By Preserve Gold Research

The American dream of homeownership is slipping away. Rising home prices and a shortage of available homes have made a quintessential piece of the American dream unattainable for many.

Compared to three years ago, typical monthly mortgage payments have doubled, leaving nearly one in four households worryingly stretched thin. Home buyers can now expect to spend about a third of their income on mortgage payments, up from 24% in 2021.

Of course, putting more down upfront could help, but that’s easier said than done. According to an analysis by Zillow, prospective homebuyers would need to come up with about 35% of the total purchase price as a down payment to keep their mortgage payments below 30% of their income.

This is well above the traditional 20% down payment that was once considered standard, and many Americans simply don’t have that kind of cash on hand. With the national median home price in the US hovering around $438,000, that’s about $153,300 needed for a down payment.

Meanwhile, some 40% of U.S. households would have trouble covering an unexpected $400 expense, according to a report from the Federal Reserve. Even with low down payment options, home ownership has become little more than a pipe dream for many Americans who are already struggling to make ends meet.

Those that do manage to purchase a home are often saddled with high mortgage payments and the stress of living paycheck to paycheck. But it’s not just homeowners who are feeling the effects of rising home prices.

Renters are also struggling to keep up as rental prices continue to climb, with the national median rent sitting at $2,150 per month.

The unrelenting rise in housing costs has forced many Americans to make difficult decisions about where to live and how much they can afford. Some have been pushed out of their communities completely, while others have been forced to take on additional jobs to keep a roof over their heads.

Living in overcrowded conditions or in substandard housing has become a harsh reality for many low-income families, who simply can’t keep up with the rising costs of housing in their area.

In light of this growing issue, it’s not surprising that affordable housing has become a major topic of concern in recent years.

The Fed and the Housing Market

While the media often portrays the root cause of the affordable housing crisis as a shortage of available homes, the reality is more nuanced. The Fed’s policies can have a direct impact on the housing market, and ultimately, on the affordability of housing for Americans.

Tasked with maintaining a stable economy, the Federal Reserve sets monetary policies that affects the supply of money and credit in the economy.

One way they do this is through interest rate changes – they can lower or raise interest rates to stimulate or slow economic growth. In the early 1980s, when the country was facing double-digit inflation rates, Fed Chairman Paul Volcker raised interest rates to 20% to help curb inflation.

While this had the desired effect of reducing inflation, it also made borrowing for home purchases more expensive. As a result, many Americans were priced out of the housing market during that time.

On the other hand, when interest rates are lowered, it can lead to easier access to credit and encourage more home purchases. In the wake of the 2008 financial crisis, the Fed slashed interest rates to near-zero levels.

For nearly a decade, mortgage rates remained historically low, causing a surge in demand for housing as mortgages became more affordable. Realizing the potential for another housing bubble, the US central bank began gradually raising interest rates beginning in 2015.

By 2019, rates had reached 2.5% with further increases planned, but this proved to be too little too late.

When Covid-19 hit in 2020, the Fed once again lowered interest rates to near-zero levels to help stimulate the economy. This, along with other measures like quantitative easing and loan programs, may have helped prevent a deeper economic downturn, but it also continued to fuel the already hot housing market.

Cheap borrowing costs combined with an increase in remote work led to a surge in demand for homes that rivaled the pre-2008 levels. Coupled with a limited supply of homes for sale due to pandemic-related disruptions in the construction and real estate industries, home prices skyrocketed, something that experts say could have been avoided if interest rates had been raised earlier.

