By Preserve Gold Research

Wall Street might not say it aloud, but its posture has shifted recently. The confidence that lifted tech valuations and fueled crypto’s speculative rush has weakened, leaving cracks that could widen if liquidity tightens further. U.S. equities that pushed into record territory over the summer have surrendered a notable portion of those gains. Even the Nasdaq, often seen as a barometer of market resilience, has slipped more than 6% from its late October peak as of mid-November.

The crypto landscape has fared even worse. A sudden flare in U.S.-China trade tensions in early October sparked one of the sharpest single-day selloffs of the year. The S&P 500 dropped more than 2%, and Bitcoin plunged nearly 15% within hours. Over the course of a week, Bitcoin tumbled from a record $126,000 to $104,000, and by mid-October, sentiment had soured from mild caution to outright panic.

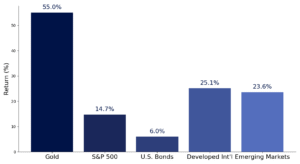

As these risk assets unraveled, gold reclaimed its role as a safe haven. Its price climbed to historic highs in October, briefly topping $4,380 per ounce, signaling that investors could be positioning for a far more volatile environment. For the first time in decades, gold has outperformed nearly every major asset class, rising more than 50% year to date. The divergence is becoming difficult to ignore. Stocks have slipped, crypto has buckled, and gold has accelerated to levels that suggest a deeper strain running through the financial system.

What might be driving this rotation is still debated, but several signals keep surfacing. Louise Street, senior market analyst at the World Gold Council, notes that “heightened geopolitical tensions, stubborn inflationary pressures and uncertainty around global trade policy have all fueled appetite for safe haven assets as investors look to build resilience in their portfolios.” Other analysts point instead to the froth around artificial intelligence and the sky-high valuations of tech firms that do not yet generate earnings.

Whatever the catalyst, something has shifted across the investment landscape. From billionaire hedge fund managers to major institutional allocators, a shared realization has taken hold. The easy-money optimism that colored the first stretch of 2025 has faded, replaced by a more cautious outlook for what lies ahead.

Market Froth Fades as Skepticism Returns

For much of 2025, U.S. equities seemed to defy gravity. Excitement over artificial intelligence, paired with surprisingly resilient corporate earnings, pushed the S&P 500 to more than 30% above its spring low, with mega-cap tech names leading the way. By August, market valuations were stretched by almost any historical measure. The S&P’s forward price-to-earnings ratio moved above 22 times, far above its 10-year average, and it did so in a market that already showed signs of thin liquidity. That kind of exuberance only makes sense if several major assumptions hold: a smooth path of Federal Reserve rate cuts, an economy that avoids any recessionary slip, and AI-driven profits that unfold exactly as projected. Any break in those assumptions could expose how fragile the rally may have been all along.

As the summer slipped into fall, those assumptions began to fray. The Federal Reserve has eased rates only modestly and continues to signal caution, noting that additional cuts are not a “foregone conclusion” and may depend on data that has grown harder to read. Meanwhile, the autumn government shutdown has clouded key indicators, leaving investors, in Jerome Powell’s words, “driving in the fog,” unsure of what the underlying economy truly looks like. More unsettling, several veterans of past market cycles have started to voice concern that valuations may have pushed far beyond what the fundamentals could support, a pattern that might invite a sharper correction if conditions shift.

In early November, the co-chief investment officers of Bridgewater Associates, the world’s largest hedge fund, issued a sober warning to clients. Investors, they argued, have been underpricing the risks that have supported the year’s AI-driven rally. “U.S. equities are priced as though the favorable conditions that lifted all companies will persist,” they wrote, noting that growth expectations have reached levels seen only in a few moments over the past century, aside from the 1999 dot-com bubble.

They highlighted a long list of threats that markets have brushed aside: persistent inflation, elevated interest rates, shifting trade policies, and the longest federal shutdown in history. Yet volatility measures have remained unusually subdued. Bridgewater cautioned that such calm carries “an uncomfortably high probability of unknowable and extreme outcomes.” In simpler terms, the number of things that could go wrong has widened, even as markets have refused to acknowledge it.

