By Preserve Gold Research

Milton Friedman’s cautionary words, “Inflation is always and everywhere a monetary phenomenon,” have echoed across decades, reminding us of monetary policy’s impact on economies. While the Federal Reserve’s policies and, more specifically, their control of the money supply undoubtedly contributes to the dynamics of inflation, many economists argue that other, equally important factors are at play. Geopolitical events, supply and demand forces, and even consumer psychology can all contribute to the rise and fall of prices—an intricate web of factors that some experts say is far more nuanced than a simple cause-and-effect relationship.

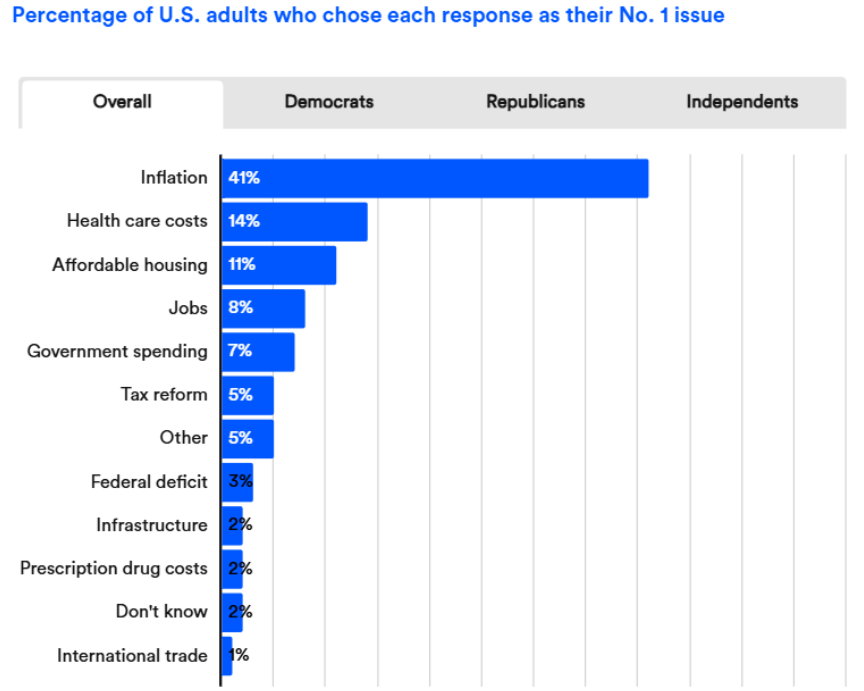

With inflation ranking among the top concerns in the recent election—41% of Americans citing it as the most pressing economic issue—the spotlight is once again on the Federal Reserve’s monetary policy. But a new factor has emerged as a potential driver of rising prices: tariffs. The incoming administration’s Department of Government Efficiency (DOGE) has captured headlines as a proposed solution to tackle the federal deficit and curb inflation. However, several significant yet largely overlooked factors could undermine the effectiveness of these policies. Among them are Trump’s bold economic proposals, including steep tariffs on imports from Mexico, Canada, and China.

Source: Bankrate

Far from being isolated policies, these actions are inextricably connected to the economic well-being of everyday Americans. Experts warn that these measures could increase costs for essential goods, from fresh produce to electronics, placing additional pressure on already strained wallets. Tariffs, intended to protect domestic industries or as leverage in international negotiations, often backfire by forcing businesses to offset increased costs. Coupled with policies like mass deportations—which could shrink the labor pool—some fear the consequences of a protectionist approach may ultimately lead to higher consumer prices.

While the narrative of protecting U.S. jobs and interests may sound reassuring, the broader implications of these policies on inflation are less certain. With nearly half of all U.S. imports coming from China, Mexico, and Canada, these tariffs could lead to retaliatory measures—a tit-for-tat trade war—that could further drive up costs.

There’s also the risk of companies shifting production to the U.S. to avoid tariffs, which could lead to higher wages and, ultimately, higher consumer prices. The debate over how to best address inflation may feel abstract, but its consequences are anything but. Beyond policy nuances lies a stark reality for millions of Americans already grappling with high living costs. Isolationist policies, like tariffs and deportations, may offer a short-term fix for bolstering U.S. industries, but at what cost to the average American consumer? And are these measures truly sustainable in the long run?

Trump Tariffs: A Catalyst for Inflation?

