By Preserve Gold Research

The US economy is a behemoth, historically renowned for its resiliency and strength. But behind the facade of growth and prosperity looms a warning from legendary investor Paul Tudor Jones — the possibility of a “debt bomb” due to unchecked government deficit spending.

Jones, who famously predicted the stock market crash of 1987, recently sounded the alarm on the US’s growing debt and its potential to trigger a financial meltdown.

In an environment where the term “on steroids” is often used in sports discussions, it has surprisingly found a place in the lexicon of economic analysis. In a recent interview with CNBC, Jones likened the US economy to a high-functioning athlete “on steroids,” surging ahead with seemingly limitless strength and speed, but masking an underlying danger.

“Fiscal recklessness” is the primary culprit, according to Jones — a sentiment echoed by many economists who are concerned about the country’s ballooning national debt.

Dialogue on market trajectories rarely shifts from the well-trodden path of GDP growth, without the weight of wisdom behind it. With decades of experience and a track record of prescience, when Paul Tudor Jones speaks, the markets listen.

As the Founder and CEO of Tudor Investment Corporation, Jones has amassed a fortune of over $ 7 billion, making him one of the wealthiest hedge fund managers in the world, and one of the most influential voices on Wall Street.

Hailing from the school of thought that favors macroeconomic analysis, Jones has had an uncanny ability to predict market shifts before they happen. His recent portrayal of the US economy as “on steroids” comes with a warning — one that stems from concerns over aggressive government spending and what he sees as an inevitable collision with the wall of debt that is piling up.

While it may be easy to dismiss Jones’ comments as fear-mongering, he’s one of a growing number of market insiders who are sounding the alarm. So, what does this all mean for the average American and their financial future?

An Illusion of Strength

Government spending in the United States has reached eye-watering levels, with expenditures swelling to $6.13 trillion in 2023. Compared to just $4.8 trillion in 2021, it marks a 28% increase in government outlay — the biggest jump since World War II, excluding pandemic relief spending. Since 2002, the federal government has run a deficit every year, with the total national debt now exceeding $34 trillion.

With another $1.7 trillion deficit added in 2023, many economists are worried that the US may be at risk of reaching a tipping point. Despite this, rosy headlines from mainstream media outlets would have Americans believe otherwise.

“US economy delivers blockbuster performance in third quarter” – Reuters

“Another shockingly good jobs report shows America’s economy is booming” – CNN

“Our Economy Isn’t ‘Goldilocks.’ It’s Better.” – The New York Times

These and other similar headline stories paint a picture of an economy on the upswing, with strong job growth and robust consumer spending. With GDP growth expected to reach 3.4% in Q1 2024, it’s easy to see why optimism is high. However, behind these headlines lies a different story — one of mounting debt and soaring deficits that could have far-reaching consequences for the country’s financial future.

The government’s massive spending spree has garnered the attention of many fiscal conservatives like Jones, who say that current policies have created a false sense of prosperity, masking the underlying vulnerabilities of the US economy.

“I think it’s strong,” Jones said of the economy. “Why shouldn’t it be? We’ve got a 6%-7% budget deficit. We’re fast-pouring consumption like crazy. It should be going gangbusters because we’ve got an economy on steroids, and it’s unsustainable.” Jones’ concerns are shared by others in the financial community, who worry that the current trajectory of government spending is unsustainable.

In a recent ‘60 Minutes’ interview, Fed Chairman Jerome Powell warned of the risks of piling up debt and passing it on to future generations. “The US federal government’s on an unsustainable fiscal path…the debt is growing faster than the economy,” Powell said.

“It’s probably time, or past time, to get back to an adult conversation among elected officials about getting the federal government back on a sustainable fiscal path,” he added.

Pointing to the worrying $34 trillion total debt figure, warnings from JPMorgan echo Jones’ and Powell’s apprehensions. According to the bank, the US’s fiscal trajectory is at risk of veering off the path of sustainability, potentially culminating in a “boiling frog” scenario where the economy slowly deteriorates without a clear warning sign.

As the Congressional Budget Office starkly projects, the debt picture for the United States is poised to deteriorate further in the coming years. By the early 2030s, entitlement spending, mandatory expenditures and the net interest payments on the existing debt are anticipated to surpass the government’s total revenue. Without a major overhaul to the current system, this trajectory is only likely to worsen.

The stark contrast between headlines and the warnings of financial experts raises important questions about the true state of the US economy. Can Americans trust the rosy picture being painted by the media when it comes to economic growth and prosperity? Or are there underlying issues that could spell trouble for the country’s future?

When juxtaposed with the concerns of experts like Jones and Powell, it’s clear that the answer may not be so simple. While recent jobs reports and stock market gains may seem promising, kicking the can down the road when it comes to fiscal responsibility and debt accumulation can’t go on forever. Eventually, the bill will come due, and it may not be just future generations that bear the burden.

