By Preserve Gold Research

Unrealistic optimism often comes at a cost. And in the context of overly optimistic assessments of the economy, the cost could be more than most Americans are willing to bear. Soft landing optimism has surged in recent months amid rosy headlines and upbeat assessments from the Federal Reserve. But we’ve seen this before and while history may not repeat itself, it often provides us with valuable clues as to what could be in store.

The Fed is attempting to pull off what it has only achieved once in its history – a soft landing of the economy following a period of rapid monetary tightening. In 2006, the last time the Fed funds rate was raised above 5% – which is where the Fed finds itself today – it failed and the economy sunk into a recession that lasted nearly two years. Before that, in 1999, the Fed raised the fed funds rate to 6.5% in an effort to cool the economy. Instead, it tipped it into a recession, wiping out 75% of the tech-heavy Nasdaq’s value and sending the markets into a tailspin.

In each case, news headlines were filled with optimism of a soft landing from the Fed, analysts, and economists alike.

“Economists Predict ‘Soft Landing’ As Growth Slows to 3% in 1999,” one Wall Street Journal headline read.

“Fed chairman projects ‘soft landing’ for U.S. economy,” a New York Times headline proclaimed shortly before the ‘08 crash.

The benefit of hindsight shows that, in most cases, economic optimism is often misguided. Now, two decades later, we find ourselves in a similar situation. The Fed is once again projecting a soft landing with many economists echoing their forecasts. But, as history has taught us time and time again, soft landing optimism is often met with the harsh reality of a recession. Even using the most broad definition of a soft landing, six of the last eleven Fed tightening cycles ended in a hard landing, according to a report by former Fed Vice Chair Alan Blinder.

With the Fed hiking rates to levels not seen in over 20 years, the cracks in the economy are beginning to show underneath the façade of soft landing optimism. The confluence of accelerating wage growth and rising debt levels amid the prospect of future rate hikes all point to a more nuanced outlook than headlines would have one believe. Given the Fed’s track record of success with past soft landing attempts, some experts have warned that a soft landing may not be in the cards this time around.

The Threat of Wage-Price Spiral

Despite assurances that the economy is settling into a soft landing, other less noticeable but more worrying signs paint an increasingly nuanced picture.

Take July’s employment situation report for example. The Bureau of Labor Statistics’ survey showed the economy added 187,000 jobs last month compared to a six-month trailing average of more than 270,000. With unemployment inching closer to a half-century low of 3.5%, it might seem like a good month for the Fed. After all, an economy with low unemployment and moderating job growth is what the central bank is hoping for as it looks to temper inflation.

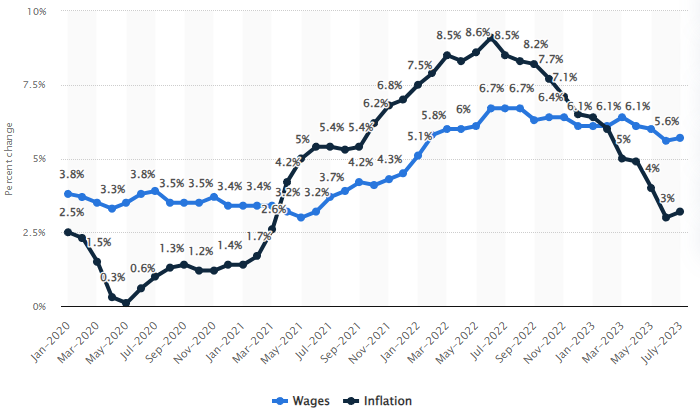

But the devil is in the details and, like most things, the situation is more than meets the eye. Beneath the glossy headline figures, average hourly wages increased by .40% in July while inflation moderated, inching up by only .20% month-over-month. A welcome development for workers, but one that points to an economy that could begin heating up again in the near future. As wages increase, businesses often pass on the extra costs to consumers in the form of higher prices. And with consumer spending closely tied to how much money people have in their pocket, wage growth could be a precursor to a renewed round of inflationary pressures.

Source: Statista

The Janus-faced effect of wage inflation has long been a source of debate for economists with some contending that rising wages are indicative of a healthy labor market. Others, like former Treasury Secretary Lawrence Summers point to the threat of a wage-price spiral, when rising wages spurs inflation as businesses pass on the extra costs to consumers.

In response to July’s numbers, Summers warned, “I don’t think we can yet be confident that we’re not going to see a real acceleration of inflation at some point down the road…If you look at wage inflation, it was faster for the month than for the quarter, faster for the quarter than for the year.”

Echoing Summers’ concern, Fed Chairman Jerome Powell stated during a press conference in July that the central bank was keeping a close eye on wage growth. “We want wages to be going up at a level that’s consistent with, with 2 percent inflation over time,” Powell said. But with wage growth outpacing inflation since the start of the year, Powell’s comments hint at a central bank that is beginning to look beyond the headlines of soft landing optimism and directly into the cracks of a slowly unfolding reality.