President Trump’s proposed tariffs on imports from Mexico, Canada, and China have stirred concerns about the potential impact of derailing the Fed’s efforts to stabilize inflation. While the incoming administration has touted these measures as necessary for protecting U.S. jobs and interests, some economists warn they could have unintended consequences. Potential tariffs include a 25% levy on Mexican and Canadian goods and an additional 10% on Chinese products.

With U.S., Mexican, and Canadian trade amounting to $1.78 trillion annually under the USMCA, these proposals cast a shadow over the largely integrated North American supply chain. “Tariffs distort the marketplace and will raise prices along the supply chain, resulting in the consumer paying more at the checkout line,” says Alan Siger, President of the Association of Trade Economists.

The president-elect has been vocal about his belief that the U.S. has been treated unfairly in trade agreements, and these policies are a way to level the playing field. By reducing reliance on foreign countries for goods, the administration hopes to bring jobs back to the U.S. and boost domestic production. However, opponents point to mixed results from previous attempts to protect domestic industries through tariffs and argue that they could ultimately harm the very workers they intend to help.

Consumer Price Shock

For American households, the consequences of tariffs can be felt most directly through higher prices. According to Ed Brzytwa, Vice President of International Trade at the Consumer Technology Association (CTA), “The likelihood of retailers or any importer absorbing the tariff cost is very low, so the pass through to consumers will be quick.” This means that essential products—laptops, smartphones, and even common produce—may soon strain already tight budgets.

Retail giants like Best Buy have already expressed concerns over the potential impact of these tariffs on their bottom line. “I absolutely can see a world where there’s more consumer impact because the cost of those tariffs ends up flowing through to the consumer,” said Best Buy CEO Corie Barry. With vendors facing razor-thin margins already, “the vast majority of that tariff will probably be passed on to the consumer as a price increase,” she added.

The automobile industry has also braced for the effects of the proposed tariffs. The industry publication Automotive News estimates that a 25% tariff on imported vehicles and parts could cause an average price increase of $3,000 per vehicle. Larger vehicles, such as pickup trucks and SUVs, could see price hikes of up to $10,000. With around 88% of pickups sold in the U.S. manufactured in Mexico and over a quarter of all vehicles on American roads built there, these tariffs could significantly impact the average consumer.

The possibility of such steep increases “is a two-alarm fire for the auto industry,” said Patrick Anderson, CEO of economic consulting firm Anderson Economic Group. “There is probably not a single assembly plant in Michigan, Ohio, Illinois, and Texas that would not immediately be affected by a 25 percent tariff.” And it’s not just consumers who could feel the burn—the auto industry is responsible for millions of jobs in the U.S. and contributes billions to the economy. If these tariffs are more than just a negotiating tactic and become a reality, the industry could see a sharp decline in sales, production, and overall profitability.

Gasoline, too, could become pricier as over half of U.S. petroleum imports originate from Canada. With over four million barrels of crude oil crossing the U.S. border each day, price hikes as steep as $0.70 per gallon could hit consumers almost immediately, particularly in the Midwest and Great Lakes regions. Apart from the immediate impact on consumer wallets, industry experts also warn that Canadian oil producers could rethink their export strategies and look to markets other than the U.S. if tariffs continue to rise. Should this happen, consumers could face even higher prices, as reduced competition may lead to less favorable pricing.

Collectively, these price increases could lead to a sharp reduction in consumer spending power, particularly for middle and low-income households. The CTA estimates that Trump’s proposed tariffs could cost U.S. consumers an additional $3.2 billion per month, resulting in a $38.4 billion hit to American consumer wallets each year. “Another way to think about this is it’s 4 to 5 months of a normal year’s inflation in one fell swoop,” noted Ernie Tedeschi from The Budget Lab at Yale. Tedeschi’s analysis suggests that these tariffs could slash household purchasing power by as much as $1,200 annually—nearly equal to the median monthly rent in the U.S.

Broader Potential Economic Consequences

Beyond the immediate impact on consumer prices, economists warn that these tariffs could have broader but less visible economic consequences—especially in the short term. Over the past few years, global credit challenges have intensified as ongoing international conflicts and U.S.-China tensions have strained international trade relations. Add to the mix the potential for increased trade protectionism following Trump’s return to office, and the situation becomes even more precarious.

