By Preserve Gold Research

Don’t spend more than you earn. A basic tenet of Finance 101 that the U.S. government seems to have a hard time following. As of July 2024, the national debt has skyrocketed to a staggering $35 trillion, a figure that has sent shivers down the spines of economists and taxpayers alike. This relentless borrowing spree, as Maya MacGuineas, president of the Committee for a Responsible Federal Budget, puts it, “just keeps marching along, reckless and unyielding.” Despite countless warnings, the deafening alarm bells seem to be ignored by policymakers.

For American taxpayers, understanding this colossal debt is critical as it affects every aspect of our lives, from the economy to job opportunities, and ultimately, the future of our nation. Fueled by an aging population, rising healthcare costs, and insufficient tax revenues, experts say that the national debt has become an existential threat to the country’s financial stability. “America’s fiscal outlook is more dangerous and daunting than ever,” warned Michael Peterson, CEO of the Peter G. Peterson Foundation.

With nearsightedness and political polarization plaguing Washington, the debt issue has become a game of political football, with each party blaming the other for the escalating crisis. Debt “ceilings” are routinely raised while government shutdowns have become a common resort to force political agendas. Temporary solutions only add to the long-term burden, leaving future generations to foot the bill. This constant cycle of borrowing and over-spending has created a vicious cycle that shows no signs of stopping—a powder keg that experts say could cause irreparable damage to the American economy.

Understanding National Debt

While the national debt may seem like an abstract and distant concept, it has real implications for every American citizen. National debt is essentially the money the government owes to its creditors, both domestic and international. This debt accumulates when the government spends more than it earns. Picture it as a massive credit card bill. The government covers its expenditures—like social programs, defense, and infrastructure—using borrowed money when tax revenues fall short.

Over time, these borrowing mechanisms—primarily through the issuance of government bonds and loans—add up, leading to a staggering amount of debt. This debt, like any other loan, comes with interest. The higher the debt, the more interest payments the government must make, leading to a cycle of borrowing to pay off previous debts. Like a chain around the economy, debt and interest continue to grow, creating a burden that becomes increasingly difficult to bear.

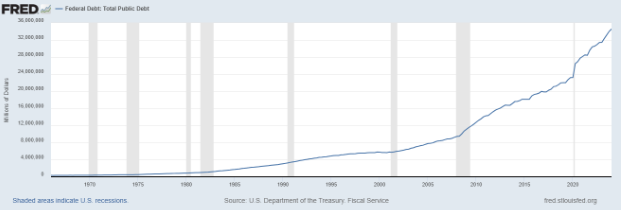

Historically, the U.S. national debt has seen fluctuations, rising and falling depending on economic conditions and government policies. However, in recent decades, the debt has been on a steady upward trajectory and is expected to continue increasing in the coming years. From the Revolutionary War to the present day, the numbers have soared as the government continues to spend well beyond its means. A country founded on the principle of limited government has now found itself in a precarious position with its debt reaching record levels and future generations saddled with the burden.

A Ticking Time Bomb

The U.S. national debt now stands at a staggering $35 trillion, growing by $1 trillion in just seven months. This terrifying increase is not just a number; it may just be a ticking time bomb. To put it in perspective, the debt is now 124% of the country’s GDP, a ratio not seen since post World War II. This alarming debt-to-GDP ratio indicates that the government owes more than the country can produce in a year—for every dollar the U.S. generates, it owes $1.20. Meanwhile, the debt per individual has skyrocketed. As of July 2024, every American citizen’s share of the national debt is over $103,000. This means that every man, woman, and child in the country carries a substantial financial burden that will only continue to grow if the debt is not addressed.

Several factors have contributed to the current state of the national debt and the increasing rate of its growth. The pandemic relief efforts, while necessary to some extent, have added trillions to the debt, with close to $6 trillion spent on COVID-19 relief. But the issue existed long before the pandemic. Chronic overspending and a lack of budget control have been ongoing issues for the government since the early 1980s. Expanding social welfare programs, rising healthcare costs, and unchecked government spending have all contributed to the current debt crisis.

Source: FRED Economic Data

Less obvious but equally important is the demographic shift occurring in the U.S. The aging population, combined with a declining birth rate and increasing life expectancy, means that there are fewer workers contributing to government revenue while more individuals require social security and Medicare benefits. Given that we spend twice as much on healthcare per person compared to other developed countries, the cost of providing for an aging population is only set to increase.

Then there’s the effects of immigration. Steven Camarota, Director of Research at the Center for Immigration Studies, notes, “Illegal immigrants are a net fiscal drain, meaning they receive more in government services than they pay in taxes.” This isn’t because they’re not working; in fact, many are employed. The real issue lies in their low average education levels, leading to lower earnings and fewer tax contributions. But it doesn’t stop there. The surge of illegal immigration has reached unprecedented levels, with over 2.7 million inadmissible aliens released into the country since January 2021. According to The National Academies, each illegal immigrant represents a net lifetime drain of about $68,000, driven primarily by high welfare usage.