Others have echoed this unease. Michael McGowan, investment strategy director at Pathstone, noted that “the market certainly has some froth both in terms of valuations and expectations,” adding that “a healthy skepticism” is finally returning after months of unchecked enthusiasm. Tony Roth, chief investment officer at Wilmington Trust, argued that investors have become uneasy and “needy of reassurance” on two key issues: whether the Fed will cut rates and whether the AI boom might slow just as capital has rushed into it. With no firm answers on either front, many money managers are reducing exposure and stepping back from risk.

“I can’t think of a real reason to go in and buy aggressively until [we get more clarity],” admitted Peter Tuz, president of Chase Investment Counsel, as he sat on the sidelines waiting for a key round of tech earnings in November. Just months earlier, investors were piling into high-flying growth stocks with gusto. But by Q3’s end, some of Wall Street’s most seasoned veterans started taking profits and quietly rotating out.

SEC filings show that many top hedge funds have trimmed their positions in overvalued tech names, cutting exposure to AI favorites such as NVIDIA and Tesla, even as retail traders have continued to chase the rally. Scion Asset Management, the firm led by “Big Short” investor Michael Burry, even went so far as to close its doors entirely in November after Burry had warned again and again that an AI bubble had been forming.

This more defensive posture doesn’t necessarily mean the stock market is poised for a full-blown crash. Some analysts argue that the recent pullback looks more like a routine correction than a broad retreat. Marta Norton, chief investment strategist at Empower, noted that “such froth coming out of several assets is a sign of how sentiment had gotten very complacent… I don’t think it’s a bubble.” But even if stocks haven’t collapsed, the effortless momentum that defined earlier months has stalled. Volatility is nudging higher, and market leadership has narrowed to a handful of mega-cap tech firms while smaller names continue to struggle. These are late-cycle conditions, and they tend to make experienced investors more cautious.

“It’s a really good time to gut-check your exposure and get comfortable with the potential for a pullback more meaningful than one day or a week,” said wealth advisor Jim Carroll. That mindset marks a clear departure from the FOMO-driven optimism that dominated much of early 2025. Portfolios have tilted toward higher quality names and defensive sectors, while exposure to the frothiest speculative trades has been reduced.

Crypto Markets Crater as Leverage Turns Market Dip Into a Market Meltdown

If equities merely wobbled in Q3, the cryptocurrency market outright cratered. The most jarring shock came in October, when an unexpected trade-war flare-up sparked chaos across risk assets. In an echo of 2018’s tariff scares, news of a steep U.S. tariff plan on Chinese imports hit trading desks on October 10th, and the reaction turned violent almost immediately. Within minutes, traders scrambled to get out of the way as risk-on assets began a sharp, brutal descent. The high-flying Nasdaq plunged 3.6% in hours, and Bitcoin plunged nearly 8% in sympathy.

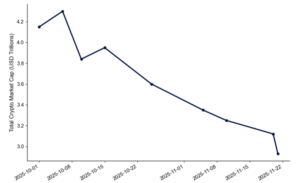

Crypto Total Market Capitalization Crash

October 2025 marked the steepest single-week decline in total crypto market cap as panic selling swept across the sector. Source: Coin Gekko

Other cryptocurrencies fared even worse. By the next day, over $19 billion in leveraged crypto positions had been liquidated, marking the largest 24-hour crypto wipeout ever recorded. “Last Friday, you saw volatility just jump across the board… more people are worried about downward turns,” observed Sean Dawson, head of research at a crypto trading firm, as he watched traders scramble for cover. Options activity showed a surge of put buying, a clear sign that sophisticated investors were hedging against additional downside. By mid-October, Bitcoin had slipped to $105,000 and Ethereum had fallen below $3,500, erasing months of gains in a few days. And by mid-November, Bitcoin had fallen further, dropping below $90,000, while Ethereum had fallen below $3,000.

What caused such a spectacle? Part of the answer lies in macro fear. Concerns that a renewed trade war could drag on global growth shook traders across every corner of the risk complex. But crypto’s collapse also exposed its internal vulnerabilities. Years of speculative excess and expanding leverage have left the system dangerously stretched, and the tariff shock was simply the catalyst. As margin calls rippled through the market, many of the most leveraged traders were forced out.

Institutional investors, who had only tiptoed into digital assets over the past few years, largely avoided the altcoin mania and kept their exposure centered on Bitcoin, and even there, their positioning stayed restrained. When crypto markets started to roll over earlier in 2025, including a sharp February slip, many hedge funds quietly trimmed their allocations. Those who chose to stay did so with layers of protection, often through hedged structures.

