By Preserve Gold Research

The global economy has seen considerable challenges during the past few years with global supply chains being constrained in the aftermath of the pandemic shutdowns all over the world. This caused devastating inflation, prompting central banks to raise interest rates, resulting in increased costs of living for consumers and higher costs of borrowing for businesses. Although inflation has eased as of late, causing the U.S. Federal Reserve and other central banks to slow down or completely stop their interest rate hikes, there are still warning signs that the U.S. and global economy may still be heading toward a significant recession.

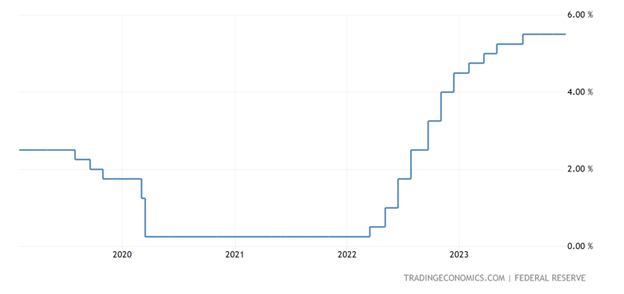

Fed Misread on Inflation May Have Forced Overly Aggressive Rate Hikes

Many in the financial industry believe that the Fed had expected inflation to stick around for much longer than it did which resulted in the central bank raising rates too quickly. Of course, this was followed by the rest of the central banks around the world following suit. This may have caused unnecessary damage to the economy which could reap detrimental consequences in the near future.

Investors in 2024 may see the Fed’s mistakes bring about an economic recession, according to Jason Cummins, a top economist at the hedge fund Brevan Howard. Cummins says the Fed’s misread can be seen in their forecasts for core PCE inflation. The Fed had forecast that particular inflation reading would be at 3.9% at the end of January, but it is now looking like this estimate was well off by around a whole percent. Even by December, the inflation measure had gone down to 3.2%.

Cummins focused on the historical significance of such a miss by the Fed and its potential implications on the economy. In 2019, the Fed missed its forecast by 30 basis points which Cummins noted resulted in a major mid-cycle adjustment of 75 basis points. Now this time the Fed forecast had missed by what it is looking like around 100 basis points.

Essentially, what Cummins and other like-minded economists are suggesting is that because the Fed increased rates too aggressively, the damage sustained to economic growth will force the Fed and other central banks to turn around and cut rates. However, if it is a “mid-cycle” adjustment, as Cummins suggested, there would be more rate increases after the drop-in rates, likely a response to a resurgence in inflation. This could ultimately create a considerable level of volatility in markets.

Hawkish Fed Hurts U.S. Housing Market

One sector that may have been particularly hurt by Fed interest rate hikes is the housing market in the U.S. During 2023, in the face of soaring interest rates, home sales in the U.S. reached a record low pace. The U.S. saw 4.09 million homes sold during 2023 which was a 19% decline from the year before and the lowest level reached since 1999. This decline followed an 18% drop during the period of 2021 to 2022.

Economists at Fannie Mae are warning that the U.S. housing market is expected to continue to struggle for a considerable amount of time as a result of the recent high-interest rate environment. The recent increase to 7% in 30-year mortgage rates has pushed many buyers and sellers out of the market, according to Fannie Mae economists. The higher rates have increased the cost of borrowing for buyers while also discouraging sellers from listing their real estate in the first place because they know that demand would be lower than usual.

Geopolitical Risk

Just like when the pandemic severely hindered global supply chains, causing devastatingly high inflation, a similar effect may occur because of geopolitical risks that could shut down worldwide trade routes. Chaos in global supply chains caused by widening wars around the world could once again cause unsustainable inflationary effects which may push the global economy, including the U.S., into recession.

Although supply chain disruptions have recalibrated after the Covid-19 pandemic subsided, there was another major supply chain disruption that arose in the wake of the Russian war in Ukraine. As of now, supply chains have readjusted to a certain degree, but there is no telling what could happen in the future and how it could affect the world’s trade routes.