Perhaps most worrying is the lack of concrete plans from presidential candidates to address this monumental issue. Both sides of the political aisle seem to be steering clear of the debt topic, despite its pressing nature. “The election is less than 100 days away, and we’re projected to add another $1 trillion more in debt even during this short period,” said the Peter G. Peterson Foundation, adding “We can’t keep pretending this is not a problem.” With election campaigns in full swing, the absence of a concrete debt reduction plan is glaring, leaving many to wonder about the future fiscal stability of the nation.

Impact on American Taxpayers

The impact of rising U.S. debt on American taxpayers is as profound as it is alarming. Higher interest costs on the national debt are projected to consume a growing share of the federal budget, leaving fewer resources for essential government services and programs. Expert analysts warn that “within three years, if interest rates remain elevated, payments on the debt could become the second-largest federal program—behind only Social Security.” Within ten years, interest costs are expected to double. This terrifying reality means less budgetary room for critical services like education, healthcare, and infrastructure. Imagine a future where more money is spent on servicing debt than on programs for children, a scenario already forming according to the Committee for a Responsible Federal Budget.

Government borrowing also reduces funds available for private investment, a concept known as crowding out. When the government sucks up savings to finance its debt, less is left for businesses to invest in innovation, technology, and growth. This reduced investment leads to slower economic growth and lower productivity. In the long term, this can lead to lower wages and fewer job opportunities for Americans.

High debt also leaves the U.S. vulnerable to crises. A large debt burden constrains the government’s ability to respond to emergencies like recessions and wars. The Congressional Budget Office (CBO) explains that “a large amount of debt leaves less flexibility for government actions to address financial and economic crises.” Recent federal spending during the COVID-19 pandemic would be considerably harder to replicate under the current debt trajectory, as the government would have less room to borrow and spend.

High debt also increases the risk of a sudden loss of confidence in U.S. Treasury bonds. Experts say if investors start doubting the government’s ability to service its debt, a catastrophic fiscal crisis could ensue. Already reeling from the recent downgrades to its credit rating, the U.S. could see a further decrease in investor trust and an increase in borrowing costs. This could lead to a snowball effect, as higher borrowing costs would require even more borrowing, exacerbating the already high debt burden.

Taxpayers must also brace for potential higher taxes and reduced services. To manage high debt, the government might be forced to raise taxes or cut public services, impacting economic growth and public welfare. Imagine paying higher taxes while receiving fewer benefits—an unsettling prospect for many Americans. Then there’s the possibility of the government potentially resorting to inflating away the debt—a silent tax that most Americans have become all too familiar with. Inflating away debt could lead to hyperinflation, something that has ravaged economies in the past.

The U.S. is already experiencing slower economic growth due to high debt levels. Resources that could be used for productive activities are instead diverted to servicing debt, leading to a decrease in investments and innovation. With $2.4 billion being spent on interest payments alone every day, the high debt burden is a heavy weight on the economy and hampers its potential for growth. Today’s staggering debt isn’t just a number on a balance sheet; it’s a looming crisis that continues to be kicked down the road, piling up for future generations to handle.

Protecting Your Future

As Brian Riedl, a senior fellow at the Manhattan Institute, points out, “The federal government is sitting on a ticking time bomb. Payments on the debt already doubled over the last two years, and are expected to double again over the next decade. Congress remains completely asleep at the wheel, and unwilling to make even minor gestures toward reining in the toxic combination of rising debt and higher interest rates.” In a landscape overshadowed by the looming shadow of U.S. national debt, America finds itself at a crossroads. With potential tax increases on the horizon, experts say it’s crucial to prepare now rather than later.

Prepare for Potential Tax Increases

Governments may raise taxes to service the mounting debt—something that experts have repeatedly warned about. Joe Seydl, a senior markets economist with JP Morgan, notes, “One of the key ways the government is likely to avoid this fate will be by raising taxes to increase revenues.” The prudent course of action is to anticipate these tax hikes and plan accordingly.

Optimize Tax Strategy

In anticipation of future tax hikes, tax strategy optimization becomes imperative, says Seydl. By leveraging resources like a Gold IRA, Americans can help minimize their tax liability while potentially realizing higher returns. Also known as precious metals IRAs, Gold IRAs allow individuals to hold physical gold and other approved precious metals in a tax-deferred retirement account.

Plan for Inflation

Inflation—a ubiquitous side effect of government stimulus—erodes purchasing power, making it difficult to maintain one’s standard of living. With the government borrowing and spending at unprecedented levels, inflation may be inevitable. Seydl offers a stark reminder, “Investors should also consider adding real assets to their portfolios to hedge this long-term risk—just in case.” Precious metals like gold have historically performed well during inflationary periods. They can act as a buffer, maintaining value while other assets falter.

Diversify Investments

Diversification isn’t just an investment buzzword; it’s a strategy grounded in mitigating risk. Seydl advises that “investors who like to be very prepared should consider adding real assets to their portfolios, given the historically tight inverse relationship between the U.S. dollar and a diversified portfolio of real assets.