2009 to September 2019, gold exhibited lower 10-year volatility than most major real-asset categories. That steadier risk profile is one reason investors pair gold with higher-beta real assets to smooth portfolio swings over time Source: State Street Global Advisors

More importantly, labeling gold as “risky” overlooks its behavior in relation to other investments. Gold often moves differently than traditional assets, which is precisely why it can reduce overall portfolio risk. When stock markets tumble or other assets lose value, gold tends to maintain its value or rise. This negative correlation in turbulent times means adding gold to a portfolio can actually make the overall portfolio less volatile. A study of mixed portfolios found that even a modest allocation to gold significantly reduced drawdowns and volatility in a stock/bond mix, without sacrificing returns.

As the World Gold Council notes, gold is “a clear complement to stocks, bonds and a welcome addition to broad-based portfolios…providing robust performance in both rising and falling markets.” In plainer terms, gold can function as a stabilizer. It’s there when other parts of your portfolio are struggling. From a holistic perspective, that dampens risk rather than increasing it. The myth that gold is “too volatile” likely stems from a misunderstanding of how volatility works and from focusing on short-term moves in isolation. Individuals who recall gold’s sudden drops may dismiss it as dangerous, but they would be overlooking the flip side: gold’s sudden surges at times when other assets are plummeting. Volatility cuts both ways, and that counterweight effect is critical.

Used with care, gold is not markedly riskier than other investment vehicles. Most assets, particularly those that are highly leveraged like equities, will see sudden price swings from time to time. But whereas equities are subject to fundamental risks such as business performance, gold’s price movements are driven by market sentiment. And over the long haul, its volatility is reasonably well-contained. Experts say the key is not to speculate on gold with short-term, leveraged bets (which is risky), but to hold it as one component of a balanced portfolio.

Myth 4: Gold is Only for the Wealthy

The idea that gold belongs behind velvet ropes is stubborn—and plainly wrong. Yes, family offices may buy 400-ounce bars and rent private vaults. But everyday investors can build exposure in small, budget-friendly steps. You don’t need a seven-figure account. You need a plan, a clear time horizon, and a solid understanding of costs. So, why does the myth persist? For decades, gold has conjured images of bullion stacks, safety deposit boxes, and numismatic auctions. High per-unit prices reinforced that perception. A single 1-oz coin might cost more than a month’s rent, so many people assumed the asset class was out of reach. Traditional gold dealers also marketed larger pieces because spreads were better, which helped maintain the “wealthy only” aura.

But today’s gold market is very different from those of past decades. Those bullion stacks and safety-deposit boxes? They’re being replaced by electronic markets with vaults acting as intermediaries for investors who don’t want to take physical delivery of their holdings. Even fractional ownership is moving mainstream. Practical paths now span the spectrum. Brokerage accounts offer gold-backed ETFs and mutual funds that trade like any other stock and settle without requiring you to arrange storage.

Bullion has shrunk from ounces to grams, which makes dollar-cost averaging realistic for a household budget. Digital and vaulted accounts can hold fully allocated metal in insured facilities and allow redemptions when balances reach a chosen level. Retirement savers can use 401(k) menus or IRAs that include gold funds, while self-directed IRAs can hold approved coins and bars through custodians. None of these routes requires elite access. Wealthy investors no longer own the on-ramp.

Myth 5: Gold Only Appreciates When the Dollar Is Falling

Because gold is priced internationally in dollars, there’s a common belief that gold’s price seesaws in opposition to the dollar’s value, i.e., “gold goes up only when the USD goes down, and vice versa.” It is true that gold and the dollar often move in inverse relation. A weak dollar (meaning it buys fewer foreign goods or currencies) tends to correspond with higher gold prices in USD terms, and a strong dollar often puts downward pressure on gold. When the dollar declines, it typically takes more dollars to buy the same ounce of gold, and also investors seek hard assets like gold as an alternative to depreciating cash. However, the myth lies in the word “only.”

In reality, gold is influenced by a complex interplay of forces beyond the US dollar. While a weaker dollar can be a tailwind for gold, it’s not the sole determinant of its price. Factors such as economic uncertainty, geopolitical turmoil, interest rate changes, inflation expectations, and investor demand can all independently propel gold prices, regardless of the dollar’s trend. During periods of severe financial stress, it’s possible to see a flight to safety that boosts both the US dollar and gold simultaneously. The dollar can strengthen as people seek liquidity and US Treasury assets, and gold rises as a haven from market risk. Early 2020 provided a clear example as both assets attracted safety flows. This positive correlation, although unusual, demonstrates that both the dollar and gold can serve as safe havens in a crisis, debunking the notion that they must always move in opposite directions.

The opposite can happen, too. The dollar might weaken due to rate cuts, but if those same cuts improve economic growth prospects, investors might rotate out of gold and into riskier assets, blunting gold’s rise. Or if the dollar is declining very gradually, gold might not react much if there’s little fear in the market. The takeaway is that gold’s price dynamics can’t be reduced to a simple USD inverse tracker.

Analysts at State Street Global Advisors note that people often confuse this structural relationship (gold being dollar-denominated) with causation, erroneously believing that “gold will appreciate only when the USD declines.” The reality is that market drivers rarely align in a linear sequence, which is why single-variable rules often fail. For those considering gold, the implication is not to oversimplify your expectations. Betting on gold isn’t just a bet on a falling dollar, and holding gold can pay off even if the dollar is stable or rising, provided other conditions favor gold.

Setting the Record Straight on Gold

Strip away the myths, and a clearer picture comes into focus. Gold does not need a coupon to matter. It may earn its keep through appreciation, by protecting purchasing power, and by providing a steadier ride to a diversified portfolio when other assets stumble. It is not only for panics, not only for the wealthy, and not only for a falling dollar. It is a tool. Used with intent, it might strengthen the plan you rely on when conditions turn.

Consider the direction the US economy is taking. The national debt continues to rise as Washington grapples with budget deficits and standoffs. The Fed’s tone has softened even as inflation pressures grow. Trade and tariff policies have whipsawed market sentiment, with rollbacks and retaliations a recurring threat. And with no shortage of international conflict, geopolitical risks remain elevated. In this setting, fragile confidence can ripple through both stocks and bonds simultaneously. An allocation that does not depend on an issuer’s promise could serve as valuable insurance.

Gold may not solve every problem, and it may not rise in every season. However, it can help reduce drawdowns and preserve optionality when policy mistakes or liquidity shocks catch investors off guard. Whether you’re considering buying a few gold coins or just evaluating gold’s role in the economy, remember that the narratives around gold can be exaggerated. The metal’s true value lies in balance: it’s a tangible asset that carries no credit risk, can’t go bankrupt, and moves to its own rhythm apart from stocks and bonds. In a world of uncertainties, that can be quite powerful, just not in the simplistic one-dimensional ways the myths would have you believe.