By the time the October selloff hit, the options tape showed seasoned traders moving heavily into protective puts, a clear signal that they suspected deeper trouble was on the way. Their behavior suggests they weren’t blindsided; they sensed the excess that had built up and acted to shield themselves. Retail traders, along with late-arriving speculators, absorbed most of the damage, repeating a pattern that has played out in markets for generations.

A Relentless Rally Pushes Gold to Uncharted Highs

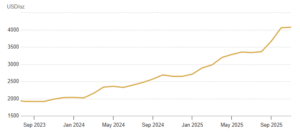

In contrast, one asset’s rise in 2025 appears almost fated. Gold has reclaimed its place as the market’s preferred refuge, and if there were ever a year for it to reaffirm that role, this has been it. By Q3, the metal had established itself once again as the closest thing to portfolio insurance investors might find. The figures speak for themselves. Prices advanced throughout the first nine months of the year, breaching historic levels at an unusual pace. Gold crossed $3,000, then $3,500, and by early October pushed past $4,000 per ounce. It began the year near $2,850 and reached almost $4,380 by late October, a gain of roughly 55% in less than ten months.

Gold’s Historic 2025 Surge

Gold prices have surged to record highs in 2025, breaking above $4,000/oz as investors worldwide rotate out of risk assets and seek shelter from rising geopolitical shocks, sticky inflation, and late-cycle economic uncertainty. Source: World Gold Council

Not since the late 1970s, another period marked by inflation and global instability, has gold behaved with such force. For the first time in memory, gold has become the strongest performing major asset class, outpacing stocks, bonds, and commodities. The metal that many had dismissed as outdated once again showed why seasoned investors continue to keep it in their playbooks.

The motivations behind gold’s ascent are unsurprising. By midyear, investors were staring at a convergence of problems that would unsettle even the most seasoned portfolio managers. Inflation was still running above comfortable levels in many countries, even as growth showed signs of slowing—a whiff of stagflation that spooked both bondholders and stockholders. Central banks had tightened aggressively through 2023 and 2024, and while they eased somewhat in 2025, policy remained restrictive.

At the same time, government deficits swelled, raising long-term fiscal questions that could shadow markets for years. Geopolitical tensions simmered on every front. The Russia-Ukraine conflict showed no clear path to resolution. U.S.–China relations remained on edge, as the tariff episode made painfully clear. New flare-ups in the Middle East added another layer of uncertainty.

Gold, being no one’s liability, looks especially attractive when trust in governments or currencies wavers. That pattern returned in 2025 as the U.S. dollar came under pressure. By October, the dollar softened as markets anticipated further rate cuts and as countries continued to diversify their foreign exchange reserves. Central banks across emerging markets accelerated gold purchases, buying more between 2022 and 2025 than at any point since the 1970s. Many of those institutions openly signaled a desire to reduce their dependence on the dollar, giving gold an additional lift.

The scale of gold inflows in 2025 is striking evidence of this shift. Investors poured money into gold exchange-traded funds (ETFs) at a record pace. In October alone, global physically backed ETFs drew $8.2bn, marking the fifth consecutive month of inflows and lifting total gold ETF assets under management to $503bn.

Even with the brief price pullback late in the month, the appetite for gold remained unmistakable. Trading volumes exploded to an average of $561bn per day, underscoring the market’s intense focus on the metal. October also marked gold’s fiftieth all-time high of the year, with spot prices holding above $4,000 per ounce for the first sustained period on record. As one headline quipped, this is “Gold Rush 2.0,” except the prospectors aren’t in remote hills but in high-rise offices from Manhattan to Shanghai.

It’s not just fear driving the shift; it’s also strategy. Many veteran investors have long argued that a small allocation to gold can be a hedge against precisely the kind of tail risks that seemed plausible in 2025. A sharp correction, a sudden inflation flare-up, or a currency disruption all create the kind of shock gold tends to absorb. By Q3, more of them acted on that conviction. “The outlook for gold remains optimistic, as continued U.S. dollar weakness, lower interest-rate expectations, and the threat of stagflation could further propel investment demand,” said the WGC’s Louise Street, reinforcing the case that gold’s run might have further to go.