America’s Looming Debt Crisis

The specter of massive borrowing by the US government looms ominously—a dire testament to a fiscal tightrope that the country is currently walking on. As government spending continues to outpace revenue, experts warn that the debt load could reach a staggering $54 trillion by 2034, threatening the future credit worthiness of the country and its ability to support critical programs like Social Security and Medicare.

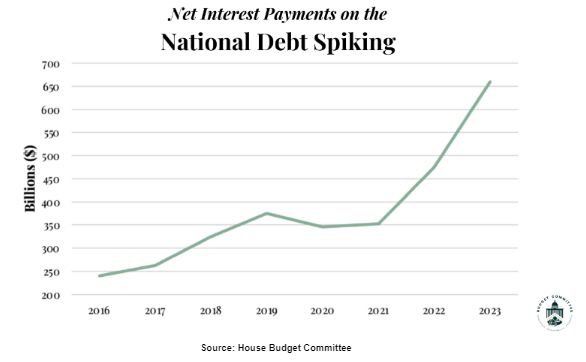

“The federal government is sitting on a ticking time bomb. Payments on the debt have already doubled over the last two years, and are expected to double again over the next decade,” cautioned Brian Riedl, a Senior Fellow at the Manhattan Institute.

“Congress remains completely asleep at the wheel, and unwilling to make even minor gestures toward reining in the toxic combination of rising debt and higher interest rates,” Riedl added.

Last year, Fitch Ratings downgraded the US credit rating to AA+ from AAA, citing concerns over the government’s debt levels. With Standard & Poor’s having already downgraded the country’s credit rating in 2011, and Moody’s lowering its outlook to negative in November 2023, the message from credit rating agencies is clear: the US needs to get its fiscal house in order.

If the country’s credit rating were to be downgraded again, it could result in higher borrowing costs for the government, which could lead to even higher deficits and debt levels. According to the Congressional Budget Office (CBO), interest payments on national debt are projected to reach 3.7% of GDP by 2033, triple the 1.2% of GDP seen in 2022.

This means that in less than a decade, the US could be spending more on interest payments than it does on national defense, education, or healthcare.

Source: House Budget Committee

Should the US government continue its current course of unchecked spending, it could also result in a future where the cost of borrowing may become prohibitively expensive. The crowding out of private investment by government borrowing, a phenomenon where high demand for government bonds leads to higher interest rates and less available capital for private investment, could become a reality.

With higher borrowing costs, businesses may find it difficult to invest and expand, leading to slower economic growth, while consumers may be forced to tighten their belts, potentially leading to a recession. This vicious cycle of high debt, low growth, and rising interest rates is a pattern that has played out throughout history in other countries, and the US is not immune to it.

Fueling growth through borrowing is akin to a sugar rush — it often comes with a crash. And when countries continue to borrow without restraint, the crash can be catastrophic. Consider Greece, where public debt ballooned to levels higher than the country’s GDP, leading to austerity measures and a deep recession.

Similar situations have played out in countries like Argentina, Japan, and Venezuela, where unsustainable debt levels resulted in financial crises and social upheaval. While the US has a much stronger economy and is able to borrow at lower interest rates, its debt-to-GDP ratio currently stands at 123%, a historically high level that could have dangerous consequences if left unchecked.

Aside from potential credit downgrades and higher interest rates, unchecked government spending could also create a dependency on foreign investors to finance its debt. As the US government continues to issue bonds and increase its debt, it often relies on other countries, such as China and Japan, to buy these bonds.

While this may seem beneficial in the short term, it also means that these countries hold a significant amount of US debt and have influence over its economy. If these countries were to suddenly stop buying US bonds or choose to dump their holdings, it could lead to a sharp rise in interest rates and financial instability.

And with tensions between the US and China already high, susceptibility to this type of economic pressure only adds to the complexity of the situation.

Navigating the Economic Tightrope

Jones’ crystal ball may not give the exact time frame of when the economy’s artificial support system will buckle under its own weight, but it’s clear that the US will need to address its growing debt burden sooner rather than later. The prodigious growth spurred by government spending poses a glaring juxtaposition to a potential “debt bomb” — fueled by a combination of soaring debt and ballooning interest payments.

However, finding a balance between cutting back on government spending and maintaining economic stability is a delicate dance. Immediate austerity measures could lead to a recession, while continued excessive spending could lead to long-term financial instability.

As we digest the sobering tonic served up by Paul Tudor Jones, the question remains: what can Americans do? One option is to take a page from Jones’ playbook and diversify savings beyond traditional stocks and bonds. Precious metals, like gold and silver, have historically been used as a hedge against economic uncertainty for centuries and could provide a buffer against debt-fueled market volatility.

As Jones himself said, “I can’t love stocks, but I love bitcoin and gold.” The artificial high on which the economy currently rides isn’t just untenable — it’s unsustainable.