While trade fragmentation may not seem like an immediate concern for the average American consumer, it can have far-reaching effects on overall economic stability. As tariffs and trade barriers are erected, multinational companies may find it difficult to operate efficiently. Higher trade barriers can lead to increased business costs, reduced profitability, and potential job losses. This could have a ripple effect on the broader economy, impacting employment rates and GDP growth.

A retreat from global trade could also lead to a reduction in foreign investment as international companies become more hesitant to invest in U.S. markets. “Foreign direct investment flows are also being redirected along geopolitical lines,” noted Gita Gopinath, the International Monetary Fund’s First Deputy Managing Director. “Some countries are reevaluating their heavy reliance on the dollar in their international transactions and reserve holdings,” she added.

The lack of clarity on new tariffs, including their scope, severity, and timing, could cause a surge in market volatility as the risk premia associated with trade protectionism increases. This could be particularly damaging for sectors that rely heavily on international trade, like manufacturing and agriculture, as well as companies with global supply chains. While geopolitical tensions and trade conflicts often act as a catalyst for building supply chain resiliency, it’s not without its challenges. Relocating factories and reorganizing supply chains can be expensive, timely, and risky endeavors—not to mention the impact on jobs and operations of small businesses.

Retaliatory tariffs and second-order effects further exacerbate these concerns. Past bouts of protectionism have shown that trade restrictions often lead to unforeseen consequences. The Smoot-Hawley Tariff Act of 1930, which imposed high tariffs on over 20,000 imported goods, is widely considered to have contributed to the severity of the Great Depression. Despite economists urging against it, the act was passed to protect American industries and farmers from foreign competition. While it did provide some short-term relief, it ultimately led to a decrease in global trade and deepened the economic downturn as other countries retaliated by imposing their own tariffs on American exports.

Both Mexico and Canada have strongly opposed Trump’s proposed tariffs, hinting at reciprocal measures targeting critical U.S. industries like agriculture and manufacturing. If history is any indication, these retaliatory tariffs could lead to a downward spiral of increasing trade barriers and declining economic activity. “The tariffs are akin to shooting yourself in the foot,” noted Mexican Economy Minister Marcelo Ebrard in response to the proposed tariffs on Mexican imports.

Navigating the Economic Fallout

This isn’t to say that President-elect Trump’s focus on reshoring and supporting domestic production is without merit. There are legitimate concerns about overreliance on foreign manufacturing, especially in critical industries like pharmaceuticals and medical equipment. However, implementing tariffs is a delicate and complex issue that economists warn could lead to an immediate price surge. Experts say that even if 10% tariffs were implemented on all imports, it would translate to an overall cost increase of $2,421 per year for the average American household.

Though the intention to curb government expansion and reset fiscal balance is commendable, the proposed methods—like heavy-handed tariffs—may do more harm than good. The intertwined global economy doesn’t yield easily to isolationist measures. While supporters speculate these tariffs may serve as a negotiating tactic rather than a definitive policy, the risk of triggering inflationary pressures—a particularly sore point after the 2022 spike in inflation—looms large. With consumer prices still a top concern for American families, the rapid escalation in retail costs could undermine public confidence in economic resilience. And, as history has shown, a loss of public confidence can be an economic death knell.

Whether these tariffs ultimately materialize or serve as leverage in international disputes, the uncertainty is already impacting businesses and consumers. Companies are hesitant to make long-term investments that depend on a stable global trade environment. And as supply chains continue to be disrupted, Americans may see shortages of certain goods and a further price increase.

For many, the constant threat of inflation only adds to the anxiety of an already fragile economy. Fortunately, options exist for those who value stability. Allan Greenspan once said, “In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.” It’s a sobering truth in times like these. Policymakers may wrestle with macroeconomic pressures, but the challenges hit closer to home for individuals. How do you safeguard your hard-earned savings when everything—from food to fuel—becomes more expensive?

That’s where gold stands as a beacon of hope. Known as a hedge against inflation and economic uncertainty, gold has been trusted for centuries to help preserve purchasing power. The value of peace of mind is immeasurable at a time when markets fluctuate wildly, and policies remain unpredictable. The reality is that bringing inflation back to the Fed’s 2% target will not be quick or easy, even with the momentum of Trump’s administration. While some outcomes may serve specific sectors, the unpredictability of others will continue to keep Americans on edge.