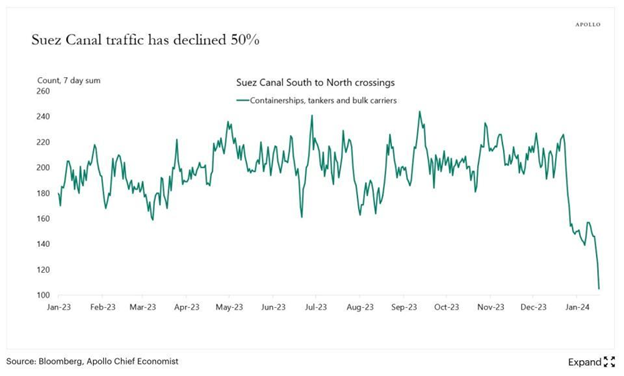

Meanwhile, the Middle East is experiencing its own geopolitical chaos with the Israeli military siege on Gaza which is now significantly affecting global supply routes and increasing the costs of goods for consumers all over the world. This is due to the Houthis in Yemen, in solidarity with the Palestinians, attacking ships they suspect to be affiliated with Israel or the U.S. passing through the Red Sea. Ships affiliated with other nationalities have also been targeted.

The Red Sea is important for global trade because the Suez Canal, which connects the Mediterranean Sea to the Red Sea, is a major shipping route used for the trade of commodities, energy, and consumer goods. Approximately 30% of global shipping containers make their way through the Suez Canal in order for goods to travel from East Africa and Asia to Europe. Shippers have responded to Houthi actions by rerouting their trade routes to avoid having to go through the Red Sea. Egypt, which operates the Suez Canal, has reported a drop of 40% in transit fees during the first 11 days of the year. Overall traffic has dropped by 50% from normal levels.

The increase in cost to ship goods has been large, with rates to ship goods from Asia to North Europe spiking by 173% while rates for shipping to the east coast of North America are up 52%. This will undoubtedly contribute to increasing costs of goods and services for consumers which can lead to inflation problems which the Fed and other central banks could take as a sign that they will need to increase rates again. With housing affordability at record lows and gas prices still relatively high compared to before the pandemic, one never knows how consumers will react to even more increases in prices caused by Fed intervention.

China’s Economic Weakness Warns of Global Recession

Along with problems related to geopolitics and the US economy, the Chinese economy is also showing weakness which could be warning signs of an impending global recession. China, being the second largest economy behind the U.S., could have a major impact on global trade and finance if its economy suffers a major meltdown of some type. As of now, there are multiple factors that could end up bringing the Chinese economy down.

One of these factors is the real estate sector in China which has seen its share of troubles as of late. Many started to take notice of potential problems with the Chinese real estate market when real estate developer Evergrande collapsed due to unsustainable debt, eventually filing for bankruptcy in Hong Kong, and liquidating the firm. This implosion of China’s most valuable real estate company is what started the current ongoing real estate crisis in China which has seen numerous other property developers face similar problems.

Also, consumer demand has become a worry for market watchers and the world business community. China has seen its consumer base show signs of weakness which has resulted in a slowdown in economic growth. In fact, demand has been so low that it has caused China’s economic policymakers to worry about out-of-control deflation. The real estate crisis and low wages have played a significant role in souring consumer appetite for spending in China.

Although just one of these warning signs in China may not be enough to cause the Chinese economy to collapse, a combination of all of these various factors could result in enough economic contagion to spread weakness into other parts of the global economy.

Smart Investors Prepare for Looming Recession

Undoubtedly, the threat of a potential global recession has many investors worried about their portfolio and how they are currently positioned. Those who have all their money in the stock market may find their portfolios at risk in the wake of a recession. This is why smart investors make the proper adjustments to their portfolios in order to mitigate the risk of economic catastrophe.

One way savvy investors are protecting their portfolios from this type of risk is through diversification into assets that have been historically considered “safe havens”. These types of assets tend to appreciate in value during times of great fear and worry in the markets. Most financial professionals recognize that precious metals, such as gold, have a history of being an effective hedge against a crashing economy. If you’re seeing warning signals, then it may be a great time to explore physical precious and help hedge against what could soon be coming.