While the Fed might be pulling out all the stops in its current attempt to soft-land the economy, it may not have enough room to maneuver if wage growth accelerates, according to Summers and other experts. Should wages continue to move higher, the Fed’s margin for error will narrow and the central bank may soon be faced with yet another failed attempt at a soft landing.

When Tomorrow’s Problem Becomes Today’s Headache

Although history would suggest the Fed is unlikely to pull off a successful soft landing, as the saying goes, past performance does not guarantee future results. If the Fed is successful, policy makers will still have to contend with an equally vexing problem–the massive debt overhang weighing on the economy.

According to the Federal Reserve Bank of New York’s quarterly report on household debt, total credit card indebtedness rose to $1.03 trillion in the second quarter of 2023, an increase of over 4% from a year earlier and the highest level in the NY Fed’s survey’s history. At the same time, credit card delinquency rates have surged to 7.2%, surpassing pre-COVID levels as the cost of borrowing continues to rise alongside interest rates.

American households now carry more debt than ever before and, as the Fed continues to hike rates in its effort to cool off the economy, the squeeze on spending will only get tighter. For households already stretched to their financial limit, the prospect of higher interest rates could be a breaking point and could lead to a sharp spike in delinquencies, foreclosures, and bankruptcies–all of which could be the catalyst for a much-feared recession.

But it’s not the consumer debt that experts are particularly worried about–at least not yet. US national debt levels now exceed $32 trillion, the highest level in U.S. history and a number that could put the country’s long-term economic prospects in jeopardy. For perspective, it took over 190 years for the United States to reach a collective debt of $1 trillion in 1982. Yet, policy makers were able to do the same in the less than two months following the debt deal thanks to growing outlays and a higher interest burden.

More concerning, following the aftermath of the debt-ceiling debacle, Fitch Ratings downgraded US debt from AAA to AA+ citing “a steady deterioration in standards of governance” and “eroded confidence in fiscal management.” The downgrade comes as a reminder that the consequences of runaway debt not only threaten today’s economic outlook but can also have long-term implications for future generations.

With interest payments already consuming a large portion of the federal budget, the prospect of higher rates threatens to pull much-needed resources away from important programs and investments while piling extra debt onto an already fragile balance sheet. As annual interest costs continue to rise and debt levels reach new heights, the federal government may soon be forced to confront a stark reality: either slash spending or increase taxes – two scenarios that could come as the death knell for an already fragile economy…

The Prospect of Future Rate Hikes

Fed Chairman Powell reminded Americans of the present-day reality during his August speech in Jackson Hole, Wyoming. “Although inflation has moved down from its peak — a welcome development—it remains too high,” Powell said.

“We are prepared to raise rates further if appropriate, and intend to hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective,” he added.

With the federal funds rate now clocking in at 5.25-5.50% — the highest level since 2006 — experts have warned of the threat of a looming recession if the Fed continues to raise rates. Economists Ander Perez-Orive and Yannick Timmer who sit on the Board of Governors of the Federal Reserve System cautioned that “the recent policy tightening is likely to have effects on investment, employment, and aggregate activity that are stronger than in most tightening episodes since the late 1970s.”

Widely seen as one of the most tumultuous economic periods in recent US history, the late 1970s witnessed double-digit inflation and weak economic growth as stagflation spread across the country. With the prospect of a similar fate looming on the horizon, some fear that short-term soft landing optimism could quickly turn into a nightmare should the Fed continue to press ahead with its current rate-hike policy.

The Fed duo further warned, “The effects in our analysis peak around 1 or 2 years after the shock, suggesting that these effects might be most noticeable in 2023 and 2024.” The Fed began its move to tighten policy in March 2022, raising rates 10 more times since then. With the effects of earlier rate hikes already beginning to show, future rate hikes could be the tipping point for a long-dreaded recession, according to Fitch Ratings.

While the banking crisis that witnessed the collapse of two major US banks in March is thought to be behind us, the contagion that followed in its wake continues to reverberate throughout the US economy today. And with the prospect of higher interest rates combined with the effects of lags in the transmission of monetary policy, the coming months could be a test for the Fed’s soft landing optimism — and a make-or-break moment for the US economy.

Time to Take Stock and Prepare for the Future

Optimism aside, history tells us that soft landings are rarely successful and, while the Fed may be closer to its goal of bringing inflation to a manageable level, the threat of a recession remains ever-present. For the Fed to orchestrate a soft landing, it will take more than just a few months of moderating inflation and job growth, according to economists.

The Fed is in a precarious position now, as it looks to balance the risk of further ratcheting up interest rates with the risk of letting the flames of inflation reignite. But if wages continue to rise and consumer reliance on borrowing continues to grow, the choice could be made for them. And that choice could leave Americans without a path to soft landing according to some economists. Now more than ever, American households must take stock of their finances and prepare for both the best- and worst-case scenarios as interest rates rise and the future of the US economy hangs in the balance. With uncertainty prevailing at home and abroad, many investors have turned to gold to hedge against the coming month’s volatility, which may be a wise decision given its long history of preserving wealth during tumultuous times, say some experts. Only time will tell if confidence in the Fed’s soft landing optimism is warranted, but for now, it might not hurt to be prepared.