Even high-profile investors have joined the conversation. Bridgewater Associates founder Ray Dalio stressed gold’s reliability at a fall investment forum, calling it “certainly” a more dependable safe haven than the dollar. In a world burdened by high debt loads and persistent money creation, he argued, fiat currencies carry debasement risk while gold does not.

New York Times best-selling author and investor Robert Kiyosaki has voiced similar concerns with far greater urgency. Warning that a major crash could be forming, he said he’s buying rather than selling and revealed long-term targets of $27k for gold by 2026. Kiyosaki pointed to what he calls “fake money” policies from the Treasury and the Federal Reserve and invoked Gresham’s Law, arguing that real money goes into hiding when confidence in the currency weakens. His message may sound extreme, but it reflects a broader anxiety that has gained traction as investors reassess how fragile the current backdrop might be.

Meanwhile, the retreat from risk assets has become self-reinforcing. Money pulled from equities or crypto needs a destination. And much of it has gone into money-market funds, Treasury securities, or gold. U.S. Treasury yields, which had touched multi-year highs earlier in 2025, eased by Q3 as demand for government paper improved. Short-term T-bills saw heavy buying, with more than $5 trillion parked in money-market funds by midyear. But even Treasurys carried uncertainty, since persistent inflation undermined real returns. Gold benefited from what many analysts called a “portfolio effect.” It hedged multiple risks at once: inflation, volatility, geopolitical tensions, and currency stability concerns.

Gold Leads as Global Markets Reprice Risk in 2025

Gold’s surge and equities’ mixed performance reflect a broader shift in risk appetite during the volatile 2025 macro environment. Source: Market Data, 2025

None of this means equities or crypto are permanently out of favor, or that gold will continue rising in a straight line. Markets are cyclical. If inflation fades convincingly and growth holds up, if central banks engineer a softer landing, risk appetite could rebound. But as Robert Pavlik, a senior portfolio manager at Dakota Wealth, put it, “a lot of people are worried that the data is going to indicate a more protracted slowdown” ahead. That worry is leading prudent investors to de-risk now rather than later. They know that if a serious downturn or financial accident hits, it’s the early movers who preserve capital. The smart money is not timing the market so much as insuring their portfolios against worst-case scenarios. Gold insurance. Put options. Cash buffers. These are the order of the day.

Preparation Beats Prediction as the Cycle Matures

What does this shift out of risk assets portend? On one level, it reflects logical risk management given the late-cycle economic conditions. So far this year, the economy has offered conflicting signals. Unemployment stayed relatively low, but job growth softened. Corporate profits looked strong, but rising labor costs threatened to compress margins. Consumer spending held firm, but much of it appeared to rely on expanding credit. A few outspoken analysts even began invoking the word “recession” in their 2026 projections. Against that backdrop, trimming exposure seems prudent.

The fact that veteran investors are shifting out of risk assets together shouldn’t be ignored. Their collective rotation serves as a warning for anyone willing to listen. It’s not a call to abandon all risk, since excessive caution can be damaging in its own way, but it’s a reminder that bull markets don’t persist forever. Trees don’t grow to the sky. Markets rarely announce their peaks with clear signals. But if you listen carefully, they sometimes whisper. In 2025, those whispers have taken the form of subtle, deliberate withdrawals by some of the world’s most sophisticated market participants.

One thing remains clear: confidence in financial markets is finite. Once lost, it takes time to rebuild, and late 2025 has seen that confidence take a hit. You can see it in the hard numbers (surging volatility indices, weaker IPO activity, widening credit spreads), and you can hear it from market veterans. These investors have lived through this movie before. In late 1999. Again in late 2007. And smaller speculative bubbles in the years between. They understand the advantage of stepping away before the room grows too crowded. Their exits tend to be quiet, almost invisible at first, and only in hindsight do most recognize what those early moves signaled.

Viewed through that lens, the story of 2025 circles back to one theme: prudence. Stocks slipping from stretched highs reflect prudence among buyers who may no longer trust the narrative. The crypto washout, brutal as it was, revealed a form of prudence imposed on a part of the market that had pushed leverage too far. Gold’s surge speaks to a broader prudence shared across institutions—a collective choice to prepare for conditions that may turn quickly. As legendary investor Howard Marks likes to remind, “you can’t predict, but you can prepare.” The smart money is preparing. The question is whether the rest of us are paying attention.