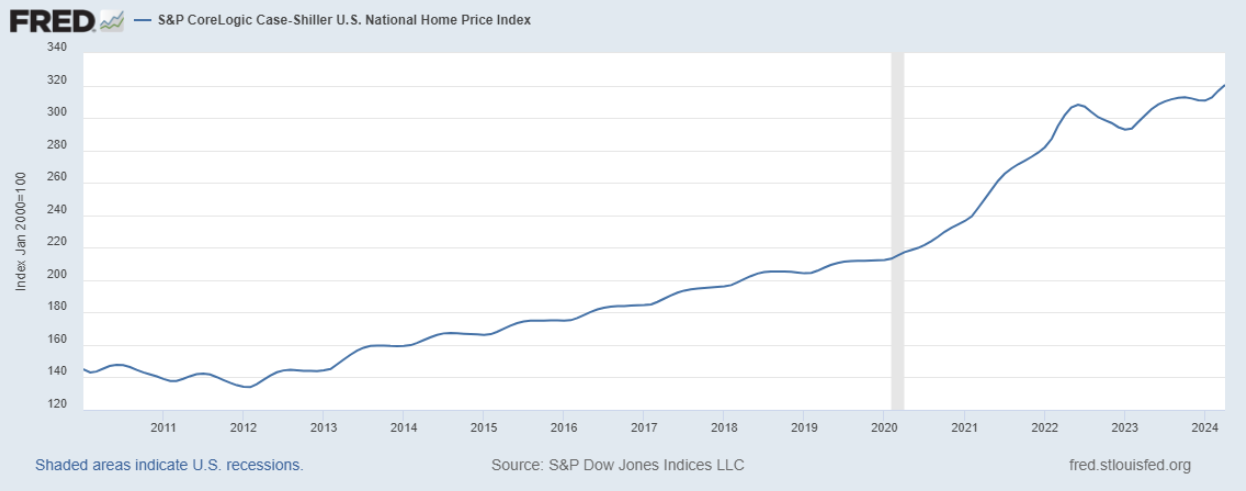

Source: FRED Economic Data

“Because the Fed kept rates too low for too long during the pandemic, listing inventory was essentially wiped off the map, keeping prices rising sharply despite the surge in mortgage rates,” said Jonathan Miller, president and CEO of Miller Samuel Inc., a real estate appraisal firm.

“Would-be home sellers that bought or refinanced at a 2.5% to 4% rate during the pandemic became trapped due to the lock-in effect. They became reluctant to list their homes because, as new buyers, they would get a lot less for their money because of the much higher mortgage rates.”

As a result, the housing market became increasingly competitive, with multiple offers being the norm in many cities. Already unaffordable housing markets, such as San Francisco and New York City, saw even more dramatic price increases, making it even more difficult for low- and middle-income households to afford a home in these areas.

At the same time, historically affordable markets in the Midwest and parts of the South also saw a surge in prices, with buyers from more expensive areas seeking out more affordable options.

According to the Case-Shiller National Home Price Index, home prices in the US increased by 19% in 2020 alone – the largest yearly increase in the index’s 30-year history. Since then, prices have continued to rise at a record-breaking pace, increasing another 28% through May 2024.

With no signs of slowing down and many Americans struggling to keep up with the rising cost of living, the question remains: what does this mean for the future of the housing market and homeownership in the US?

Consequences of the FED-Induced Housing Crisis

The FED-induced housing crisis has created a whirlwind of consequences, affecting every corner of the American dream. Strangled by the inability of labor to flow where it is most needed, the US job market has been strained as businesses struggle to find qualified workers in the face of soaring housing prices.

Even after accounting for the rise of remote work, the geographic mismatch between where jobs are and where workers can afford to live continues to widen, further perpetuating the housing crisis.

GDP growth, too, has taken a hit. According to experts, the housing crisis has contributed to a drag on GDP growth by 3.7% as a result of the difficulty in finding affordable housing and the decline in homeownership rates. “The strength of the labor market in terms of matching the right labor to the right industries and stuff like that has been a historical hallmark of the U.S. economy,” explained Mark Fleming, chief economist at First American Financial Corporation.

“Now, with everybody being less willing to move because of the financial penalty, that should, in theory, be a drag on the benefits that we would otherwise have gotten from labor mobility.”

Apart from the economic consequences, the FED-induced housing crisis has also had a profound impact on the social fabric of America. The dream of a white picket fence and a home to call one’s own has been replaced with the reality of a never-ending cycle of debt and financial instability for many.

Locked out of the homes that they can’t afford, a growing number of young adults are delaying marriage and parenthood, while some have been forced to move back in with their parents.

While homeownership has traditionally been a pathway to wealth creation for middle-class families, the inability to afford a home has perpetuated wealth inequality in America. “First-time home buyers continue to struggle to enter the housing market, lacking the housing equity that boosts the purchasing power of repeat buyers,” explained Jessica Lautz, deputy chief economist at the National Association of Realtors (NAR).

This lack of entry into homeownership not only affects the current generation but also has long-term effects on future generations, as they are unable to inherit a home or build equity for themselves.

Then there’s market volatility to contend with. With fewer homes being built as a result of high interest rates, bidding wars have become the norm, driving prices even higher. Earlier this year, 16% of homes sold for over the list price, according to NAR.

The FED’s policies have inadvertently turned the housing market into a battlefield, where only the financially strong can survive. With homeowners’ wealth averaging 40 times that of renters, experts say the division between the haves and have-nots will only continue to widen.

If the trend continues, homeownership – a cornerstone of the American Dream – may become a relic of the past for many, creating a permanent underclass of renters unable to break into the cycle of wealth creation.